- India

- /

- Auto Components

- /

- NSEI:UCAL

Robust Earnings May Not Tell The Whole Story For Ucal Fuel Systems (NSE:UCALFUEL)

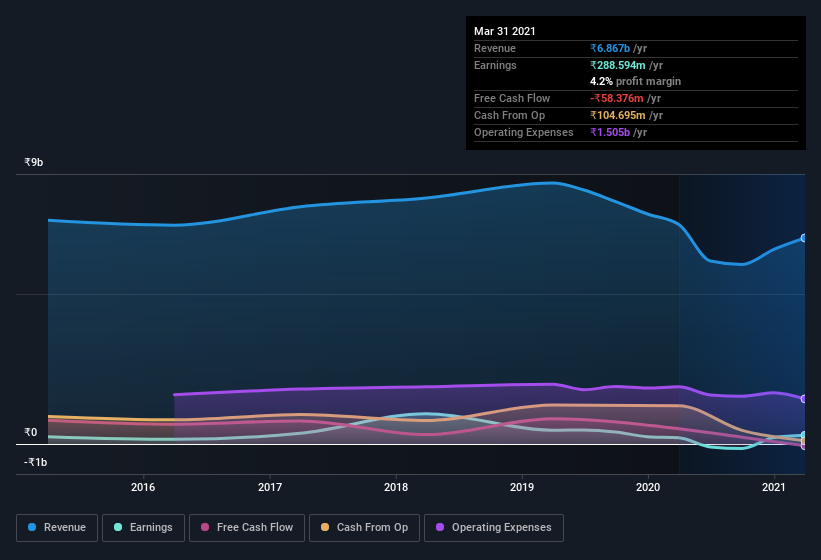

The recent earnings posted by Ucal Fuel Systems Limited (NSE:UCALFUEL) were solid, but the stock didn't move as much as we expected. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

See our latest analysis for Ucal Fuel Systems

An Unusual Tax Situation

We can see that Ucal Fuel Systems received a tax benefit of ₹179m. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! The receipt of a tax benefit is obviously a good thing, on its own. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Ucal Fuel Systems.

Our Take On Ucal Fuel Systems' Profit Performance

In its most recent report, Ucal Fuel Systems disclosed a tax benefit, as we discussed above. Given that sort of benefit is not recurring, it's safe to say the statutory profit overstates its underlying profitability quite significantly. As a result, we think it may well be the case that Ucal Fuel Systems' underlying earnings power is lower than its statutory profit. But at least holders can take some solace from the 36% EPS growth in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Our analysis shows 4 warning signs for Ucal Fuel Systems (2 are significant!) and we strongly recommend you look at these before investing.

This note has only looked at a single factor that sheds light on the nature of Ucal Fuel Systems' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Ucal Fuel Systems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:UCAL

UCAL

Engages in the manufacturers of fuel management systems for the automotive sector in India.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success