- India

- /

- Auto Components

- /

- NSEI:FMGOETZE

The Returns On Capital At Federal-Mogul Goetze (India) (NSE:FMGOETZE) Don't Inspire Confidence

What are the early trends we should look for to identify a stock that could multiply in value over the long term? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Having said that, from a first glance at Federal-Mogul Goetze (India) (NSE:FMGOETZE) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Federal-Mogul Goetze (India) is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = ₹1.4b ÷ (₹16b - ₹4.0b) (Based on the trailing twelve months to December 2023).

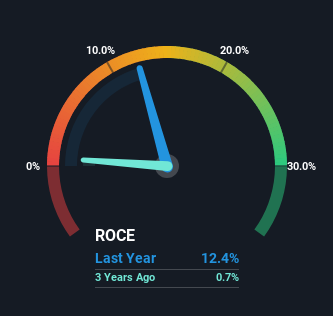

So, Federal-Mogul Goetze (India) has an ROCE of 12%. That's a relatively normal return on capital, and it's around the 15% generated by the Auto Components industry.

View our latest analysis for Federal-Mogul Goetze (India)

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Federal-Mogul Goetze (India).

What The Trend Of ROCE Can Tell Us

When we looked at the ROCE trend at Federal-Mogul Goetze (India), we didn't gain much confidence. Around five years ago the returns on capital were 17%, but since then they've fallen to 12%. On the other hand, the company has been employing more capital without a corresponding improvement in sales in the last year, which could suggest these investments are longer term plays. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

The Key Takeaway

Bringing it all together, while we're somewhat encouraged by Federal-Mogul Goetze (India)'s reinvestment in its own business, we're aware that returns are shrinking. And in the last five years, the stock has given away 39% so the market doesn't look too hopeful on these trends strengthening any time soon. Therefore based on the analysis done in this article, we don't think Federal-Mogul Goetze (India) has the makings of a multi-bagger.

While Federal-Mogul Goetze (India) doesn't shine too bright in this respect, it's still worth seeing if the company is trading at attractive prices. You can find that out with our FREE intrinsic value estimation for FMGOETZE on our platform.

While Federal-Mogul Goetze (India) may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FMGOETZE

Federal-Mogul Goetze (India)

Manufactures, supply, and distributes automotive components for two/three/four-wheeler automobiles in India and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives