- Israel

- /

- Renewable Energy

- /

- TASE:ENRG

Energix - Renewable Energies' (TLV:ENRG) five-year earnings growth trails the stellar shareholder returns

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of Energix - Renewable Energies Ltd. (TLV:ENRG) stock is up an impressive 213% over the last five years. Also pleasing for shareholders was the 15% gain in the last three months. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

The past week has proven to be lucrative for Energix - Renewable Energies investors, so let's see if fundamentals drove the company's five-year performance.

Check out our latest analysis for Energix - Renewable Energies

SWOT Analysis for Energix - Renewable Energies

- Earnings growth over the past year exceeded the industry.

- Debt is well covered by earnings.

- Dividend is low compared to the top 25% of dividend payers in the Renewable Energy market.

- Current share price is above our estimate of fair value.

- Shareholders have been diluted in the past year.

- ENRG's financial characteristics indicate limited near-term opportunities for shareholders.

- Lack of analyst coverage makes it difficult to determine ENRG's earnings prospects.

- Debt is not well covered by operating cash flow.

- Paying a dividend but company has no free cash flows.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

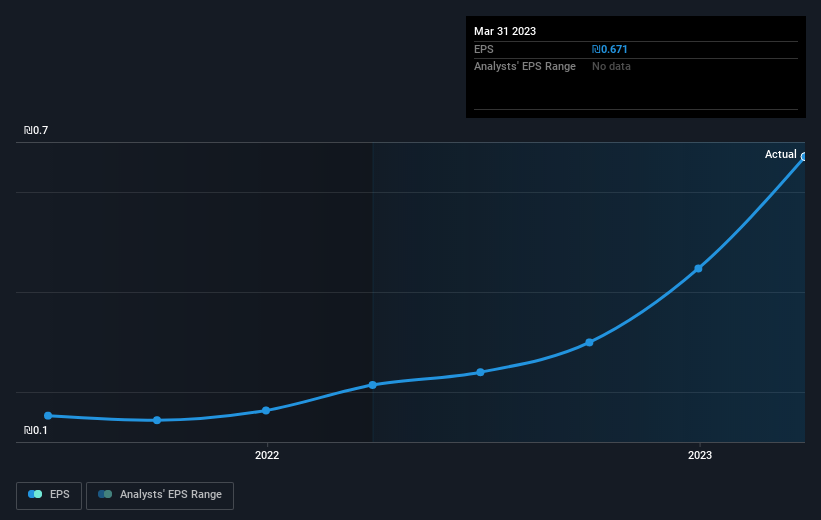

During five years of share price growth, Energix - Renewable Energies achieved compound earnings per share (EPS) growth of 58% per year. The EPS growth is more impressive than the yearly share price gain of 26% over the same period. So one could conclude that the broader market has become more cautious towards the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Energix - Renewable Energies' key metrics by checking this interactive graph of Energix - Renewable Energies's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Energix - Renewable Energies' TSR for the last 5 years was 236%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Energix - Renewable Energies shareholders have received a total shareholder return of 21% over the last year. And that does include the dividend. However, the TSR over five years, coming in at 27% per year, is even more impressive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Energix - Renewable Energies is showing 3 warning signs in our investment analysis , and 2 of those don't sit too well with us...

But note: Energix - Renewable Energies may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Energix - Renewable Energies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ENRG

Energix - Renewable Energies

Through its subsidiaries, engages in the initiation, development, financing, construction, management, and operation of facilities for the production and storage of electricity from renewable energy sources in Israel, Poland, and the United States.

Low with questionable track record.

Similar Companies

Market Insights

Community Narratives