The CEO of MRF Limited (NSE:MRF) is K. M. Mammen. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for MRF

How Does K. M. Mammen's Compensation Compare With Similar Sized Companies?

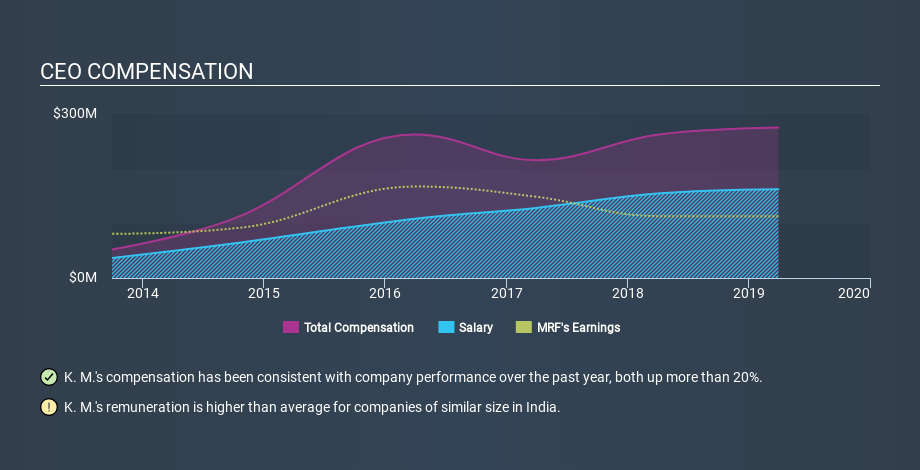

At the time of writing, our data says that MRF Limited has a market cap of ₹251b, and reported total annual CEO compensation of ₹275m for the year to March 2019. While we always look at total compensation first, we note that the salary component is less, at ₹162m. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of ₹151b to ₹484b. The median total CEO compensation was ₹58m.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of MRF. Speaking on an industry level, we can see that nearly 73% of total compensation represents salary, while the remainder of 27% is other remuneration. MRF does not set aside a larger portion of remuneration in the form of salary, maintaining the same rate as the wider market.

It would therefore appear that MRF Limited pays K. M. Mammen more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn't mean the remuneration is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance. You can see a visual representation of the CEO compensation at MRF, below.

Is MRF Limited Growing?

Over the last three years MRF Limited has shrunk its earnings per share by an average of 12% per year (measured with a line of best fit). It achieved revenue growth of 5.8% over the last year.

Unfortunately, earnings per share have trended lower over the last three years. The fairly low revenue growth fails to impress given that the earnings per share is down. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. It could be important to check this free visual depiction of what analysts expect for the future.

Has MRF Limited Been A Good Investment?

With a three year total loss of 12%, MRF Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

We examined the amount MRF Limited pays its CEO, and compared it to the amount paid by similar sized companies. Our data suggests that it pays above the median CEO pay within that group.

Earnings per share have not grown in three years, and the revenue growth fails to impress us. Over the same period, investors would have come away with nothing in the way of share price gains. This analysis suggests to us that the CEO is paid too generously! Moving away from CEO compensation for the moment, we've identified 1 warning sign for MRF that you should be aware of before investing.

If you want to buy a stock that is better than MRF, this free list of high return, low debt companies is a great place to look.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:MRF

MRF

Engages in the manufacture, sale, and trading of rubber products in India and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives