Here's Why Aaron Industries (NSE:AARON) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Aaron Industries (NSE:AARON). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Aaron Industries

How Fast Is Aaron Industries Growing Its Earnings Per Share?

Over the last three years, Aaron Industries has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Aaron Industries' EPS has grown from ₹5.02 to ₹5.68 over twelve months. There's little doubt shareholders would be happy with that 13% gain.

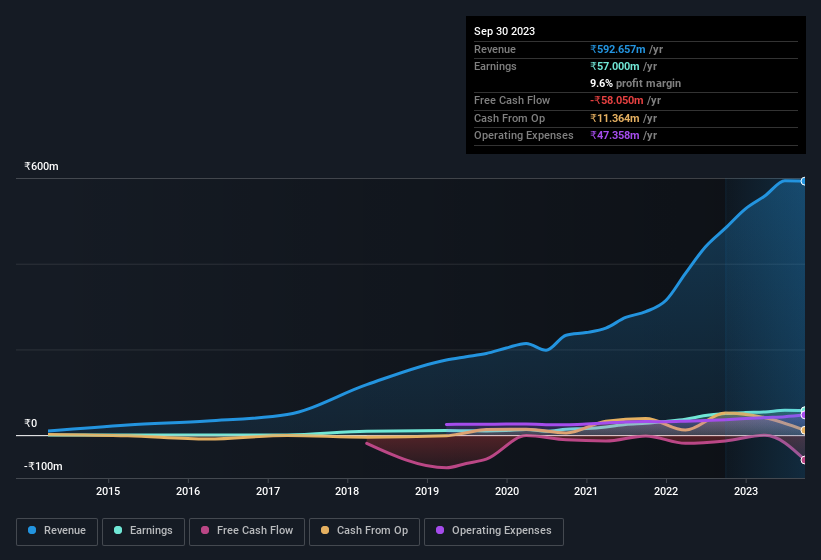

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Aaron Industries achieved similar EBIT margins to last year, revenue grew by a solid 23% to ₹593m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Aaron Industries is no giant, with a market capitalisation of ₹3.1b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Aaron Industries Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Aaron Industries shareholders can gain quiet confidence from the fact that insiders shelled out ₹28m to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. We also note that it was the Executive Chairman & MD, Amar Doshi, who made the biggest single acquisition, paying ₹10m for shares at about ₹233 each.

On top of the insider buying, we can also see that Aaron Industries insiders own a large chunk of the company. To be exact, company insiders hold 75% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. In terms of absolute value, insiders have ₹2.3b invested in the business, at the current share price. That's nothing to sneeze at!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Amar Doshi, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Aaron Industries with market caps under ₹17b is about ₹3.3m.

The CEO of Aaron Industries was paid just ₹2.8m in total compensation for the year ending March 2023. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Aaron Industries Worth Keeping An Eye On?

One positive for Aaron Industries is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. We don't want to rain on the parade too much, but we did also find 3 warning signs for Aaron Industries (1 doesn't sit too well with us!) that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, Aaron Industries isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AARON

Aaron Industries

Engages in the manufacture and sale of elevators and elevator parts in India.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives