Union Bank of India (NSEI:UNIONBANK) Eyes Growth with AI Investments Despite Dividend Concerns

Reviewed by Simply Wall St

Dive into the specifics of Union Bank of India here with our thorough analysis report.

Innovative Factors Supporting Union Bank of India

Union Bank of India has demonstrated strong financial performance, with earnings growth of 28.8% over the past year, surpassing the industry average of 15%. This growth is complemented by a consistent increase in profitability over the last five years, with earnings rising by 58.9% annually. The bank's net profit margin has also improved, reaching 30.7% compared to 27.6% the previous year, highlighting its operational efficiency. Furthermore, the bank's financial health is underscored by its cash reserves exceeding total debt, reinforcing its strong balance sheet. The dividend yield of 3.16% places it among the top 25% of dividend payers in the Indian market, appealing to income-focused investors.

Critical Issues Affecting the Performance of Union Bank of India and Areas for Growth

While the bank has achieved significant earnings growth, its revenue growth forecast of 10.1% annually lags behind the Indian market's 10.5%. Additionally, the expected earnings growth of 5% per year is below the market average of 18%, indicating potential challenges in maintaining its competitive edge. The return on equity stands at 14.3%, which is considered low compared to the ideal threshold of 20%. Over the past decade, dividend payments have been volatile, which may concern investors seeking stable returns. Shareholder dilution is also a concern, with a 3% increase in shares outstanding over the past year.

Potential Strategies for Leveraging Growth and Competitive Advantage

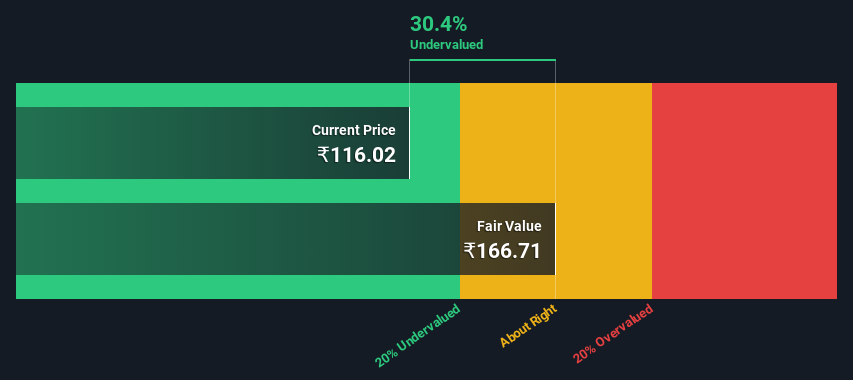

Analysts are optimistic about Union Bank's future, with a consensus predicting a 27.4% rise in stock price, suggesting potential for significant capital appreciation. The bank is currently trading at a favorable valuation compared to its peers, which could attract investment interest. Expansion into new markets and strategic alliances could further enhance its market position. The bank's focus on technological investments, such as AI and machine learning, aims to improve operational efficiency and customer experience, positioning it well against competitors.

External Factors Threatening Union Bank of India

Union Bank faces external challenges. The instability of its dividend track record may deter income-focused investors. Additionally, the expected revenue and profit growth rates are below industry averages, posing challenges in sustaining competitive performance. Economic headwinds and regulatory changes could further impact its growth trajectory, necessitating proactive management to navigate these uncertainties.

Conclusion

Union Bank of India's impressive earnings growth and improved net profit margin underscore its operational efficiency and financial resilience, with cash reserves exceeding total debt. However, the bank's revenue and earnings growth forecasts fall short of industry averages, posing challenges in maintaining its competitive edge. Despite these hurdles, analysts predict a 27.4% rise in stock price, suggesting potential for capital appreciation, especially given its favorable trading valuation compared to peers. While external factors like economic headwinds and regulatory changes present uncertainties, strategic investments in technology and market expansion could bolster its market position. The bank's volatile dividend history and low return on equity remain concerns, but its strong balance sheet and potential for strategic growth provide a mixed yet cautiously optimistic outlook for future performance.

Seize The Opportunity

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NSEI:UNIONBANK

Very undervalued with proven track record and pays a dividend.