- India

- /

- Auto Components

- /

- NSEI:SHRIPISTON

Shriram Pistons & Rings (NSE:SHRIPISTON) Share Prices Have Dropped 67% In The Last Three Years

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Shriram Pistons & Rings Limited (NSE:SHRIPISTON) shareholders know that all too well, since the share price is down considerably over three years. Sadly for them, the share price is down 67% in that time. In contrast, the stock price has popped 10.0% in the last thirty days. But this could be related to good market conditions, with stocks up around 11% during the period.

See our latest analysis for Shriram Pistons & Rings

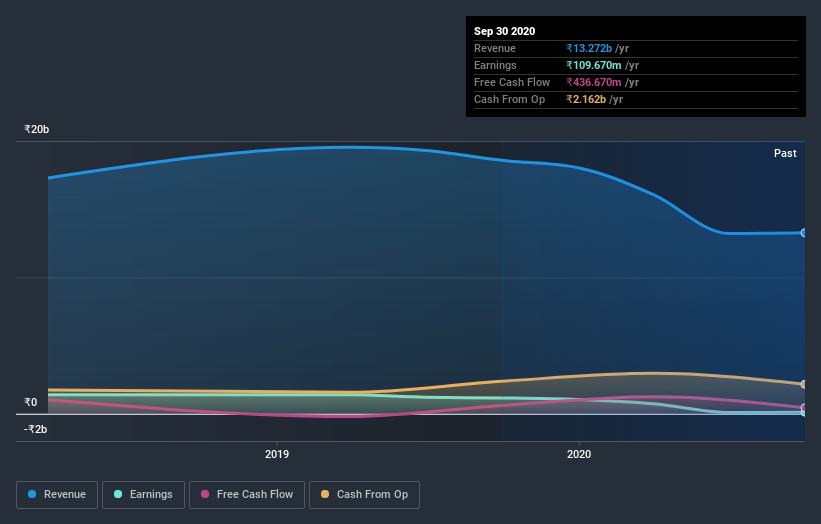

Given that Shriram Pistons & Rings only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Shriram Pistons & Rings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Over the last year, Shriram Pistons & Rings shareholders took a loss of 9.9%, including dividends. In contrast the market gained about 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, the longer term story isn't pretty, with investment losses running at 18% per year over three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with Shriram Pistons & Rings (including 1 which is is significant) .

Of course Shriram Pistons & Rings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Shriram Pistons & Rings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SHRIPISTON

Shriram Pistons & Rings

Manufactures and sells automotive components in India.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives