- India

- /

- Auto Components

- /

- NSEI:MOTHERSON

Samvardhana Motherson International Limited (NSE:MOTHERSON) Passed Our Checks, And It's About To Pay A ₹0.80 Dividend

It looks like Samvardhana Motherson International Limited (NSE:MOTHERSON) is about to go ex-dividend in the next four days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Therefore, if you purchase Samvardhana Motherson International's shares on or after the 14th of August, you won't be eligible to receive the dividend, when it is paid on the 21st of September.

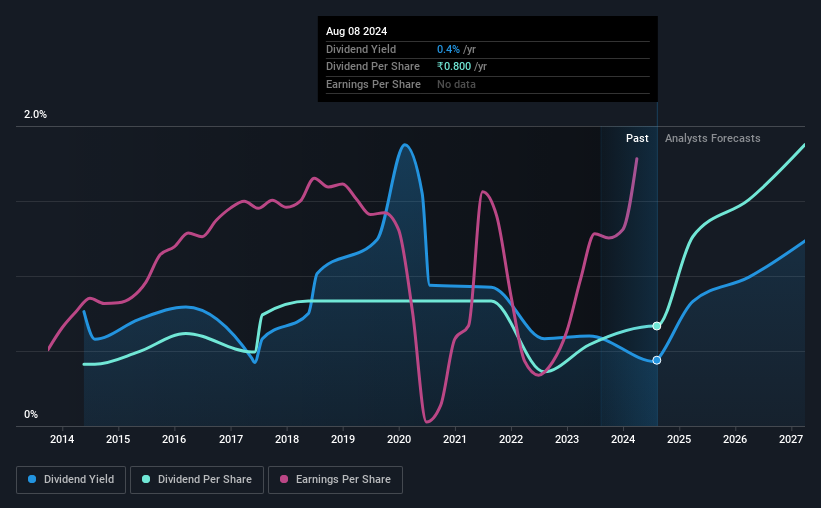

The company's next dividend payment will be ₹0.80 per share. Last year, in total, the company distributed ₹0.80 to shareholders. Based on the last year's worth of payments, Samvardhana Motherson International stock has a trailing yield of around 0.4% on the current share price of ₹182.47. If you buy this business for its dividend, you should have an idea of whether Samvardhana Motherson International's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Samvardhana Motherson International

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Samvardhana Motherson International is paying out just 20% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 13% of its free cash flow as dividends last year, which is conservatively low.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. This is why it's a relief to see Samvardhana Motherson International earnings per share are up 3.3% per annum over the last five years. Growth has been anaemic. Yet with more than 75% of its earnings being kept in the business, there is ample room to reinvest in growth or lift the payout ratio - either of which could increase the dividend.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, Samvardhana Motherson International has increased its dividend at approximately 4.9% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Final Takeaway

From a dividend perspective, should investors buy or avoid Samvardhana Motherson International? Earnings per share have been growing moderately, and Samvardhana Motherson International is paying out less than half its earnings and cash flow as dividends, which is an attractive combination as it suggests the company is investing in growth. We would prefer to see earnings growing faster, but the best dividend stocks over the long term typically combine significant earnings per share growth with a low payout ratio, and Samvardhana Motherson International is halfway there. It's a promising combination that should mark this company worthy of closer attention.

While it's tempting to invest in Samvardhana Motherson International for the dividends alone, you should always be mindful of the risks involved. Case in point: We've spotted 1 warning sign for Samvardhana Motherson International you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MOTHERSON

Samvardhana Motherson International

Manufactures and sells components to automotive original equipment manufacturers in India, Germany, the United States, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives