- India

- /

- Auto Components

- /

- NSEI:HITECHGEAR

Insider Buying: Aabha Kapuria Just Spent ₹77k On The Hi-Tech Gears Limited (NSE:HITECHGEAR) Shares

Even if it's not a huge purchase, we think it was good to see that Aabha Kapuria, a The Hi-Tech Gears Limited (NSE:HITECHGEAR) insider, recently shelled out ₹77k to buy stock, at ₹179 per share. Although the purchase is not a big one, increasing their shareholding by only 1.3%, it can be interpreted as a good sign.

View our latest analysis for Hi-Tech Gears

Hi-Tech Gears Insider Transactions Over The Last Year

Earlier in the year, insider Aabha Kapuria paid ₹150 per share in a ₹1.2m purchase. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of ₹188. Because the shares were purchased at a lower price, this particular buy doesn't tell us much about how insiders feel about the current share price.

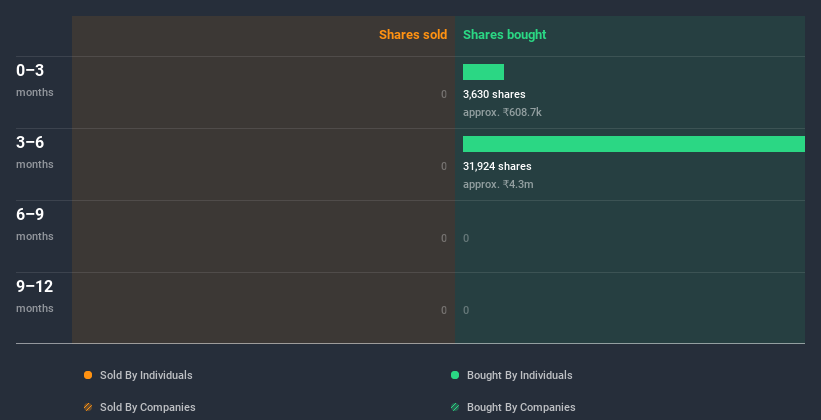

In the last twelve months Hi-Tech Gears insiders were buying shares, but not selling. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Hi-Tech Gears is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Hi-Tech Gears Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Hi-Tech Gears insiders own 56% of the company, currently worth about ₹2.0b based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About Hi-Tech Gears Insiders?

It is good to see recent purchasing. And the longer term insider transactions also give us confidence. But on the other hand, the company made a loss during the last year, which makes us a little cautious. Once you factor in the high insider ownership, it certainly seems like insiders are positive about Hi-Tech Gears. Nice! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Hi-Tech Gears. Case in point: We've spotted 3 warning signs for Hi-Tech Gears you should be aware of, and 2 of them make us uncomfortable.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Hi-Tech Gears or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hi-Tech Gears might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:HITECHGEAR

Hi-Tech Gears

Manufactures and sells auto components to automobile manufacturers and Tier 1 and 2 suppliers in India, the United States, and internationally.

Flawless balance sheet average dividend payer.