- India

- /

- Auto Components

- /

- NSEI:WHEELS

It's Unlikely That Shareholders Will Increase Wheels India Limited's (NSE:WHEELS) Compensation By Much This Year

Performance at Wheels India Limited (NSE:WHEELS) has not been particularly rosy recently and shareholders will likely be holding CEO Srivats Ram and the board accountable for this. At the upcoming AGM on 04 August 2021, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. The data we gathered below shows that CEO compensation looks acceptable for now.

View our latest analysis for Wheels India

Comparing Wheels India Limited's CEO Compensation With the industry

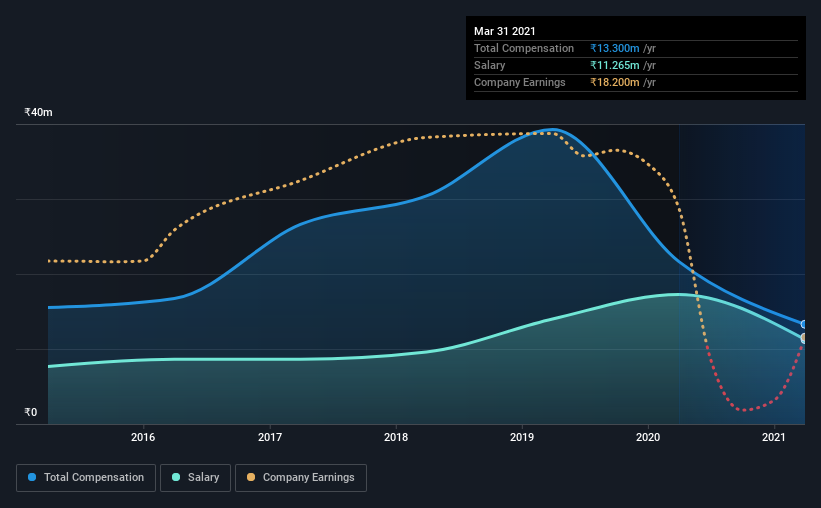

Our data indicates that Wheels India Limited has a market capitalization of ₹24b, and total annual CEO compensation was reported as ₹13m for the year to March 2021. That's a notable decrease of 39% on last year. We note that the salary portion, which stands at ₹11.3m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between ₹15b and ₹60b had a median total CEO compensation of ₹24m. That is to say, Srivats Ram is paid under the industry median. What's more, Srivats Ram holds ₹53m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹11m | ₹17m | 85% |

| Other | ₹2.0m | ₹4.4m | 15% |

| Total Compensation | ₹13m | ₹22m | 100% |

On an industry level, roughly 79% of total compensation represents salary and 21% is other remuneration. Wheels India is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Wheels India Limited's Growth Numbers

Wheels India Limited has reduced its earnings per share by 71% a year over the last three years. It saw its revenue drop 9.7% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Wheels India Limited Been A Good Investment?

Given the total shareholder loss of 12% over three years, many shareholders in Wheels India Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 4 warning signs (and 2 which shouldn't be ignored) in Wheels India we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Wheels India or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wheels India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:WHEELS

Wheels India

Together with its subsidiary, engages in the manufacture and sale of automotive and industrial components in India and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives