- India

- /

- Trade Distributors

- /

- NSEI:ANLON

Anlon Technology Solutions Limited's (NSE:ANLON) Share Price Could Signal Some Risk

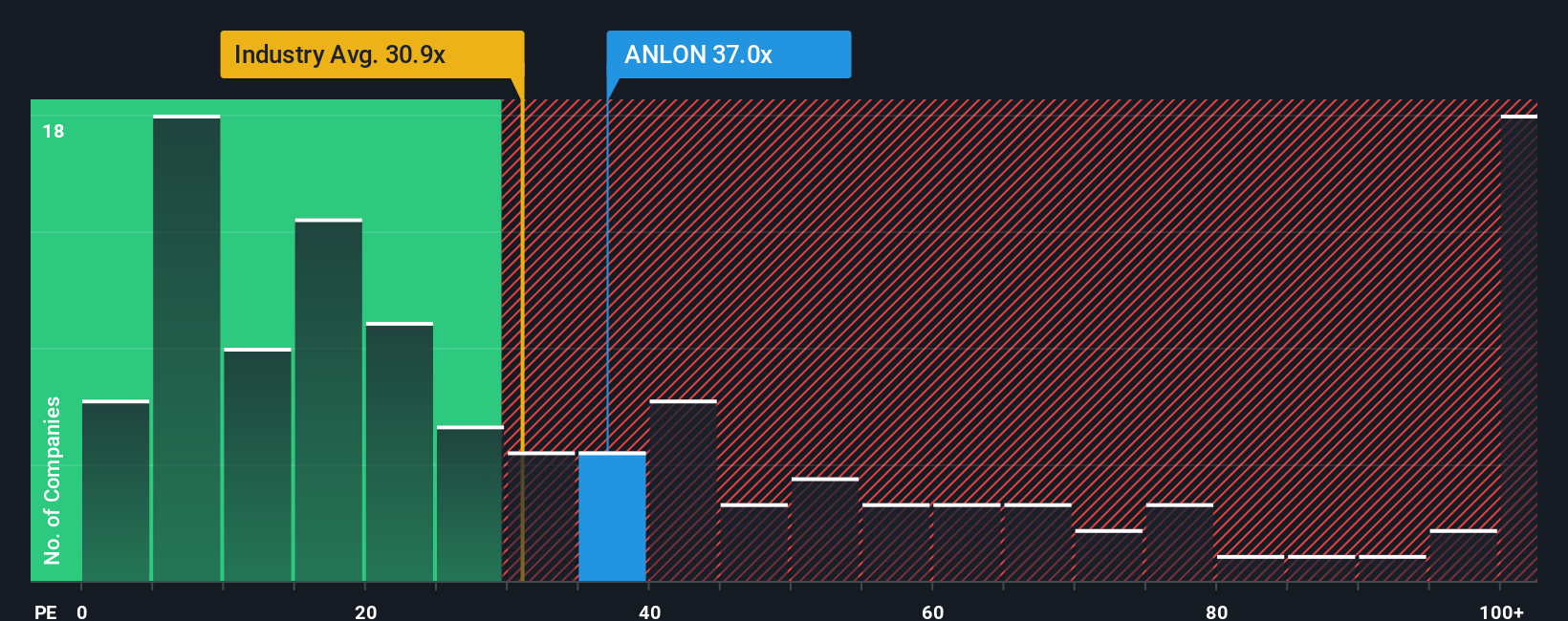

With a price-to-earnings (or "P/E") ratio of 37x Anlon Technology Solutions Limited (NSE:ANLON) may be sending bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 27x and even P/E's lower than 15x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's exceedingly strong of late, Anlon Technology Solutions has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Anlon Technology Solutions

How Is Anlon Technology Solutions' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Anlon Technology Solutions' is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 31%. The latest three year period has also seen an excellent 94% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's about the same on an annualised basis.

In light of this, it's curious that Anlon Technology Solutions' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent earnings trends would weigh down the share price eventually.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Anlon Technology Solutions currently trades on a higher than expected P/E since its recent three-year growth is only in line with the wider market forecast. Right now we are uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Anlon Technology Solutions (at least 1 which is significant), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ANLON

Anlon Technology Solutions

Engages in the distribution of spare parts and consumables in India.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives