Insiders At Mahindra & Mahindra Sold ₹961m In Stock, Alluding To Potential Weakness

The fact that multiple Mahindra & Mahindra Limited (NSE:M&M) insiders offloaded a considerable amount of shares over the past year could have raised some eyebrows amongst investors. When evaluating insider transactions, knowing whether insiders are buying is usually more beneficial than knowing whether they are selling, as the latter can be open to many interpretations. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for Mahindra & Mahindra

The Last 12 Months Of Insider Transactions At Mahindra & Mahindra

Over the last year, we can see that the biggest insider sale was by the MD, Group CEO, Anish Shah, for ₹211m worth of shares, at about ₹2,872 per share. That means that even when the share price was below the current price of ₹2,965, an insider wanted to cash in some shares. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. We note that the biggest single sale was only 37% of Anish Shah's holding.

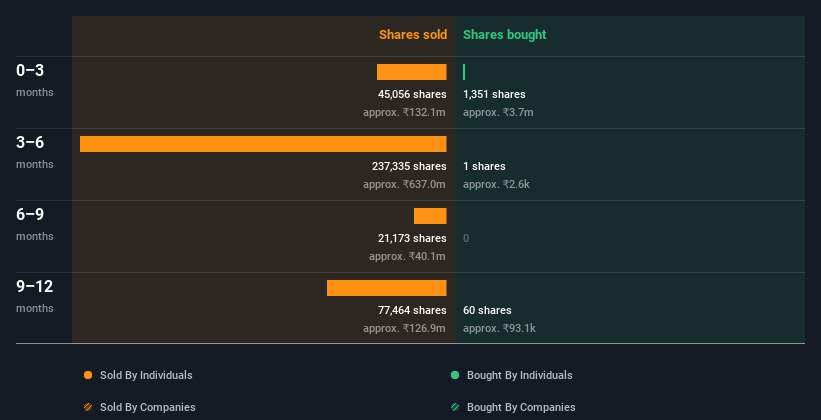

Over the last year, we can see that insiders have bought 1.41k shares worth ₹3.8m. But they sold 381.03k shares for ₹961m. Over the last year we saw more insider selling of Mahindra & Mahindra shares, than buying. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

I will like Mahindra & Mahindra better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Insiders At Mahindra & Mahindra Have Sold Stock Recently

Over the last three months, we've seen notably more insider selling, than insider buying, at Mahindra & Mahindra. In that time, insiders dumped ₹132m worth of shares. On the flip side, insiders spent ₹3.7m on purchasing shares. Since the selling really does outweigh the buying, we'd say that these transactions may suggest that some insiders feel the shares are not cheap.

Does Mahindra & Mahindra Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Mahindra & Mahindra insiders own 0.9% of the company, currently worth about ₹31b based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The Mahindra & Mahindra Insider Transactions Indicate?

The insider sales have outweighed the insider buying, at Mahindra & Mahindra, in the last three months. Despite some insider buying, the longer term picture doesn't make us feel much more positive. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For instance, we've identified 3 warning signs for Mahindra & Mahindra (1 makes us a bit uncomfortable) you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:M&M

Mahindra & Mahindra

Provides mobility products and farm solutions in India and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion