David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that BEML Limited (NSE:BEML) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for BEML

What Is BEML's Net Debt?

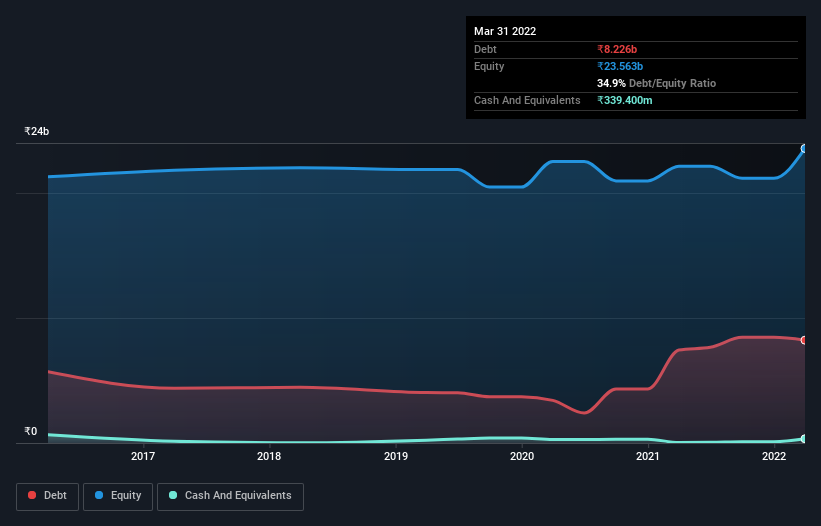

You can click the graphic below for the historical numbers, but it shows that as of March 2022 BEML had ₹8.23b of debt, an increase on ₹7.43b, over one year. On the flip side, it has ₹339.4m in cash leading to net debt of about ₹7.89b.

A Look At BEML's Liabilities

According to the last reported balance sheet, BEML had liabilities of ₹20.3b due within 12 months, and liabilities of ₹13.3b due beyond 12 months. Offsetting these obligations, it had cash of ₹339.4m as well as receivables valued at ₹24.9b due within 12 months. So its liabilities total ₹8.29b more than the combination of its cash and short-term receivables.

Of course, BEML has a market capitalization of ₹58.0b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

BEML's net debt is sitting at a very reasonable 2.5 times its EBITDA, while its EBIT covered its interest expense just 5.0 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Pleasingly, BEML is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 104% gain in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since BEML will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, BEML burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

BEML's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to to grow its EBIT is pretty flash. When we consider all the factors mentioned above, we do feel a bit cautious about BEML's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for BEML that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if BEML might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BEML

BEML

Provides products and services to the mining and construction, rail and metro, power, and defense and aerospace sectors in India.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives