If You Had Bought Ashok Leyland (NSE:ASHOKLEY) Stock A Year Ago, You Could Pocket A 124% Gain Today

Unless you borrow money to invest, the potential losses are limited. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Ashok Leyland Limited (NSE:ASHOKLEY) share price has soared 124% in the last year. Most would be very happy with that, especially in just one year! Meanwhile the share price is 3.5% higher than it was a week ago. Zooming out, the stock is actually down 29% in the last three years.

View our latest analysis for Ashok Leyland

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months Ashok Leyland went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. We might get a clue to explain the share price move by looking to other metrics.

We doubt the modest 0.4% dividend yield is doing much to support the share price. Unfortunately Ashok Leyland's fell 39% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

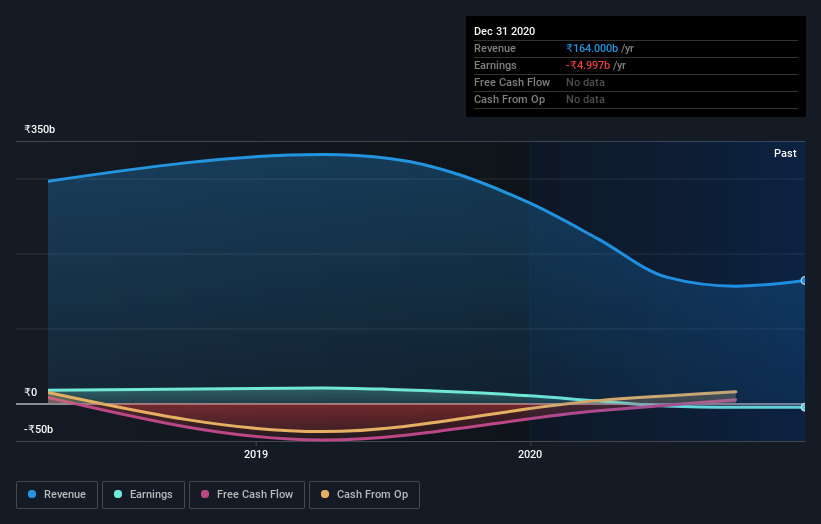

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Ashok Leyland's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Ashok Leyland has rewarded shareholders with a total shareholder return of 124% in the last twelve months. That's including the dividend. That's better than the annualised return of 5% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Ashok Leyland better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Ashok Leyland (including 2 which are concerning) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Ashok Leyland or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ASHOKLEY

Ashok Leyland

Manufactures and sells commercial vehicles in India and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives