We Think Ahlada Engineers (NSE:AHLADA) Can Stay On Top Of Its Debt

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Ahlada Engineers Limited (NSE:AHLADA) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Ahlada Engineers

What Is Ahlada Engineers's Net Debt?

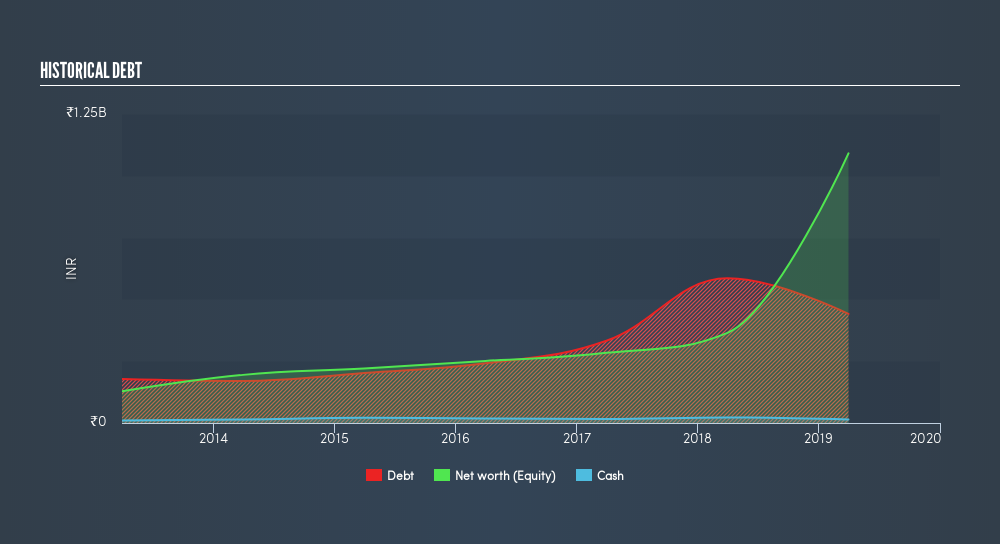

As you can see below, Ahlada Engineers had ₹441.2m of debt at March 2019, down from ₹593.9m a year prior. However, it does have ₹14.2m in cash offsetting this, leading to net debt of about ₹427.0m.

A Look At Ahlada Engineers's Liabilities

Zooming in on the latest balance sheet data, we can see that Ahlada Engineers had liabilities of ₹782.1m due within 12 months and liabilities of ₹208.6m due beyond that. On the other hand, it had cash of ₹14.2m and ₹990.3m worth of receivables due within a year. So these liquid assets roughly match the total liabilities.

Having regard to Ahlada Engineers's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the ₹949.0m company is struggling for cash, we still think it's worth monitoring its balance sheet. Since Ahlada Engineers does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Ahlada Engineers's low debt to EBITDA ratio of 1.39 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 3.04 last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. It is well worth noting that Ahlada Engineers's EBIT shot up like bamboo after rain, gaining 59% in the last twelve months. That'll make it easier to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Ahlada Engineers will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Ahlada Engineers saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Ahlada Engineers's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better In particular, we are dazzled with its EBIT growth rate. Considering this range of data points, we think Ahlada Engineers is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. Over time, share prices tend to follow earnings per share, so if you're interested in Ahlada Engineers, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:AHLADA

Ahlada Engineers

Manufactures and sells steel doors and windows in India.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives