- India

- /

- Auto Components

- /

- NSEI:VARROC

Market Cool On Varroc Engineering Limited's (NSE:VARROC) Revenues Pushing Shares 25% Lower

Varroc Engineering Limited (NSE:VARROC) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 16% in that time.

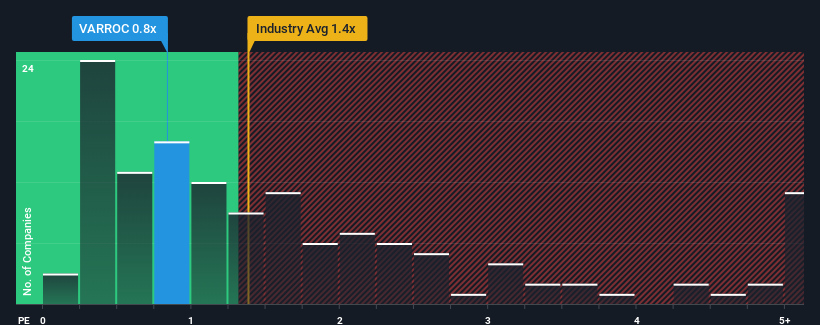

In spite of the heavy fall in price, considering around half the companies operating in India's Auto Components industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Varroc Engineering as an solid investment opportunity with its 0.8x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Varroc Engineering

How Has Varroc Engineering Performed Recently?

Recent revenue growth for Varroc Engineering has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Varroc Engineering will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Varroc Engineering will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Varroc Engineering's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 37% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 8.1%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Varroc Engineering's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Varroc Engineering's P/S Mean For Investors?

Varroc Engineering's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Varroc Engineering's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Varroc Engineering (of which 1 is potentially serious!) you should know about.

If these risks are making you reconsider your opinion on Varroc Engineering, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VARROC

Varroc Engineering

Provides aftermarket automotive components and solutions worldwide.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.