- Israel

- /

- Renewable Energy

- /

- TASE:ENRG

Why We're Not Concerned About Energix - Renewable Energies Ltd.'s (TLV:ENRG) Share Price

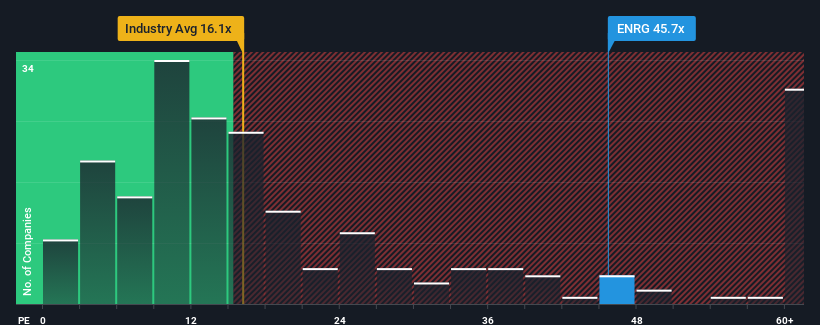

When close to half the companies in Israel have price-to-earnings ratios (or "P/E's") below 11x, you may consider Energix - Renewable Energies Ltd. (TLV:ENRG) as a stock to avoid entirely with its 45.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

As an illustration, earnings have deteriorated at Energix - Renewable Energies over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Energix - Renewable Energies

Is There Enough Growth For Energix - Renewable Energies?

In order to justify its P/E ratio, Energix - Renewable Energies would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 54% decrease to the company's bottom line. Even so, admirably EPS has lifted 120% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 11% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that Energix - Renewable Energies' P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Energix - Renewable Energies' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Energix - Renewable Energies revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Energix - Renewable Energies is showing 4 warning signs in our investment analysis, and 3 of those are significant.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Energix - Renewable Energies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ENRG

Energix - Renewable Energies

Through its subsidiaries, engages in the initiation, development, financing, establishing, construction, management, and operation of facilities for the production, storage, and sale of electricity from renewable energy sources in Israel, Poland, and the United States.

Slight risk and overvalued.

Market Insights

Community Narratives