- India

- /

- Auto Components

- /

- NSEI:RICOAUTO

More Unpleasant Surprises Could Be In Store For Rico Auto Industries Limited's (NSE:RICOAUTO) Shares After Tumbling 28%

The Rico Auto Industries Limited (NSE:RICOAUTO) share price has fared very poorly over the last month, falling by a substantial 28%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 30% in that time.

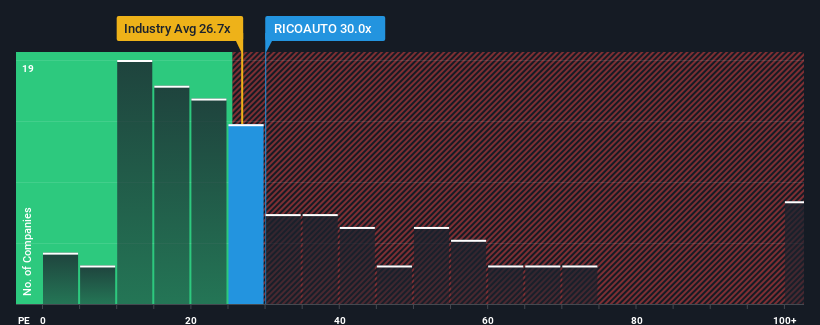

Even after such a large drop in price, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 26x, you may still consider Rico Auto Industries as a stock to potentially avoid with its 30x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

For example, consider that Rico Auto Industries' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Rico Auto Industries

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Rico Auto Industries' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 36%. Regardless, EPS has managed to lift by a handy 18% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's alarming that Rico Auto Industries' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Despite the recent share price weakness, Rico Auto Industries' P/E remains higher than most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Rico Auto Industries currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You need to take note of risks, for example - Rico Auto Industries has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, you might also be able to find a better stock than Rico Auto Industries. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RICOAUTO

Rico Auto Industries

An engineering company, manufactures and supplies high precision fully machined aluminum, and ferrous components and assemblies to original equipment manufacturers worldwide.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives