- India

- /

- Auto Components

- /

- NSEI:MODIRUBBER

We Don’t Think Modi Rubber's (NSE:MODIRUBBER) Earnings Should Make Shareholders Too Comfortable

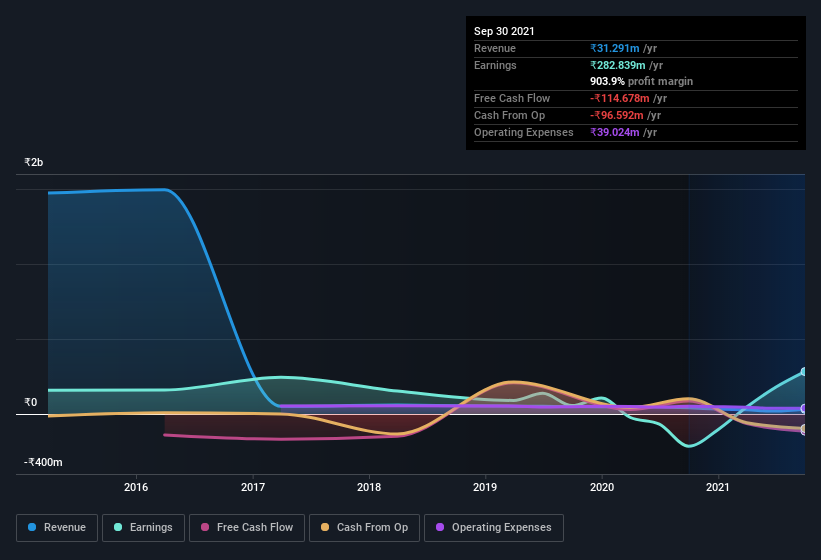

Modi Rubber Limited (NSE:MODIRUBBER) posted some decent earnings, but shareholders didn't react strongly. Our analysis has found some concerning factors which weaken the profit's foundation.

See our latest analysis for Modi Rubber

Operating Revenue Or Not?

Companies will classify their revenue streams as either operating revenue or other revenue. Generally speaking, operating revenue is a more reliable guide to the sustainable revenue generating capacity of the business. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. Notably, Modi Rubber had a significant increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from -₹7.40m last year to ₹3.57m this year. The high levels of non-operating revenue are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Modi Rubber.

The Impact Of Unusual Items On Profit

As well as that spike in non-operating revenue, we should also consider the ₹25m boost to profit coming from unusual items, over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. If Modi Rubber doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Modi Rubber's Profit Performance

In the last year Modi Rubber's non-operating revenue really gave it a boost, but not in a way that is necessarily going to be sustained. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated and everything else is equal. Considering all this we'd argue Modi Rubber's profits probably give an overly generous impression of its sustainable level of profitability. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. When we did our research, we found 4 warning signs for Modi Rubber (2 are a bit unpleasant!) that we believe deserve your full attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:MODIRUBBER

Modi Rubber

Manufactures and sells automobile tyres, tubes, and flaps in India.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026