Top Dividend Stocks On The Indian Exchange For September 2024

Reviewed by Simply Wall St

Over the past 7 days, the Indian market has risen 1.7%, and in the last year, it has climbed 41%. With earnings expected to grow by 17% per annum over the next few years, identifying strong dividend stocks becomes essential for investors looking to capitalize on this growth while securing steady income.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.09% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 3.88% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.14% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.09% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.08% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.25% | ★★★★★☆ |

| Canara Bank (NSEI:CANBK) | 3.03% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.01% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.27% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.17% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top Indian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Bank of Baroda (NSEI:BANKBARODA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Baroda Limited offers a range of banking products and services to individuals, government departments, and corporate customers both in India and internationally, with a market cap of ₹1.24 trillion.

Operations: Bank of Baroda Limited's revenue segments include Treasury (₹316.82 billion), Other Banking Operations (₹110.76 billion), Corporate/Wholesale Banking (₹502.78 billion), and Retail Banking - Other Retail Banking (₹512.25 billion).

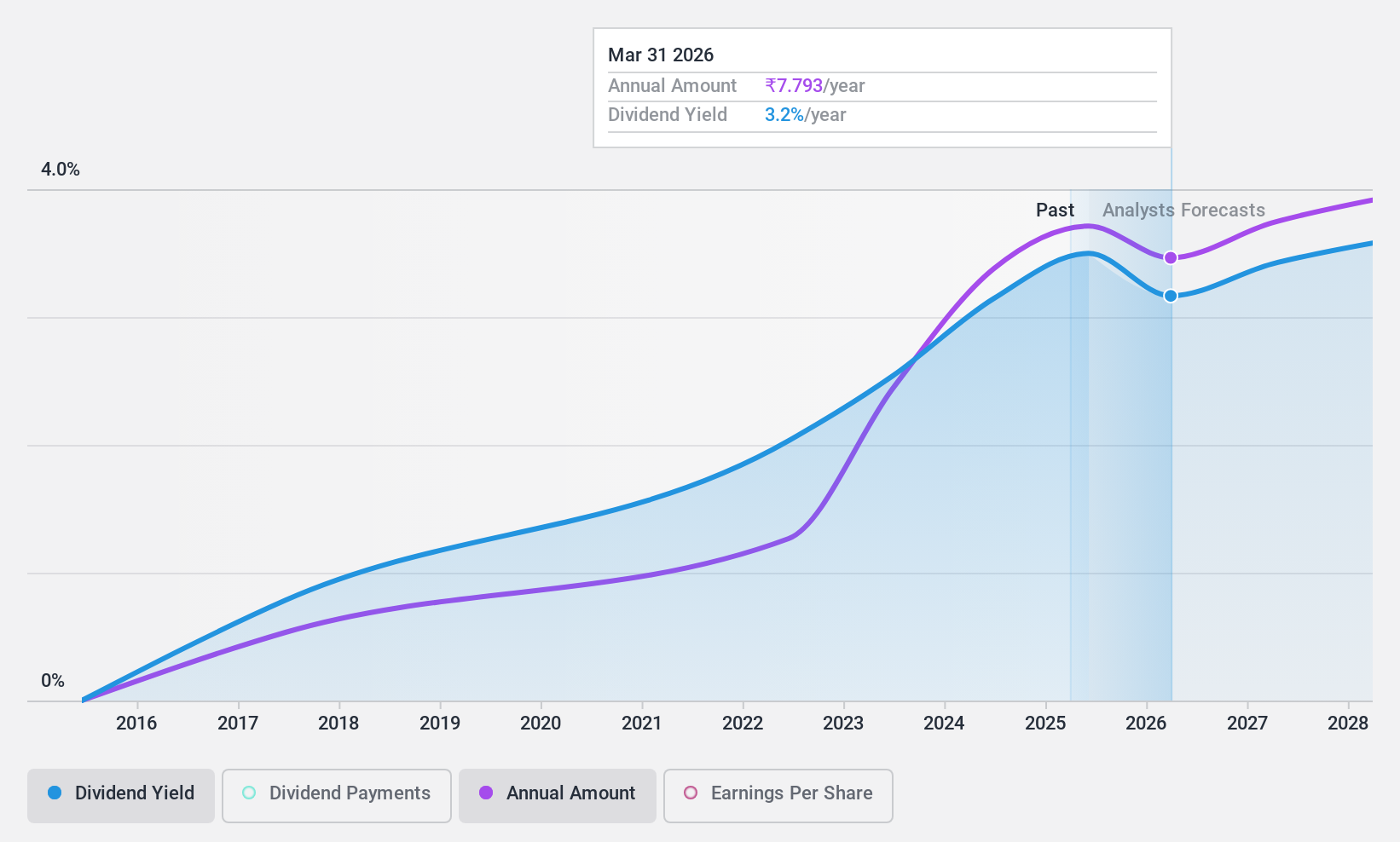

Dividend Yield: 3.2%

Bank of Baroda's dividend yield is among the top 25% in India, with a current payout ratio of 20.9%, indicating dividends are well-covered by earnings. However, its dividend history has been volatile over the past decade. Recent completion of INR 50 billion fixed-income offerings may support financial stability but also highlights ongoing capital requirements. Earnings have grown significantly at 56.5% per year over the last five years, suggesting potential for future dividend sustainability despite high levels of bad loans (2.9%).

- Get an in-depth perspective on Bank of Baroda's performance by reading our dividend report here.

- The analysis detailed in our Bank of Baroda valuation report hints at an deflated share price compared to its estimated value.

Canara Bank (NSEI:CANBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canara Bank provides various banking products and services in India and internationally, with a market cap of ₹9.65 billion.

Operations: Canara Bank's revenue segments include Treasury Operations (₹255.75 billion), Life Insurance Operation (₹120.19 billion), Wholesale Banking Operations (₹430.48 billion), and Retail Banking Operations comprising Digital Banking (₹22.30 million) and Other Retail Banking (₹632.28 billion).

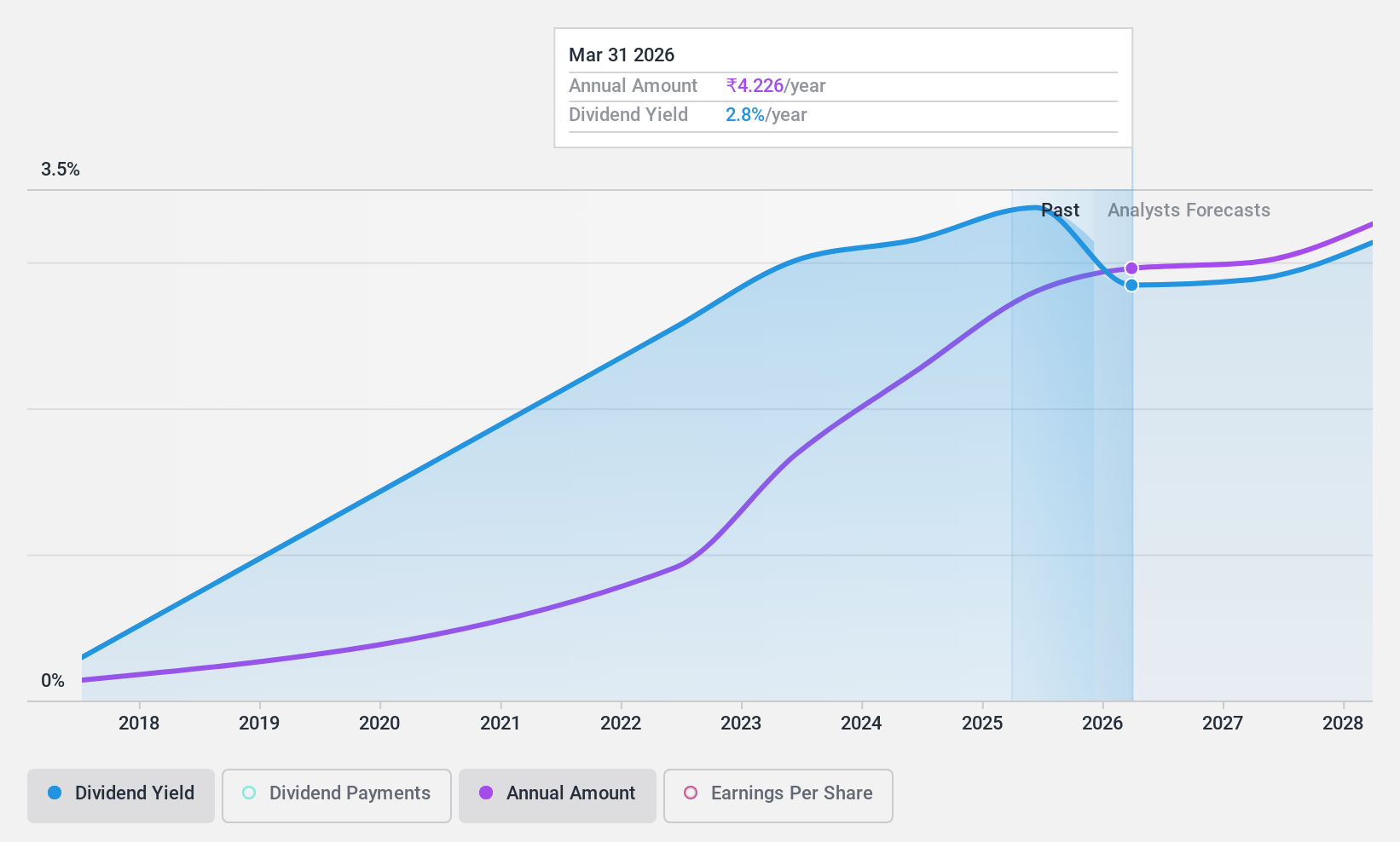

Dividend Yield: 3%

Canara Bank's dividend yield is in the top 25% of Indian payers, with a low payout ratio of 19.1%, indicating strong coverage by earnings. Dividend payments have grown over the past decade but have been volatile. Recent board changes and executive appointments aim to strengthen governance and operational efficiency. Earnings increased to ₹40.68 billion for Q1 2024, though diluted EPS dropped significantly from ₹20.61 to ₹4.48 year-over-year, reflecting mixed financial health amidst high bad loans (4.3%).

- Click here and access our complete dividend analysis report to understand the dynamics of Canara Bank.

- Upon reviewing our latest valuation report, Canara Bank's share price might be too pessimistic.

PTC India (NSEI:PTC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited, with a market cap of ₹70.52 billion, engages in the trading of power across India, Nepal, Bhutan, and Bangladesh through its subsidiaries.

Operations: PTC India Limited generates revenue primarily from its power trading operations (₹159.67 billion) and financing business (₹7.35 billion).

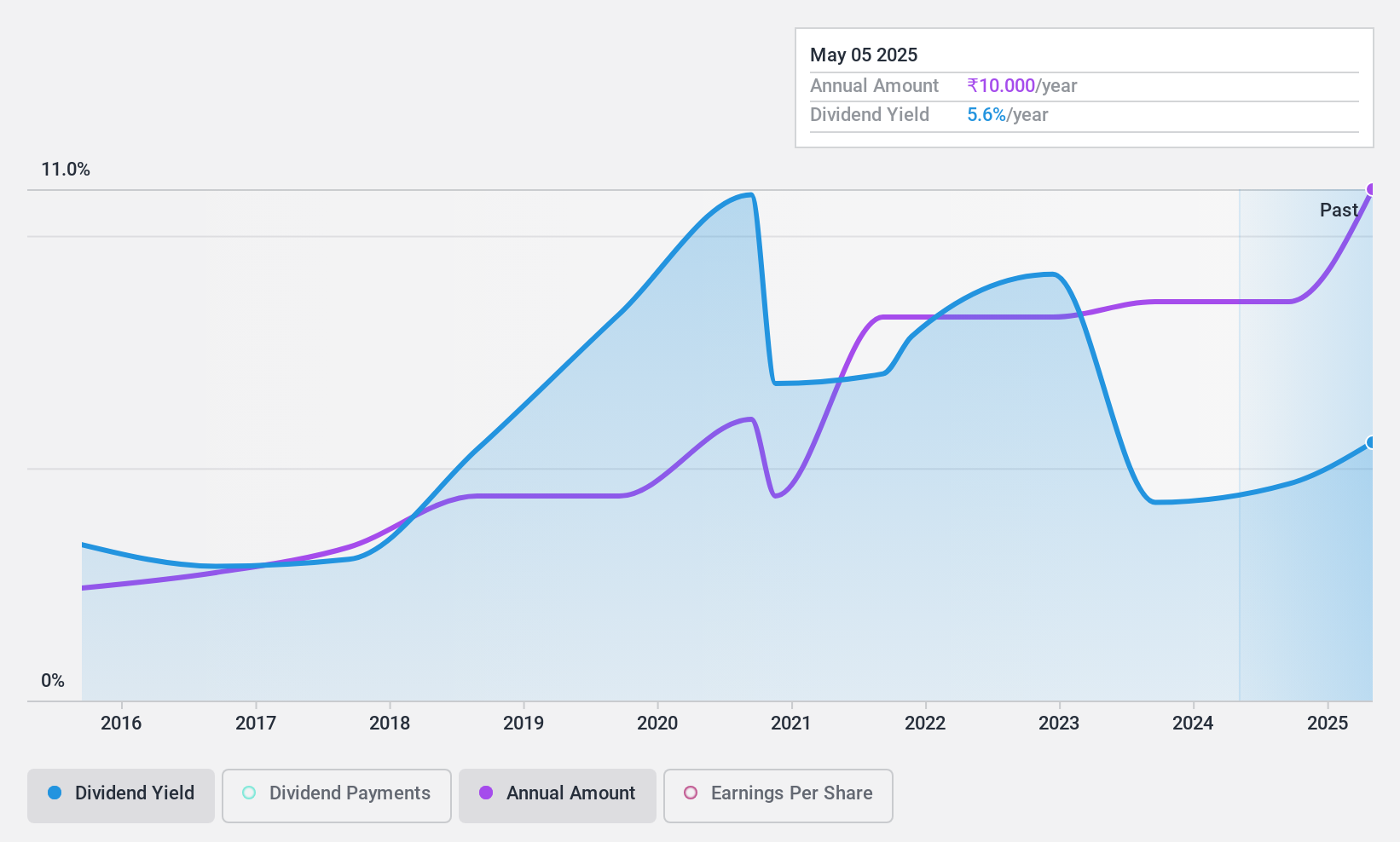

Dividend Yield: 3.3%

PTC India’s dividend yield is among the top 25% in the Indian market, supported by a low cash payout ratio of 9.4%, ensuring robust coverage by cash flows. However, dividend payments have been volatile and unreliable over the past decade despite recent increases. The company reported Q1 2024 net income of ₹1.74 billion on revenue of ₹46.88 billion, showing improvement from last year’s figures but still reflecting some financial instability amidst governance changes.

- Click to explore a detailed breakdown of our findings in PTC India's dividend report.

- According our valuation report, there's an indication that PTC India's share price might be on the cheaper side.

Make It Happen

- Explore the 18 names from our Top Indian Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Baroda might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BANKBARODA

Bank of Baroda

Provides various banking products and services to individuals, government departments, and corporate customers in India and internationally.

Established dividend payer and good value.