- India

- /

- Auto Components

- /

- NSEI:JKTYRE

JK Tyre & Industries Limited's (NSE:JKTYRE) Prospects Need A Boost To Lift Shares

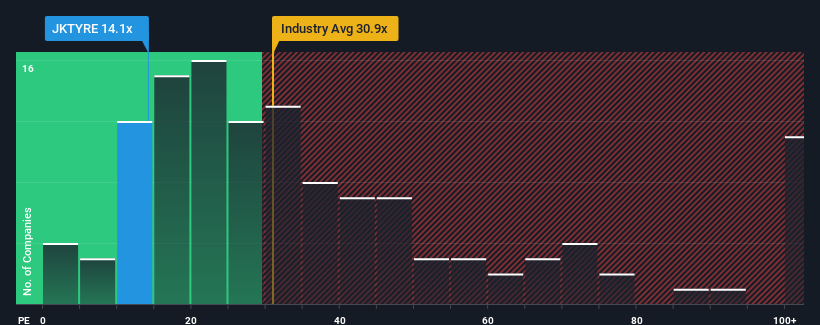

With a price-to-earnings (or "P/E") ratio of 14.1x JK Tyre & Industries Limited (NSE:JKTYRE) may be sending very bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 31x and even P/E's higher than 58x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

There hasn't been much to differentiate JK Tyre & Industries' and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

See our latest analysis for JK Tyre & Industries

What Are Growth Metrics Telling Us About The Low P/E?

JK Tyre & Industries' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 21% gain to the company's bottom line. EPS has also lifted 26% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Looking ahead now, EPS is anticipated to climb by 15% per year during the coming three years according to the six analysts following the company. With the market predicted to deliver 19% growth per annum, the company is positioned for a weaker earnings result.

With this information, we can see why JK Tyre & Industries is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that JK Tyre & Industries maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for JK Tyre & Industries (1 is potentially serious!) that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JKTYRE

JK Tyre & Industries

Develops, manufactures, markets and distributes automotive tyres, tubes, flaps, and retreads in India, Mexico, and Internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026