The Indian market has shown remarkable resilience, maintaining stability over the last week and achieving a robust 45% increase over the past year, with earnings expected to grow by 16% annually. In such a dynamic environment, uncovering stocks like ICRA that are not yet widely recognized can offer unique opportunities for growth-oriented investors.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NGL Fine-Chem | 12.35% | 15.70% | 9.76% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| Alembic | 0.42% | 11.74% | -6.39% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 20.60% | 62.92% | ★★★★★☆ |

| Avantel | 7.01% | 35.59% | 35.41% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| Nibe | 33.91% | 81.20% | 80.04% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.41% | 6.90% | 11.82% | ★★★★☆☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| SG Mart | 16.73% | 99.32% | 94.08% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

ICRA (NSEI:ICRA)

Simply Wall St Value Rating: ★★★★★☆

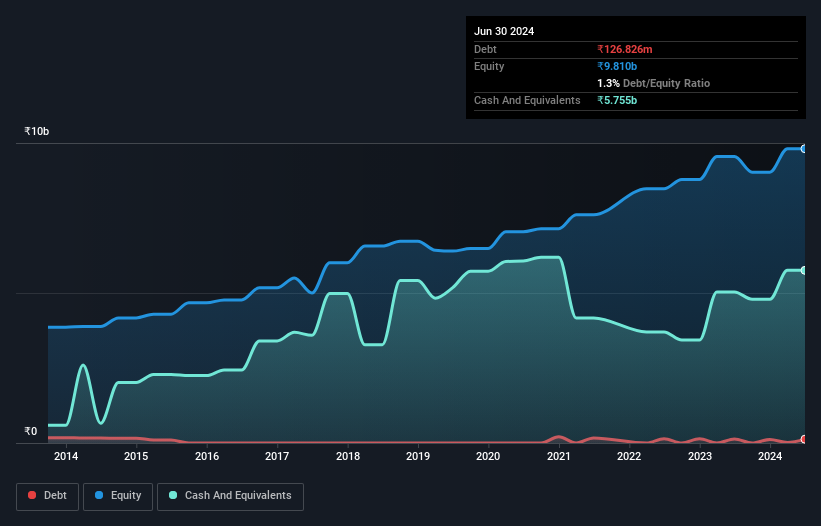

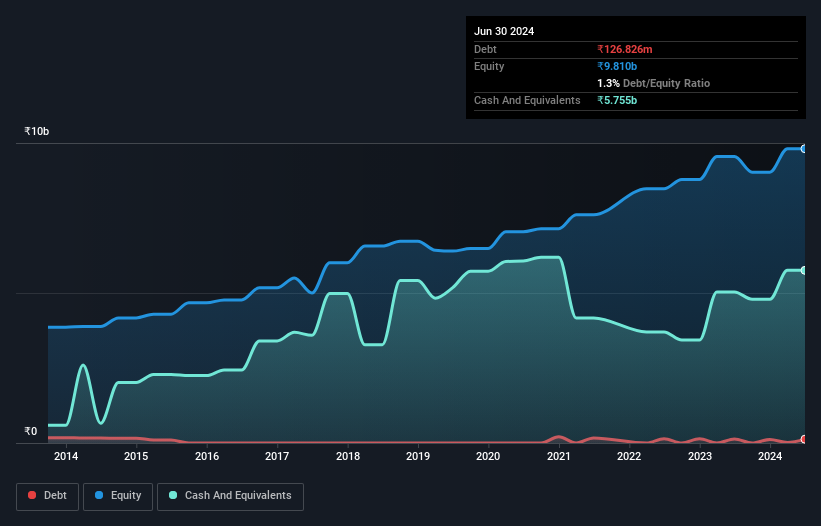

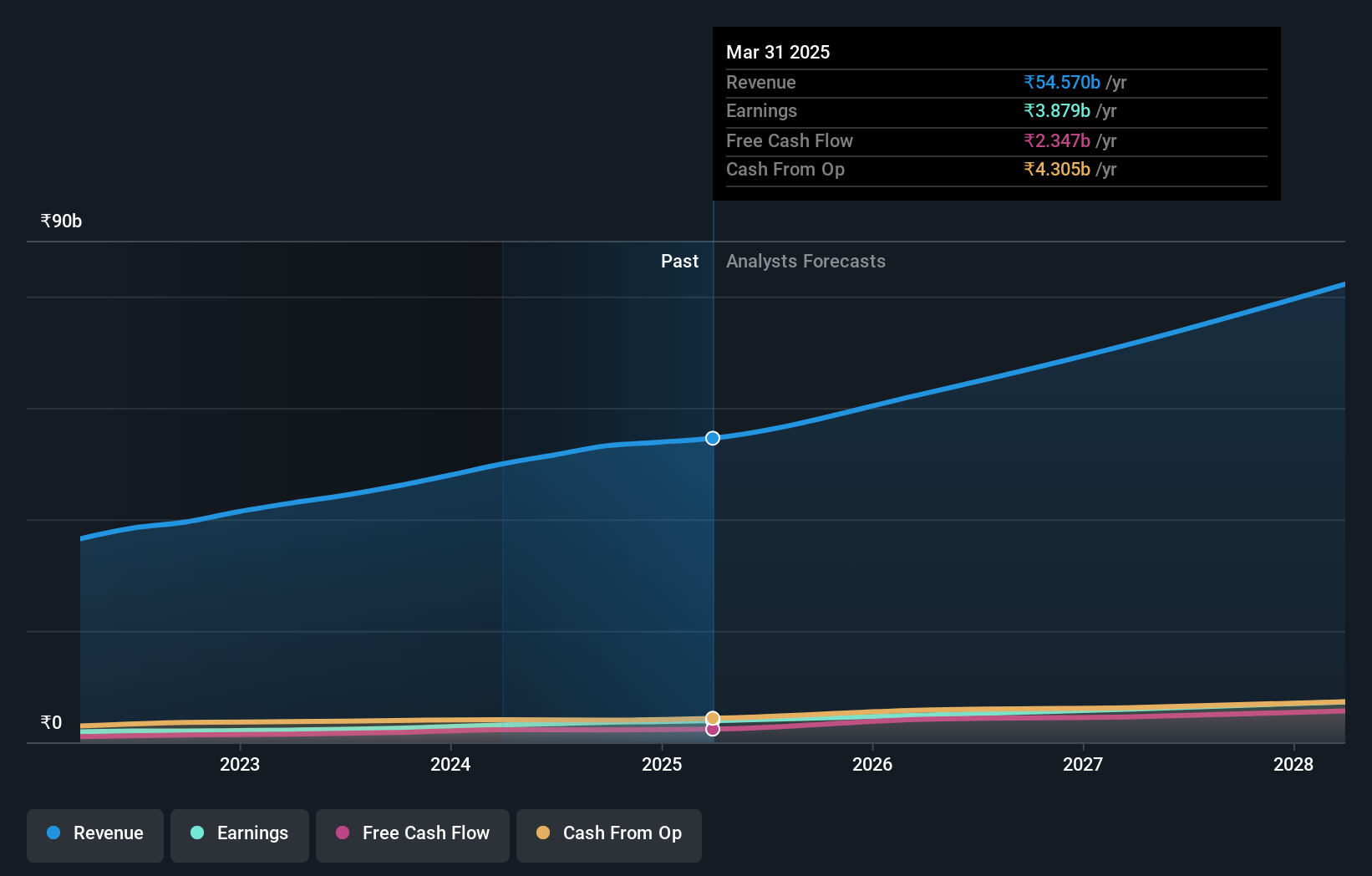

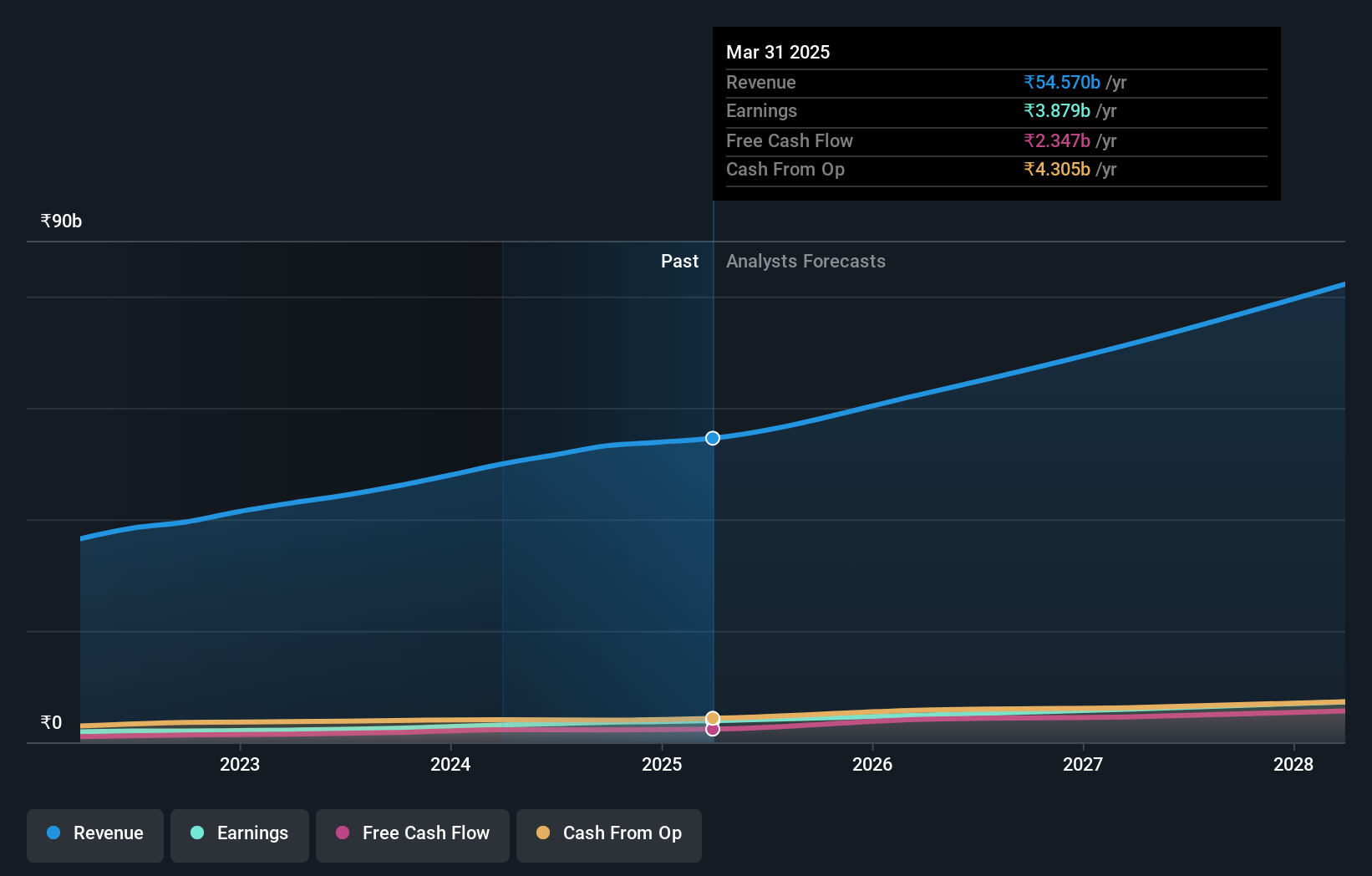

Overview: ICRA Limited is an independent and professional investment information and credit rating agency with operations in India and internationally, boasting a market capitalization of ₹58.33 billion.

Operations: The company generates its revenue primarily from Rating, Research and Other Services, which accounted for ₹2.58 billion, followed by Knowledge Services at ₹1.55 billion. It has maintained a gross profit margin around 44% to 47% over recent periods, reflecting its cost management in relation to revenue generation from these services.

ICRA, a lesser-known yet compelling player in the Indian market, has shown robust financial health with a significant one-off gain of ₹539 million enhancing its recent earnings. Over the past five years, its earnings have consistently grown by 12% annually. Despite not outpacing the industry growth rate of 54%, ICRA's strategic management of resources is evident in its positive free cash flow and minimal debt levels, positioning it well for future opportunities. This blend of steady growth and financial prudence makes ICRA an intriguing prospect for discerning investors.

- Dive into the specifics of ICRA here with our thorough health report.

Understand ICRA's track record by examining our Past report.

ICRA (NSEI:ICRA)

Simply Wall St Value Rating: ★★★★★☆

Overview: ICRA Limited is an independent and professional investment information and credit rating agency with operations in India and internationally, boasting a market capitalization of ₹58.33 billion.

Operations: The company generates its revenue primarily from Rating, Research and Other Services, which accounted for ₹2.58 billion, followed by Knowledge Services at ₹1.55 billion. It has maintained a gross profit margin around 44% to 47% over recent periods, reflecting its cost management in relation to revenue generation from these services.

ICRA, a lesser-known yet compelling player in the Indian market, has shown robust financial health with a significant one-off gain of ₹539 million enhancing its recent earnings. Over the past five years, its earnings have consistently grown by 12% annually. Despite not outpacing the industry growth rate of 54%, ICRA's strategic management of resources is evident in its positive free cash flow and minimal debt levels, positioning it well for future opportunities. This blend of steady growth and financial prudence makes ICRA an intriguing prospect for discerning investors.

- Dive into the specifics of ICRA here with our thorough health report.

Understand ICRA's track record by examining our Past report.

Jana Small Finance Bank (NSEI:JSFB)

Simply Wall St Value Rating: ★★★★☆☆

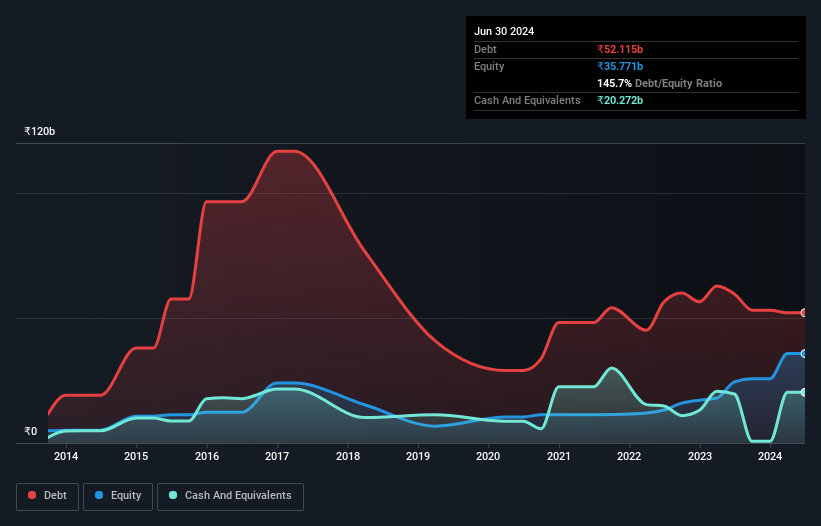

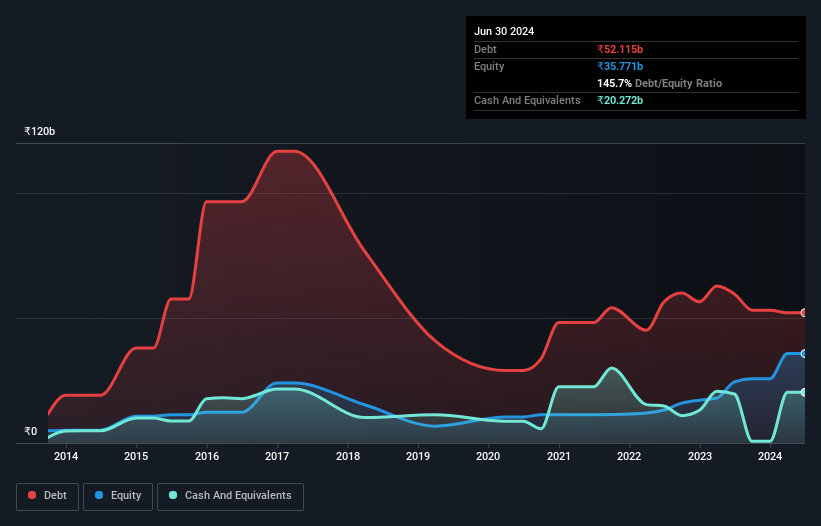

Overview: Jana Small Finance Bank Limited offers a range of banking products and services to both individual customers and businesses across India, with a market capitalization of ₹72.17 billion.

Operations: The primary revenue for Jana Small Finance Bank comes from its extensive retail banking operations, which significantly overshadow its smaller digital banking and corporate/wholesale banking segments. The bank has maintained a remarkably high gross profit margin consistently at or near 100%, indicating minimal cost of goods sold relative to its revenue streams.

Jana Small Finance Bank, a notable presence in the financial sector, boasts total assets of ₹327.1 billion and an equity base of ₹35.8 billion. With total deposits at ₹225.7 billion and loans at ₹231.1 billion, its robust net interest margin stands at 8%. Despite a low allowance for bad loans at 65%, indicating potential risk management challenges with a bad loan ratio of 2.1%, the bank has demonstrated substantial earnings growth of 161.6% over the past year, significantly outpacing industry averages.

- Delve into the full analysis health report here for a deeper understanding of Jana Small Finance Bank.

Gain insights into Jana Small Finance Bank's past trends and performance with our Past report.

Jana Small Finance Bank (NSEI:JSFB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jana Small Finance Bank Limited offers a range of banking products and services to both individual customers and businesses across India, with a market capitalization of ₹72.17 billion.

Operations: The primary revenue for Jana Small Finance Bank comes from its extensive retail banking operations, which significantly overshadow its smaller digital banking and corporate/wholesale banking segments. The bank has maintained a remarkably high gross profit margin consistently at or near 100%, indicating minimal cost of goods sold relative to its revenue streams.

Jana Small Finance Bank, a notable presence in the financial sector, boasts total assets of ₹327.1 billion and an equity base of ₹35.8 billion. With total deposits at ₹225.7 billion and loans at ₹231.1 billion, its robust net interest margin stands at 8%. Despite a low allowance for bad loans at 65%, indicating potential risk management challenges with a bad loan ratio of 2.1%, the bank has demonstrated substantial earnings growth of 161.6% over the past year, significantly outpacing industry averages.

- Delve into the full analysis health report here for a deeper understanding of Jana Small Finance Bank.

Gain insights into Jana Small Finance Bank's past trends and performance with our Past report.

Time Technoplast (NSEI:TIMETECHNO)

Simply Wall St Value Rating: ★★★★★★

Overview: Time Technoplast Limited operates in the technology-based polymer and composite products sector, serving both Indian and international markets with a market capitalization of ₹79.05 billion.

Operations: The company generates its revenue primarily from polymer and composite products, with significant gross profit margins observed over recent periods. In the latest recorded period, it achieved a gross profit margin of 28.13%.

Time Technoplast, a lesser-known yet robust player in the packaging industry, has demonstrated significant financial and operational strength. With a debt-to-equity ratio improvement from 49% to 28.5% over five years, the company underscores its commitment to financial health. Its earnings growth of 41.7% last year outpaces the industry's 2.2%, reflecting its competitive edge and innovation prowess, particularly highlighted by recent approvals for high-pressure composite cylinders for hydrogen—setting it apart as a potential market leader in niche segments.

- Click here to discover the nuances of Time Technoplast with our detailed analytical health report.

Examine Time Technoplast's past performance report to understand how it has performed in the past.

Time Technoplast (NSEI:TIMETECHNO)

Simply Wall St Value Rating: ★★★★★★

Overview: Time Technoplast Limited operates in the technology-based polymer and composite products sector, serving both Indian and international markets with a market capitalization of ₹79.05 billion.

Operations: The company generates its revenue primarily from polymer and composite products, with significant gross profit margins observed over recent periods. In the latest recorded period, it achieved a gross profit margin of 28.13%.

Time Technoplast, a lesser-known yet robust player in the packaging industry, has demonstrated significant financial and operational strength. With a debt-to-equity ratio improvement from 49% to 28.5% over five years, the company underscores its commitment to financial health. Its earnings growth of 41.7% last year outpaces the industry's 2.2%, reflecting its competitive edge and innovation prowess, particularly highlighted by recent approvals for high-pressure composite cylinders for hydrogen—setting it apart as a potential market leader in niche segments.

- Click here to discover the nuances of Time Technoplast with our detailed analytical health report.

Examine Time Technoplast's past performance report to understand how it has performed in the past.

Next Steps

- Click here to access our complete index of 459 Indian Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JSFB

Jana Small Finance Bank

Provides banking and financial services to individuals and enterprises in India.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives