El Al Israel Airlines Ltd.'s (TLV:ELAL) Share Price Boosted 29% But Its Business Prospects Need A Lift Too

El Al Israel Airlines Ltd. (TLV:ELAL) shares have continued their recent momentum with a 29% gain in the last month alone. The last month tops off a massive increase of 172% in the last year.

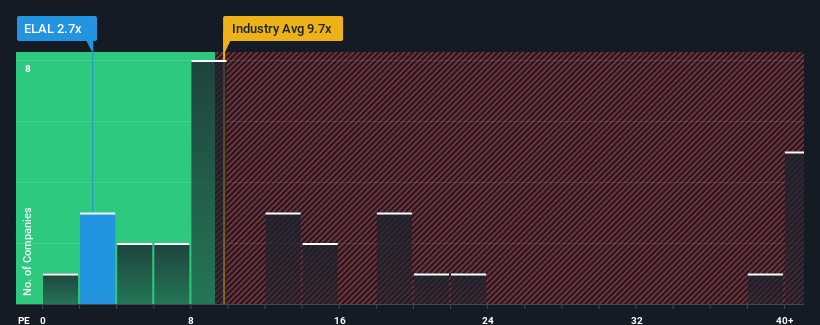

Even after such a large jump in price, El Al Israel Airlines may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 2.7x, since almost half of all companies in Israel have P/E ratios greater than 12x and even P/E's higher than 20x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's exceedingly strong of late, El Al Israel Airlines has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for El Al Israel Airlines

How Is El Al Israel Airlines' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as El Al Israel Airlines' is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 139% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the market, which is predicted to deliver 23% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that El Al Israel Airlines' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Shares in El Al Israel Airlines are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that El Al Israel Airlines maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware El Al Israel Airlines is showing 2 warning signs in our investment analysis, and 1 of those is significant.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if El Al Israel Airlines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ELAL

El Al Israel Airlines

Provides passenger and cargo transportation services.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives