- India

- /

- Auto Components

- /

- NSEI:HITECHGEAR

Is Now The Time To Put Hi-Tech Gears (NSE:HITECHGEAR) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hi-Tech Gears (NSE:HITECHGEAR). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Hi-Tech Gears

How Fast Is Hi-Tech Gears Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Hi-Tech Gears to have grown EPS from ₹9.44 to ₹61.28 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Hi-Tech Gears' EBIT margins have actually improved by 2.2 percentage points in the last year, to reach 7.5%, but, on the flip side, revenue was down 5.5%. That falls short of ideal.

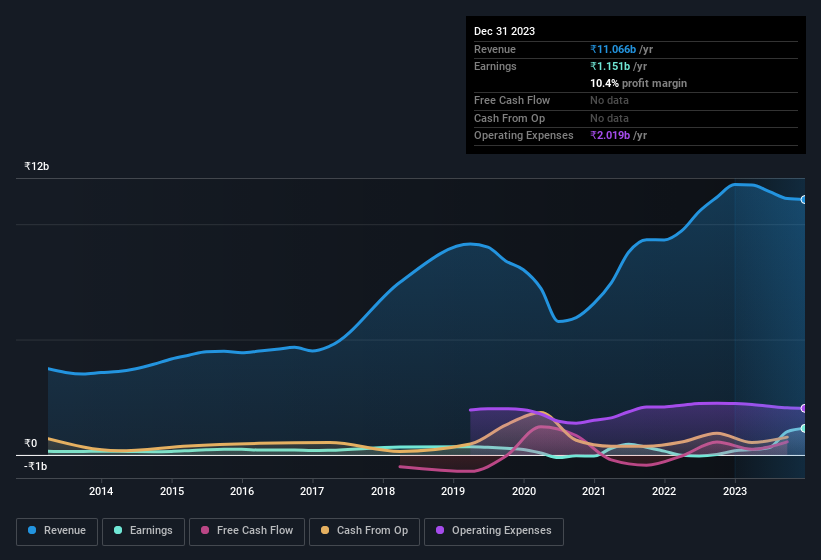

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Hi-Tech Gears is no giant, with a market capitalisation of ₹10b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Hi-Tech Gears Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One positive for Hi-Tech Gears, is that company insiders spent ₹2.2m acquiring shares in the last year. While this isn't much, we also note an absence of sales. We also note that it was the company insider, Aabha Kapuria, who made the biggest single acquisition, paying ₹1.1m for shares at about ₹276 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Hi-Tech Gears insiders own more than a third of the company. In fact, they own 53% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. To give you an idea, the value of insiders' holdings in the business are valued at ₹5.5b at the current share price. That's nothing to sneeze at!

Is Hi-Tech Gears Worth Keeping An Eye On?

Hi-Tech Gears' earnings per share growth have been climbing higher at an appreciable rate. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Hi-Tech Gears belongs near the top of your watchlist. Even so, be aware that Hi-Tech Gears is showing 4 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Keen growth investors love to see insider buying. Thankfully, Hi-Tech Gears isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hi-Tech Gears might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HITECHGEAR

Hi-Tech Gears

Manufactures and sells auto components for automobile manufacturers in India, the United States, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026