- India

- /

- Auto Components

- /

- NSEI:MUNJALAU

Investors Continue Waiting On Sidelines For Munjal Auto Industries Limited (NSE:MUNJALAU)

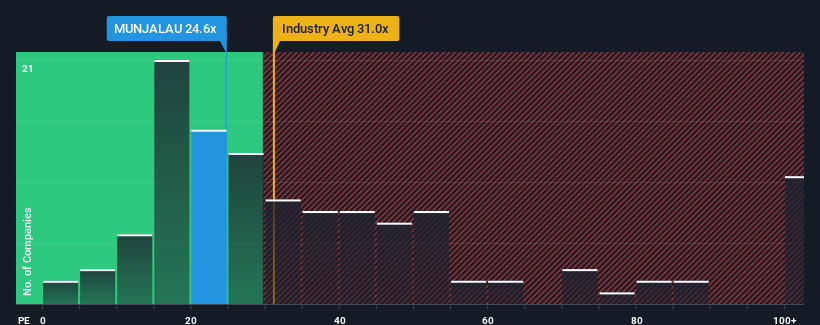

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 33x, you may consider Munjal Auto Industries Limited (NSE:MUNJALAU) as an attractive investment with its 24.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, Munjal Auto Industries' receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Munjal Auto Industries

How Is Munjal Auto Industries' Growth Trending?

In order to justify its P/E ratio, Munjal Auto Industries would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 87% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

It's interesting to note that the rest of the market is similarly expected to grow by 25% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Munjal Auto Industries' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Munjal Auto Industries revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 1 warning sign for Munjal Auto Industries that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MUNJALAU

Munjal Auto Industries

Manufactures and sells auto components for motor vehicles in India.

Low risk and slightly overvalued.

Market Insights

Community Narratives