Top Indian Growth Stocks With High Insider Ownership In September 2024

Reviewed by Simply Wall St

In the last week, the Indian market is up 1.6% and has surged 44% over the last 12 months, with earnings forecasted to grow by 17% annually. In such a robust market environment, growth companies with high insider ownership can offer unique investment opportunities due to their potential for strong performance and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| KEI Industries (BSE:517569) | 18.7% | 22.4% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

We'll examine a selection from our screener results.

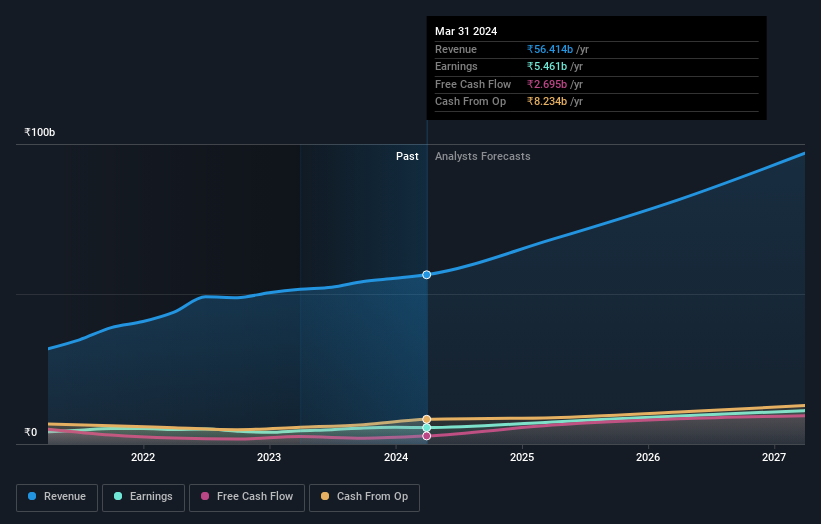

Astral (NSEI:ASTRAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Astral Limited, with a market cap of ₹5.44 billion, manufactures and markets pipes, water tanks, adhesives, and sealants in India and internationally through its subsidiaries.

Operations: Astral's revenue segments include ₹42.17 billion from plumbing and ₹15.25 billion from paints and adhesives.

Insider Ownership: 39.4%

Earnings Growth Forecast: 23.5% p.a.

Astral's earnings are forecast to grow 23.53% annually, outpacing the Indian market's 17.3%. Despite no substantial insider buying in the past three months, significant insider selling has occurred. Revenue is expected to grow at 17.3% per year, faster than the market's 10.1%. Recent expansions include a new Hyderabad plant starting production on September 2, 2024, and consolidating adhesive manufacturing operations to newer facilities in Rania and Dahej from Unnao.

- Click here and access our complete growth analysis report to understand the dynamics of Astral.

- The valuation report we've compiled suggests that Astral's current price could be inflated.

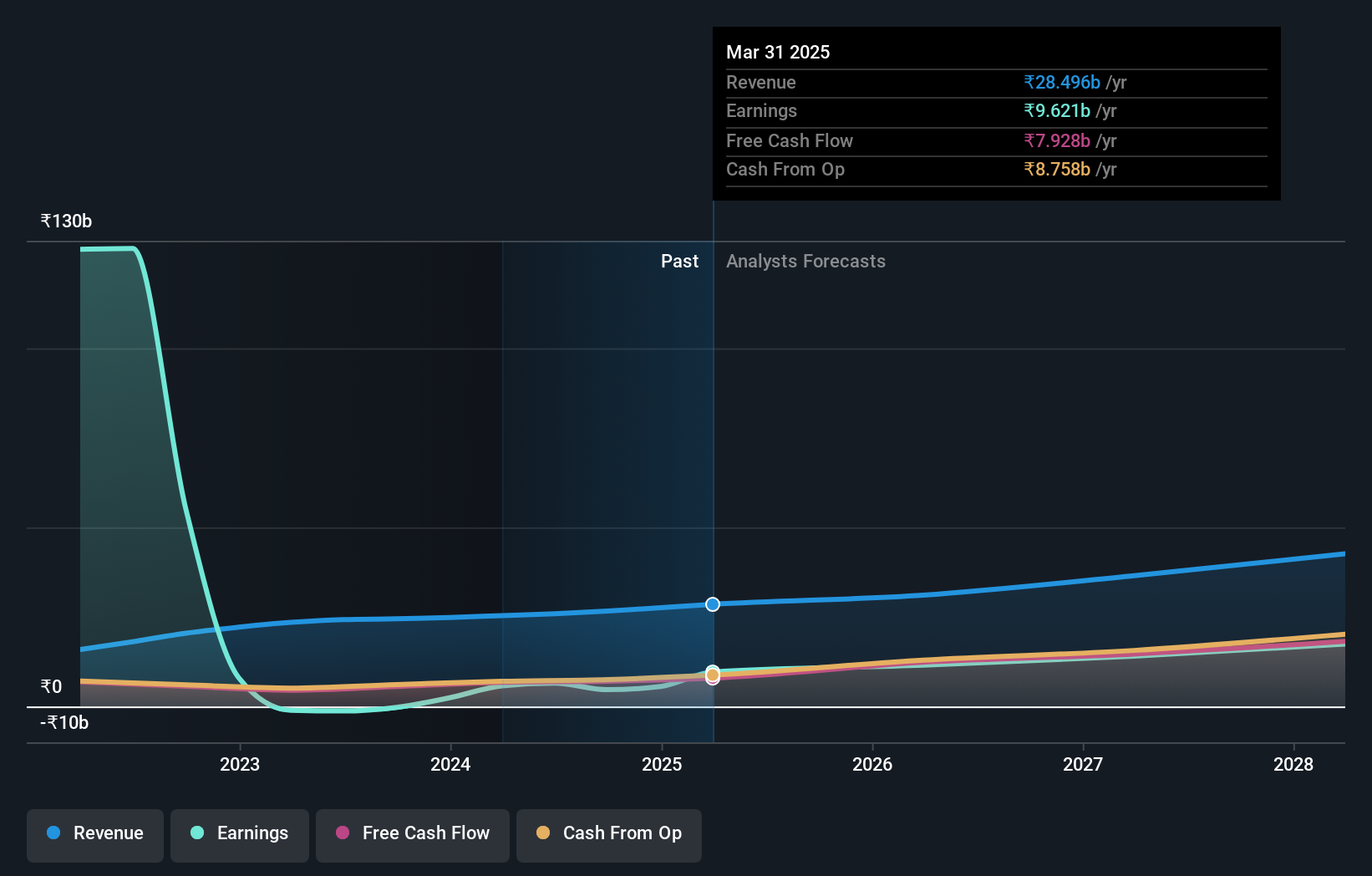

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited operates as an online classifieds company in recruitment, matrimony, real estate, and education services both in India and internationally, with a market cap of ₹1.02 trillion.

Operations: The company's revenue segments include ₹19.05 billion from Recruitment Solutions and ₹3.67 billion from 99acres for Real Estate.

Insider Ownership: 37.7%

Earnings Growth Forecast: 23.6% p.a.

Info Edge (India) Limited, with substantial insider ownership, is forecasted to grow earnings by 23.61% annually, surpassing the Indian market's 17.3%. Recent executive changes include appointing Hoonar Janu as Senior VP and Head of Public Policy. Despite significant insider selling in the past three months, revenue is expected to grow at 13% per year. The company reported strong Q1 results with net income rising from INR 1.59 billion to INR 2.33 billion year-over-year.

- Take a closer look at Info Edge (India)'s potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Info Edge (India) shares in the market.

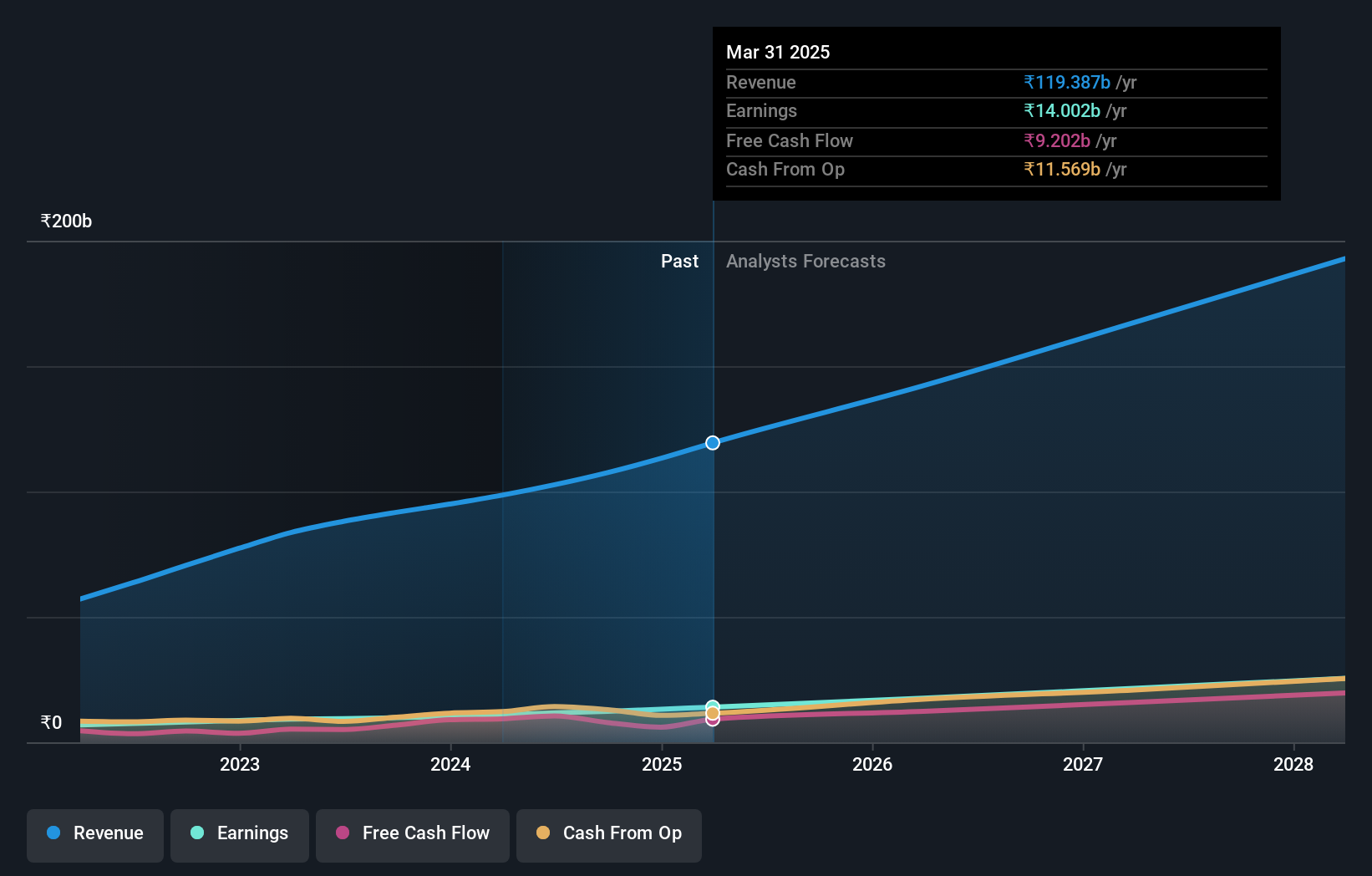

Persistent Systems (NSEI:PERSISTENT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persistent Systems Limited offers software products, services, and technology solutions across India, North America, and internationally with a market cap of ₹791.64 billion.

Operations: The company's revenue segments include Healthcare & Life Sciences (₹23.88 billion), Software, Hi-Tech and Emerging Industries (₹46.41 billion), and Banking, Financial Services and Insurance (BFSI) (₹32.08 billion).

Insider Ownership: 34.3%

Earnings Growth Forecast: 19.4% p.a.

Persistent Systems, a growth company with high insider ownership, has seen its earnings grow by 24.8% over the past year and is forecasted to continue growing at 19.4% annually, outpacing the Indian market's 17.3%. Recent executive changes include Sachin Pathak's appointment as Chief Risk Officer. The company reported Q1 revenue of INR 27.68 billion and net income of INR 3.06 billion, reflecting robust financial health despite leadership transitions and a reliable dividend payout of INR 26 per share for FY2023-24.

- Click to explore a detailed breakdown of our findings in Persistent Systems' earnings growth report.

- Upon reviewing our latest valuation report, Persistent Systems' share price might be too optimistic.

Where To Now?

- Click through to start exploring the rest of the 90 Fast Growing Indian Companies With High Insider Ownership now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ASTRAL

Astral

Engages in the manufacture and marketing of pipes, water tanks, and adhesives and sealants in India and internationally.

Flawless balance sheet with high growth potential and pays a dividend.