- India

- /

- Auto Components

- /

- NSEI:CIEINDIA

Should You Be Adding CIE Automotive India (NSE:CIEINDIA) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like CIE Automotive India (NSE:CIEINDIA), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for CIE Automotive India

CIE Automotive India's Improving Profits

In the last three years CIE Automotive India's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Over the last year, CIE Automotive India increased its EPS from ₹20.23 to ₹21.29. That's a modest gain of 5.2%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. CIE Automotive India reported flat revenue and EBIT margins over the last year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

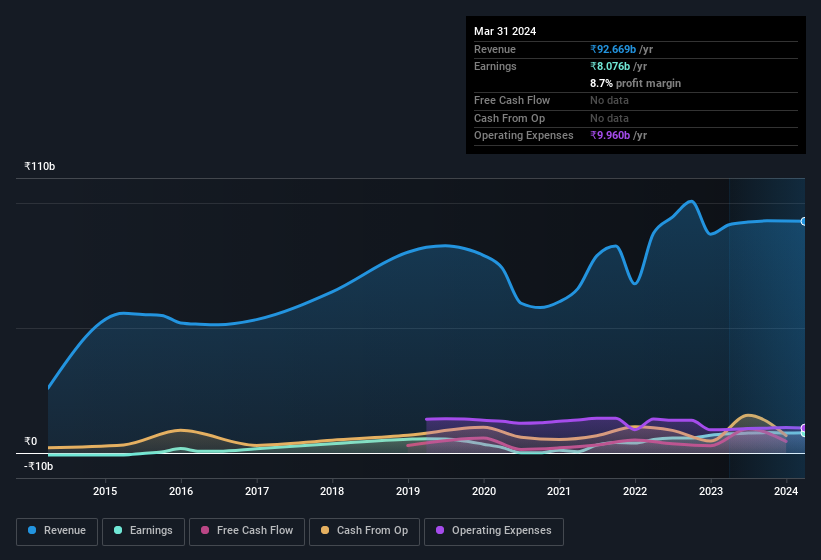

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for CIE Automotive India's future EPS 100% free.

Are CIE Automotive India Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own CIE Automotive India shares worth a considerable sum. As a matter of fact, their holding is valued at ₹2.0b. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.9%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between ₹167b and ₹535b, like CIE Automotive India, the median CEO pay is around ₹47m.

CIE Automotive India's CEO only received compensation totalling ₹2.3m in the year to December 2023. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does CIE Automotive India Deserve A Spot On Your Watchlist?

One important encouraging feature of CIE Automotive India is that it is growing profits. The fact that EPS is growing is a genuine positive for CIE Automotive India, but the pleasant picture gets better than that. Boasting both modest CEO pay and considerable insider ownership, you'd argue this one is worthy of the watchlist, at least. You should always think about risks though. Case in point, we've spotted 1 warning sign for CIE Automotive India you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CIEINDIA

CIE Automotive India

Produces and sells automotive components to original equipment manufacturers and other customers in India, Europe, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives