- India

- /

- Electrical

- /

- NSEI:BGRENERGY

BGR Energy Systems Limited (NSE:BGRENERGY) Shares Fly 31% But Investors Aren't Buying For Growth

Despite an already strong run, BGR Energy Systems Limited (NSE:BGRENERGY) shares have been powering on, with a gain of 31% in the last thirty days. The last 30 days bring the annual gain to a very sharp 43%.

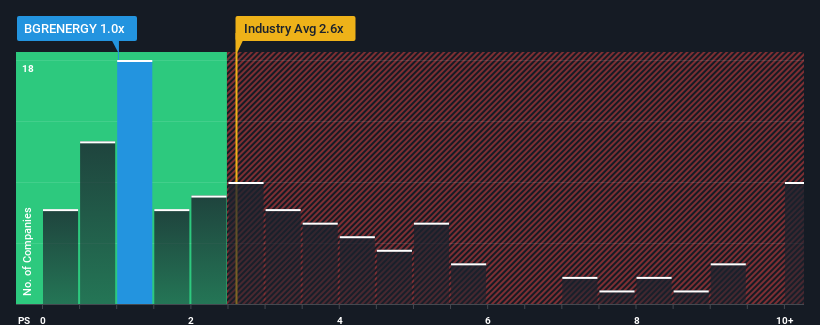

In spite of the firm bounce in price, BGR Energy Systems may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1x, considering almost half of all companies in the Electrical industry in India have P/S ratios greater than 2.6x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for BGR Energy Systems

How BGR Energy Systems Has Been Performing

For instance, BGR Energy Systems' receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on BGR Energy Systems will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for BGR Energy Systems, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

BGR Energy Systems' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. This means it has also seen a slide in revenue over the longer-term as revenue is down 60% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 28% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that BGR Energy Systems' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On BGR Energy Systems' P/S

Despite BGR Energy Systems' share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that BGR Energy Systems maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

You need to take note of risks, for example - BGR Energy Systems has 4 warning signs (and 2 which are significant) we think you should know about.

If these risks are making you reconsider your opinion on BGR Energy Systems, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade BGR Energy Systems, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BGR Energy Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BGRENERGY

BGR Energy Systems

Manufactures and sells capital equipment for power plants, petrochemical and process industries, and refineries in India and internationally.

Slight and slightly overvalued.

Market Insights

Community Narratives