- India

- /

- Auto Components

- /

- NSEI:LUMAXIND

Lumax Industries' (NSE:LUMAXIND) Dividend Will Be Increased To ₹7.00

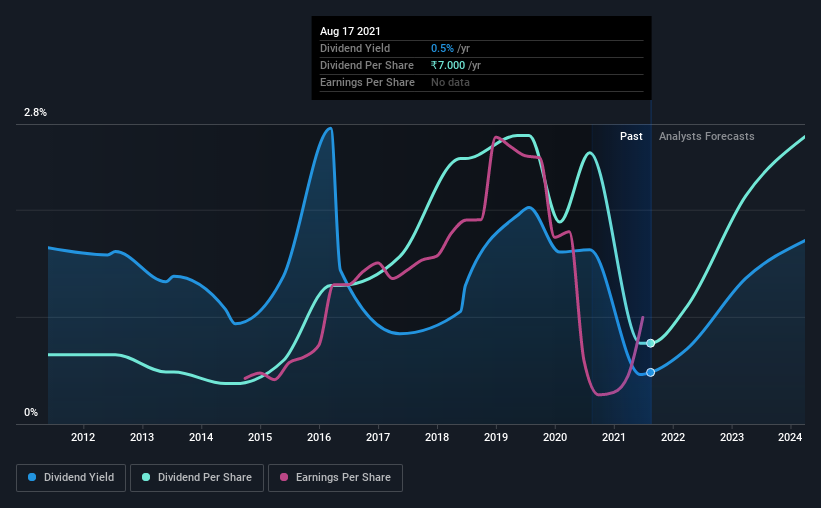

Lumax Industries Limited (NSE:LUMAXIND) will increase its dividend on the 30th of September to ₹7.00. Despite this raise, the dividend yield of 0.5% is only a modest boost to shareholder returns.

See our latest analysis for Lumax Industries

Lumax Industries' Dividend Is Well Covered By Earnings

If it is predictable over a long period, even low dividend yields can be attractive. However, Lumax Industries' earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS is forecast to expand by 39.4%. Assuming the dividend continues along recent trends, we think the payout ratio could be 12% by next year, which is in a pretty sustainable range.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2011, the first annual payment was ₹6.00, compared to the most recent full-year payment of ₹7.00. This implies that the company grew its distributions at a yearly rate of about 1.6% over that duration. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Dividend Growth Is Doubtful

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Lumax Industries has seen earnings per share falling at 5.2% per year over the last five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Lumax Industries will make a great income stock. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 2 warning signs for Lumax Industries that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you decide to trade Lumax Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:LUMAXIND

Lumax Industries

Manufactures and sells automotive components for in India.

High growth potential average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion