- India

- /

- Auto Components

- /

- NSEI:SUPRAJIT

If You Like EPS Growth Then Check Out Suprajit Engineering (NSE:SUPRAJIT) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Suprajit Engineering (NSE:SUPRAJIT). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Suprajit Engineering

How Quickly Is Suprajit Engineering Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. Suprajit Engineering managed to grow EPS by 14% per year, over three years. That's a good rate of growth, if it can be sustained.

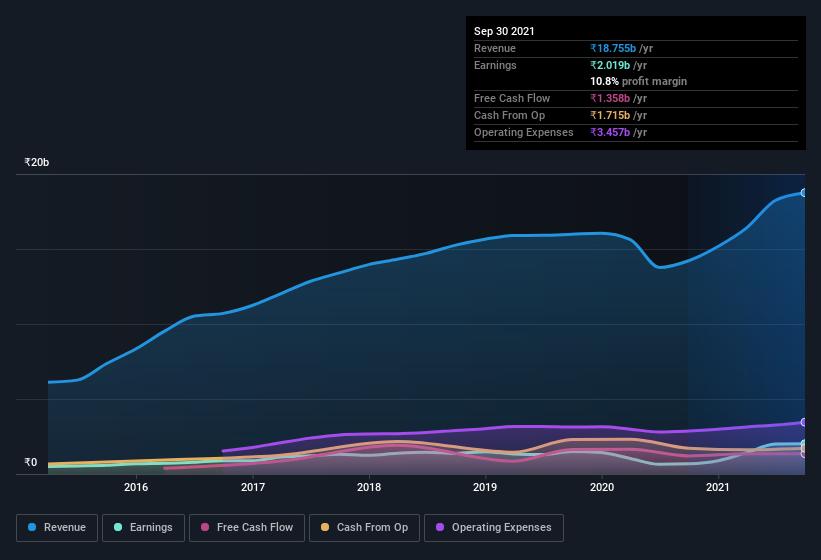

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Suprajit Engineering shareholders can take confidence from the fact that EBIT margins are up from 8.9% to 13%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Suprajit Engineering's forecast profits?

Are Suprajit Engineering Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Suprajit Engineering insiders spent ₹4.3m on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic.

Along with the insider buying, another encouraging sign for Suprajit Engineering is that insiders, as a group, have a considerable shareholding. Given insiders own a small fortune of shares, currently valued at ₹6.0b, they have plenty of motivation to push the business to succeed. At 11% of the company, the co-investment by insiders gives me confidence that management will make long-term focussed decisions.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Mohan Nagamangala, is paid less than the median for similar sized companies. For companies with market capitalizations between ₹30b and ₹120b, like Suprajit Engineering, the median CEO pay is around ₹25m.

The Suprajit Engineering CEO received ₹15m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Suprajit Engineering Deserve A Spot On Your Watchlist?

As I already mentioned, Suprajit Engineering is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Suprajit Engineering. You might benefit from giving it a glance today.

As a growth investor I do like to see insider buying. But Suprajit Engineering isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SUPRAJIT

Suprajit Engineering

Manufactures and sells automotive cables, halogen lamps, speedometers, and other automotive components in India, the United States, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives