Fridenson Logistic Services Ltd (TLV:FRDN) Goes Ex-Dividend Soon

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Fridenson Logistic Services Ltd (TLV:FRDN) is about to go ex-dividend in just three days. This means that investors who purchase shares on or after the 15th of March will not receive the dividend, which will be paid on the 22nd of March.

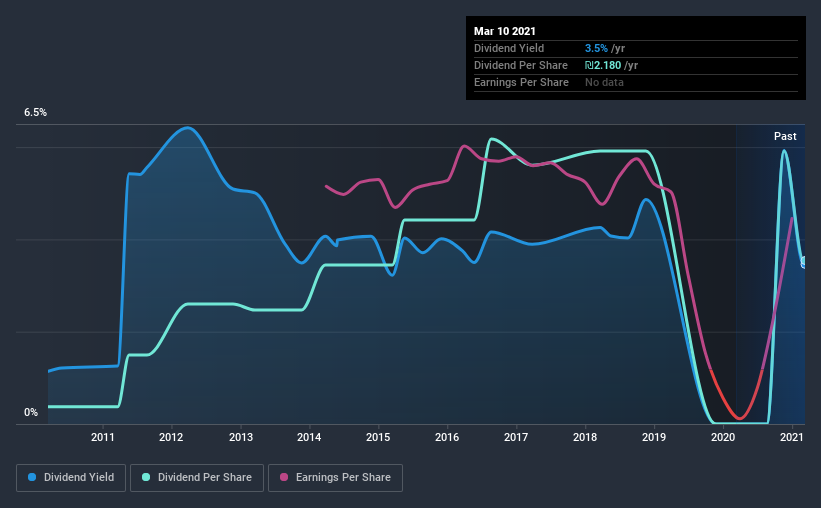

Fridenson Logistic Services's next dividend payment will be ₪1.09 per share. Last year, in total, the company distributed ₪3.64 to shareholders. Last year's total dividend payments show that Fridenson Logistic Services has a trailing yield of 3.5% on the current share price of ₪63. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Fridenson Logistic Services can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Fridenson Logistic Services

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fridenson Logistic Services is paying out an acceptable 53% of its profit, a common payout level among most companies. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Luckily it paid out just 21% of its free cash flow last year.

It's positive to see that Fridenson Logistic Services's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Fridenson Logistic Services paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. So we're not too excited that Fridenson Logistic Services's earnings are down 4.4% a year over the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Fridenson Logistic Services has delivered 25% dividend growth per year on average over the past 10 years. That's interesting, but the combination of a growing dividend despite declining earnings can typically only be achieved by paying out more of the company's profits. This can be valuable for shareholders, but it can't go on forever.

Final Takeaway

Is Fridenson Logistic Services an attractive dividend stock, or better left on the shelf? The payout ratios are within a reasonable range, implying the dividend may be sustainable. Declining earnings are a serious concern, however, and could pose a threat to the dividend in future. In summary, while it has some positive characteristics, we're not inclined to race out and buy Fridenson Logistic Services today.

If you're not too concerned about Fridenson Logistic Services's ability to pay dividends, you should still be mindful of some of the other risks that this business faces. For example, Fridenson Logistic Services has 4 warning signs (and 2 which can't be ignored) we think you should know about.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Fridenson Logistic Services, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:FRDN

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026