- India

- /

- Electrical

- /

- NSEI:AARTECH

Do Its Financials Have Any Role To Play In Driving Aartech Solonics Limited's (NSE:AARTECH) Stock Up Recently?

Aartech Solonics (NSE:AARTECH) has had a great run on the share market with its stock up by a significant 15% over the last three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. In this article, we decided to focus on Aartech Solonics' ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Aartech Solonics

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Aartech Solonics is:

9.6% = ₹29m ÷ ₹302m (Based on the trailing twelve months to December 2023).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each ₹1 of shareholders' capital it has, the company made ₹0.10 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Aartech Solonics' Earnings Growth And 9.6% ROE

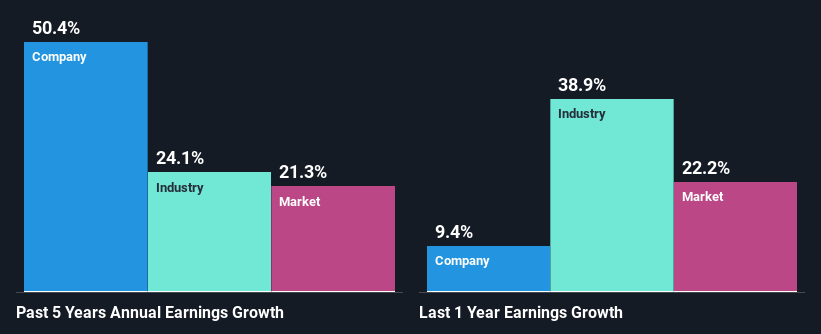

At first glance, Aartech Solonics' ROE doesn't look very promising. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 16%. However, we we're pleasantly surprised to see that Aartech Solonics grew its net income at a significant rate of 50% in the last five years. Therefore, there could be other reasons behind this growth. Such as - high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that Aartech Solonics' growth is quite high when compared to the industry average growth of 24% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Aartech Solonics is trading on a high P/E or a low P/E, relative to its industry.

Is Aartech Solonics Using Its Retained Earnings Effectively?

Aartech Solonics' three-year median payout ratio to shareholders is 18%, which is quite low. This implies that the company is retaining 82% of its profits. So it looks like Aartech Solonics is reinvesting profits heavily to grow its business, which shows in its earnings growth.

Additionally, Aartech Solonics has paid dividends over a period of four years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

On the whole, we do feel that Aartech Solonics has some positive attributes. Even in spite of the low rate of return, the company has posted impressive earnings growth as a result of reinvesting heavily into its business. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. You can see the 5 risks we have identified for Aartech Solonics by visiting our risks dashboard for free on our platform here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AARTECH

Aartech Solonics

Operates as a system solution oriented research and development enterprise in the field of specialized and selected energy appliances in India and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026