- Israel

- /

- Renewable Energy

- /

- TASE:ECNR

Investors in Econergy Renewable Energy (TLV:ECNR) from a year ago are still down 34%, even after 18% gain this past week

This week we saw the Econergy Renewable Energy Ltd (TLV:ECNR) share price climb by 18%. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact, the price has declined 34% in a year, falling short of the returns you could get by investing in an index fund.

While the stock has risen 18% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Econergy Renewable Energy

Econergy Renewable Energy recorded just €1,933,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. Investors will be hoping that Econergy Renewable Energy can make progress and gain better traction for the business, before it runs low on cash.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

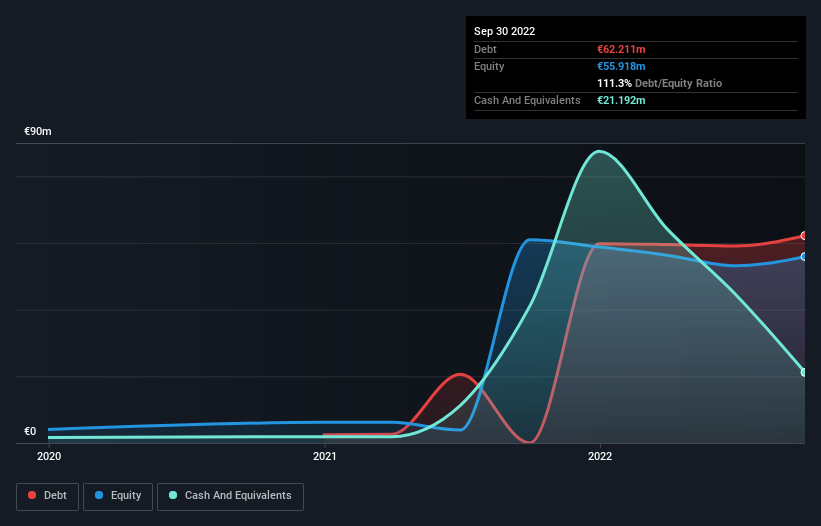

Econergy Renewable Energy had liabilities exceeding cash when it last reported, according to our data. That put it in the highest risk category, according to our analysis. But with the share price diving 34% in the last year , it's probably fair to say that some shareholders no longer believe the company will succeed or they are worried about dilution with the recent cash injection. The image below shows how Econergy Renewable Energy's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

Econergy Renewable Energy shareholders are down 34% for the year, even worse than the market loss of 22%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 13%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Econergy Renewable Energy better, we need to consider many other factors. For instance, we've identified 2 warning signs for Econergy Renewable Energy that you should be aware of.

Of course Econergy Renewable Energy may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Econergy Renewable Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ECNR

Econergy Renewable Energy

An independent power producing company, develops, owns, and operates utility-scale renewable energy projects in Italy, the United Kingdom, Romania, Spain, Poland, and Greece.

Questionable track record very low.

Market Insights

Community Narratives