- India

- /

- Auto Components

- /

- NSEI:ASAHIINDIA

If EPS Growth Is Important To You, Asahi India Glass (NSE:ASAHIINDIA) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Asahi India Glass (NSE:ASAHIINDIA). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Asahi India Glass

How Fast Is Asahi India Glass Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Asahi India Glass has achieved impressive annual EPS growth of 43%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

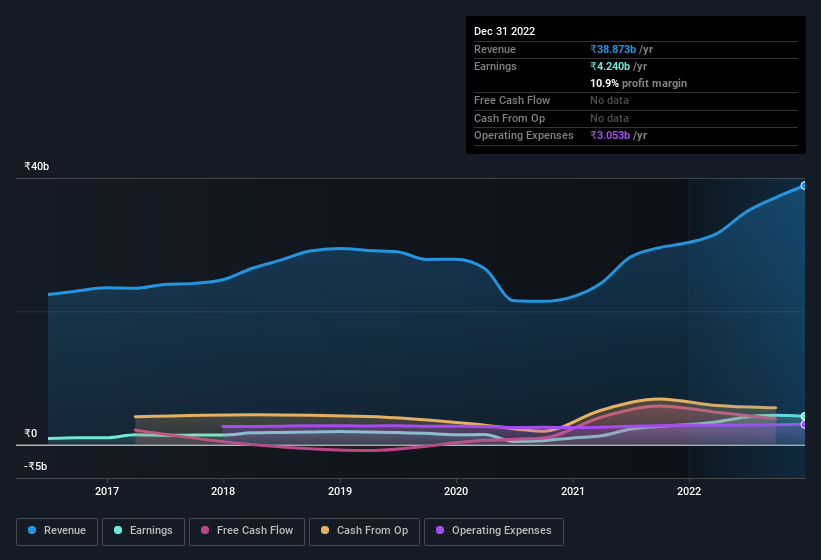

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Asahi India Glass achieved similar EBIT margins to last year, revenue grew by a solid 28% to ₹39b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Asahi India Glass Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Over the preceding 12 months, we see that company insiders sold ₹39m worth of Asahi India Glass stock. On a brighter note, we see that company insider Brij Labroo paid ₹41m for shares, at an average acquisition price of ₹562 per share. Overall, that is something good to take away.

On top of the insider buying, it's good to see that Asahi India Glass insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at ₹33b. This totals to 29% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Very encouraging.

Is Asahi India Glass Worth Keeping An Eye On?

Asahi India Glass' earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Asahi India Glass deserves timely attention. You still need to take note of risks, for example - Asahi India Glass has 2 warning signs we think you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Asahi India Glass isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASAHIINDIA

Asahi India Glass

An integrated glass and windows solutions company, manufactures and supplies various glass products in India and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives