Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Nextcom Ltd. (TLV:NXTM) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Nextcom

What Is Nextcom's Net Debt?

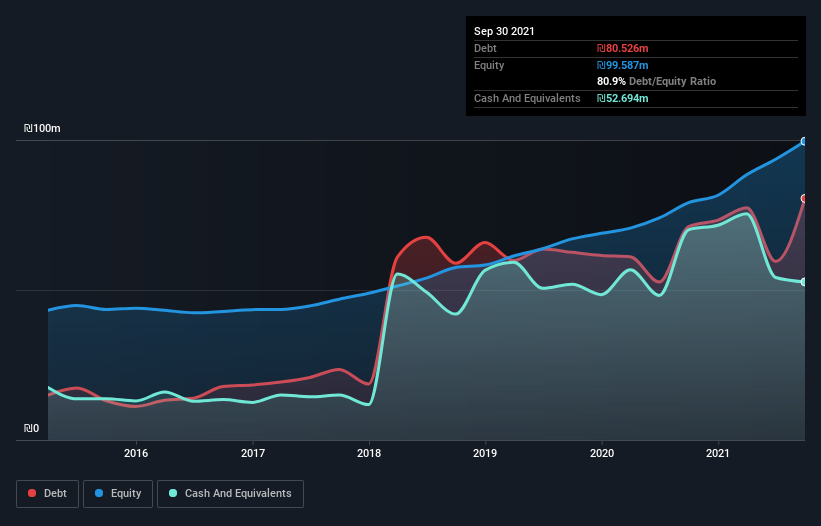

As you can see below, at the end of September 2021, Nextcom had ₪80.5m of debt, up from ₪71.1m a year ago. Click the image for more detail. However, it does have ₪52.7m in cash offsetting this, leading to net debt of about ₪27.8m.

How Strong Is Nextcom's Balance Sheet?

The latest balance sheet data shows that Nextcom had liabilities of ₪134.9m due within a year, and liabilities of ₪50.4m falling due after that. Offsetting these obligations, it had cash of ₪52.7m as well as receivables valued at ₪157.1m due within 12 months. So it actually has ₪24.5m more liquid assets than total liabilities.

This surplus suggests that Nextcom has a conservative balance sheet, and could probably eliminate its debt without much difficulty.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Nextcom's net debt is only 0.74 times its EBITDA. And its EBIT covers its interest expense a whopping 10.6 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. In addition to that, we're happy to report that Nextcom has boosted its EBIT by 57%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Nextcom will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Nextcom created free cash flow amounting to 18% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Happily, Nextcom's impressive EBIT growth rate implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its conversion of EBIT to free cash flow. Zooming out, Nextcom seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Nextcom (of which 1 is significant!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Nextcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:NXTM

Nextcom

Operates in the communications infrastructure and renewable energy sectors in Israel and internationally.

Excellent balance sheet moderate and pays a dividend.

Market Insights

Community Narratives