- India

- /

- Auto Components

- /

- NSEI:SHARDAMOTR

Sharda Motor Industries Limited's (NSE:SHARDAMOTR) Shares Leap 27% Yet They're Still Not Telling The Full Story

Despite an already strong run, Sharda Motor Industries Limited (NSE:SHARDAMOTR) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 155% in the last year.

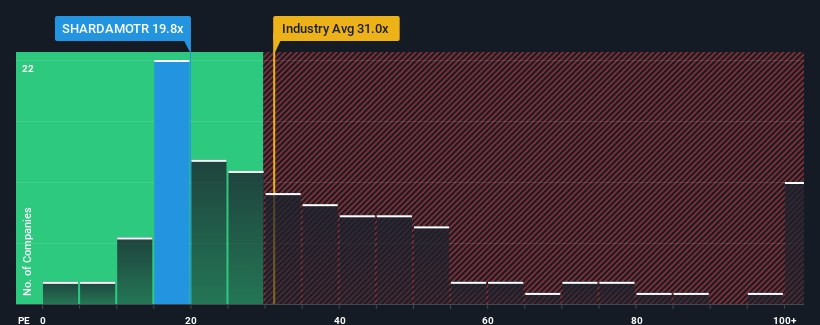

Although its price has surged higher, Sharda Motor Industries' price-to-earnings (or "P/E") ratio of 19.8x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 33x and even P/E's above 64x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Sharda Motor Industries has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Sharda Motor Industries

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Sharda Motor Industries' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 44%. The latest three year period has also seen an excellent 350% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Sharda Motor Industries is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Despite Sharda Motor Industries' shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sharda Motor Industries currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Sharda Motor Industries you should know about.

Of course, you might also be able to find a better stock than Sharda Motor Industries. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SHARDAMOTR

Sharda Motor Industries

Manufactures, assembles, trades in, and sells auto components to automobiles and electronics original equipment manufacturers in India.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives