- India

- /

- Auto Components

- /

- NSEI:IGARASHI

We're Not Counting On Igarashi Motors India (NSE:IGARASHI) To Sustain Its Statutory Profitability

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. This article will consider whether Igarashi Motors India's (NSE:IGARASHI) statutory profits are a good guide to its underlying earnings.

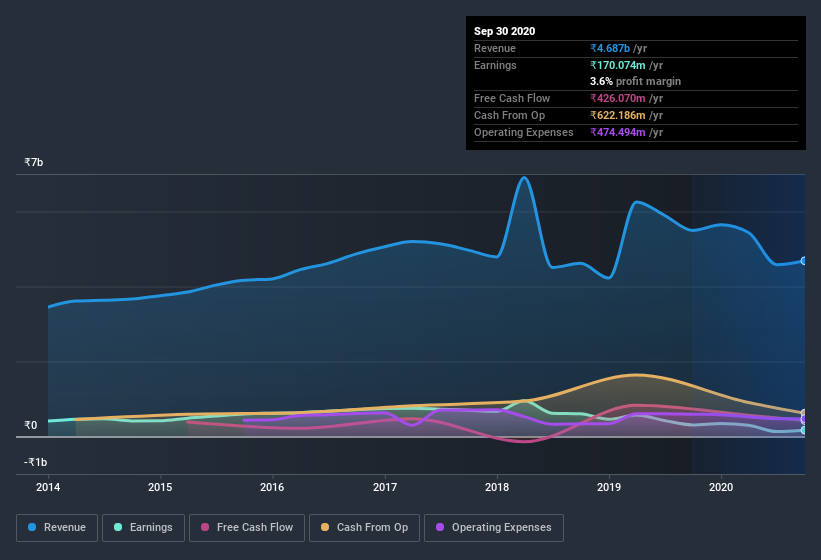

While Igarashi Motors India was able to generate revenue of ₹4.69b in the last twelve months, we think its profit result of ₹170.1m was more important. The chart below shows that both revenue and profit have declined over the last three years.

View our latest analysis for Igarashi Motors India

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. As a reuslt, we think it's important to consider how unusual items and the recent tax benefit have influenced Igarashi Motors India's statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Igarashi Motors India.

How Do Unusual Items Influence Profit?

For anyone who wants to understand Igarashi Motors India's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from ₹15m worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. If Igarashi Motors India doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Igarashi Motors India received a tax benefit which contributed ₹66m to the bottom line. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Igarashi Motors India's Profit Performance

In the last year Igarashi Motors India received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. Furthermore, it also benefitted from a positive unusual item, which boosted the profit result even higher. Considering all this we'd argue Igarashi Motors India's profits probably give an overly generous impression of its sustainable level of profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Our analysis shows 2 warning signs for Igarashi Motors India (1 makes us a bit uncomfortable!) and we strongly recommend you look at them before investing.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Igarashi Motors India or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:IGARASHI

Igarashi Motors India

Manufactures and sells electric micro motors and motor components in India, the United States, Japan, Germany, Hong Kong, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026