- India

- /

- Electrical

- /

- NSEI:BHEL

A Piece Of The Puzzle Missing From Bharat Heavy Electricals Limited's (NSE:BHEL) 29% Share Price Climb

Despite an already strong run, Bharat Heavy Electricals Limited (NSE:BHEL) shares have been powering on, with a gain of 29% in the last thirty days. The annual gain comes to 129% following the latest surge, making investors sit up and take notice.

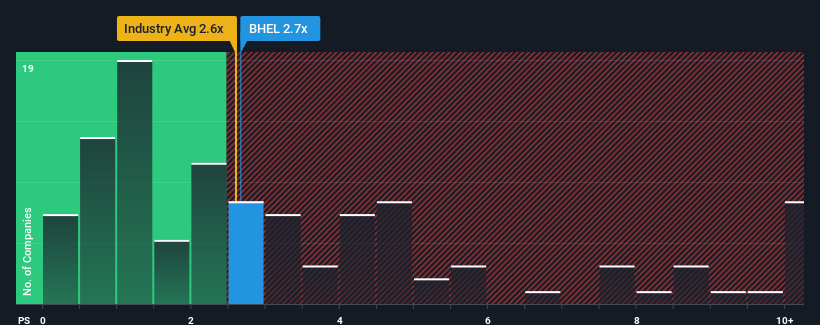

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Bharat Heavy Electricals' P/S ratio of 2.7x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in India is also close to 2.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Bharat Heavy Electricals

What Does Bharat Heavy Electricals' Recent Performance Look Like?

Bharat Heavy Electricals could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bharat Heavy Electricals.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Bharat Heavy Electricals' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 44% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 21% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 16% per annum, which is noticeably less attractive.

In light of this, it's curious that Bharat Heavy Electricals' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Bharat Heavy Electricals' P/S

Bharat Heavy Electricals appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Bharat Heavy Electricals currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Bharat Heavy Electricals that you need to take into consideration.

If you're unsure about the strength of Bharat Heavy Electricals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Bharat Heavy Electricals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BHEL

Bharat Heavy Electricals

Operates as engineering and manufacturing company in India and internationally.

High growth potential with solid track record.