United Spirits (NSEI:UNITDSPR) Faces Overvaluation Concerns Despite Strong Earnings and AI Innovation

Reviewed by Simply Wall St

United Spirits (NSEI:UNITDSPR) continues to demonstrate strong financial health with an impressive earnings growth rate of 25.2% annually over the past five years and a strong forecasted Return on Equity of 21.2%. However, recent developments, including the introduction of three new product lines and the initiation of dividend payments, highlight both opportunities and challenges in maintaining this momentum. The following report explores key areas such as competitive advantages, critical performance issues, expansion opportunities, and potential risks that could impact United Spirits' future success.

Navigate through the intricacies of United Spirits with our comprehensive report here.

Competitive Advantages That Elevate United Spirits

United Spirits has demonstrated impressive earnings growth, averaging 25.2% annually over the past five years, which underscores its financial health. This growth is complemented by a forecasted Return on Equity of 21.2%, exceeding market benchmarks and indicating efficient management of shareholder investments. The company's debt-free status further strengthens its financial position, allowing it to reinvest earnings into growth initiatives without the burden of interest expenses. Additionally, the introduction of three new product lines has been met with positive customer feedback, showcasing a commitment to innovation that enhances customer loyalty and market presence.

Critical Issues Affecting the Performance of United Spirits and Areas for Growth

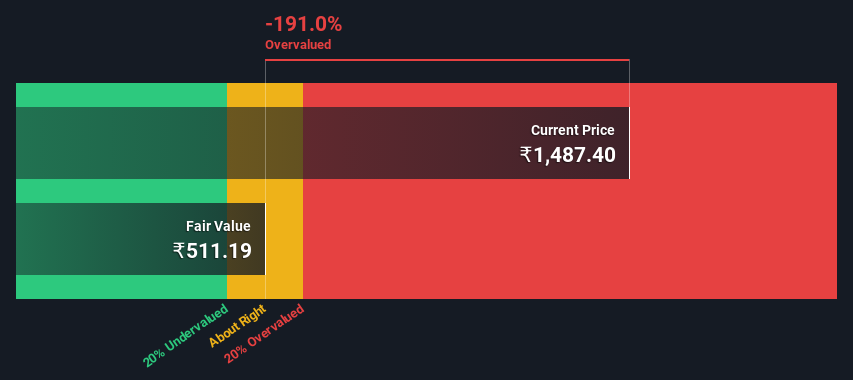

United Spirits faces challenges, such as a current ROE of 18.6%, which falls short of the ideal 20% mark. Furthermore, the company's earnings growth forecast of 15.9% per year lags behind the Indian market average of 18%. The recent initiation of dividend payments also poses a challenge in assessing their reliability and potential for growth. The trading price of ₹1,442.35, significantly above the estimated fair value of ₹511.19, suggests potential overvaluation, which could affect investor sentiment.

Areas for Expansion and Innovation for United Spirits

Opportunities abound for United Spirits, particularly in expanding into the Asia-Pacific region, where significant growth potential exists. The company's strong financial position allows it to invest in AI and machine learning, enhancing product offerings and operational efficiency. By targeting younger demographics through strategic marketing initiatives, United Spirits can broaden its customer base and increase market share, positioning itself for sustained growth.

Key Risks and Challenges That Could Impact United Spirits's Success

External threats, such as economic headwinds and regulatory changes, pose risks to United Spirits's growth trajectory. The potential for an economic slowdown could impact consumer spending, while changes in regulations may necessitate adjustments in business practices. Additionally, the company's high Price-To-Earnings Ratio of 72.2x, compared to the industry average of 19.3x, raises concerns about overvaluation, which could affect its competitiveness in the beverage industry.

Conclusion

United Spirits has showcased strong financial health with impressive earnings growth and a solid Return on Equity, indicating effective management and strategic reinvestment capabilities. However, the company's current trading price significantly exceeds its estimated fair value, suggesting that investor optimism may not fully align with its underlying financial performance. This disparity highlights the importance of cautious investment strategies, particularly as the company navigates external threats like economic fluctuations and regulatory changes. Nonetheless, by leveraging its debt-free status and focusing on expansion into the Asia-Pacific region and innovation through AI, United Spirits is well-positioned to capitalize on growth opportunities and enhance its market presence, provided it addresses these valuation concerns.

Taking Advantage

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NSEI:UNITDSPR

United Spirits

Engages in the manufacture, sale, and distribution of alcoholic beverages and other allied spirits in India and internationally.

Flawless balance sheet with proven track record.