- India

- /

- Auto Components

- /

- NSEI:ZFCVINDIA

Getting In Cheap On ZF Commercial Vehicle Control Systems India Limited (NSE:ZFCVINDIA) Might Be Difficult

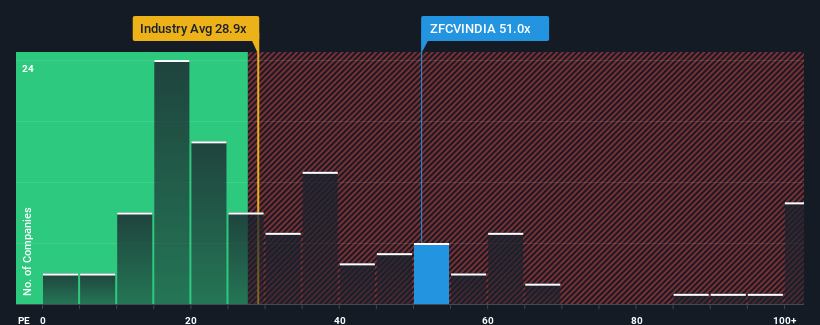

ZF Commercial Vehicle Control Systems India Limited's (NSE:ZFCVINDIA) price-to-earnings (or "P/E") ratio of 51x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 29x and even P/E's below 17x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

ZF Commercial Vehicle Control Systems India could be doing better as it's been growing earnings less than most other companies lately. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for ZF Commercial Vehicle Control Systems India

What Are Growth Metrics Telling Us About The High P/E?

ZF Commercial Vehicle Control Systems India's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.5% last year. The latest three year period has also seen an excellent 166% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 24% per annum as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 19% each year growth forecast for the broader market.

With this information, we can see why ZF Commercial Vehicle Control Systems India is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that ZF Commercial Vehicle Control Systems India maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for ZF Commercial Vehicle Control Systems India you should know about.

If these risks are making you reconsider your opinion on ZF Commercial Vehicle Control Systems India, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if ZF Commercial Vehicle Control Systems India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZFCVINDIA

ZF Commercial Vehicle Control Systems India

Engages in supplying systems for automotive and industrial technology in India and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026