- Israel

- /

- Renewable Energy

- /

- TASE:OPCE

OPC Energy (TLV:OPCE) Has Gifted Shareholders With A Fantastic 157% Total Return On Their Investment

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. For instance the OPC Energy Ltd. (TLV:OPCE) share price is 136% higher than it was three years ago. That sort of return is as solid as granite. On top of that, the share price is up 18% in about a quarter.

Check out our latest analysis for OPC Energy

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last three years, OPC Energy failed to grow earnings per share, which fell 3.1% (annualized).

Based on these numbers, we think that the decline in earnings per share may not be a good representation of how the business has changed over the years. So other metrics may hold the key to understanding what is influencing investors.

You can only imagine how long term shareholders feel about the declining revenue trend (slipping at 0.7% per year). The only thing that's clear is there is low correlation between OPC Energy's share price and its historic fundamental data. Further research may be required!

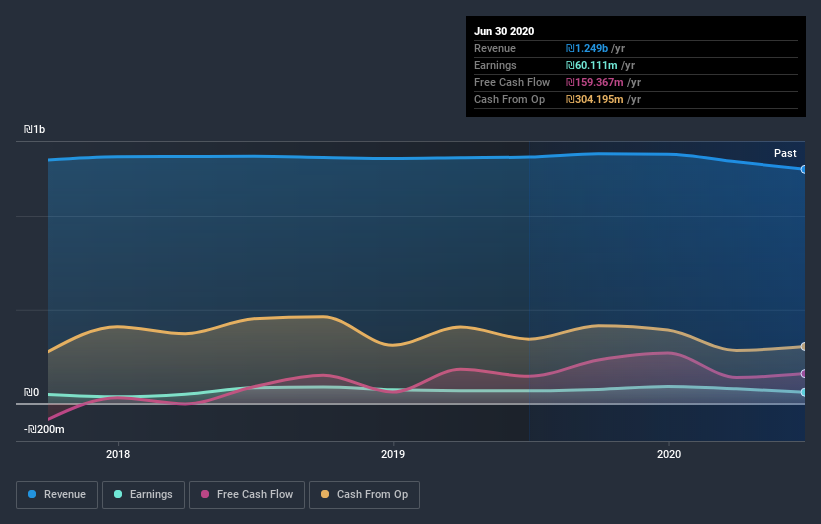

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at OPC Energy's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered OPC Energy's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that OPC Energy's TSR, at 157% is higher than its share price return of 136%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Pleasingly, OPC Energy's total shareholder return last year was 9.7%. But the three year TSR of 37% per year is even better. It's always interesting to track share price performance over the longer term. But to understand OPC Energy better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for OPC Energy (of which 2 are significant!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

When trading OPC Energy or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TASE:OPCE

OPC Energy

Engages in the planning, development, construction, and operation of power stations in Israel.

Solid track record with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives