- Israel

- /

- Electronic Equipment and Components

- /

- TASE:PRTC

Additional Considerations Required While Assessing Priortech's (TLV:PRTC) Strong Earnings

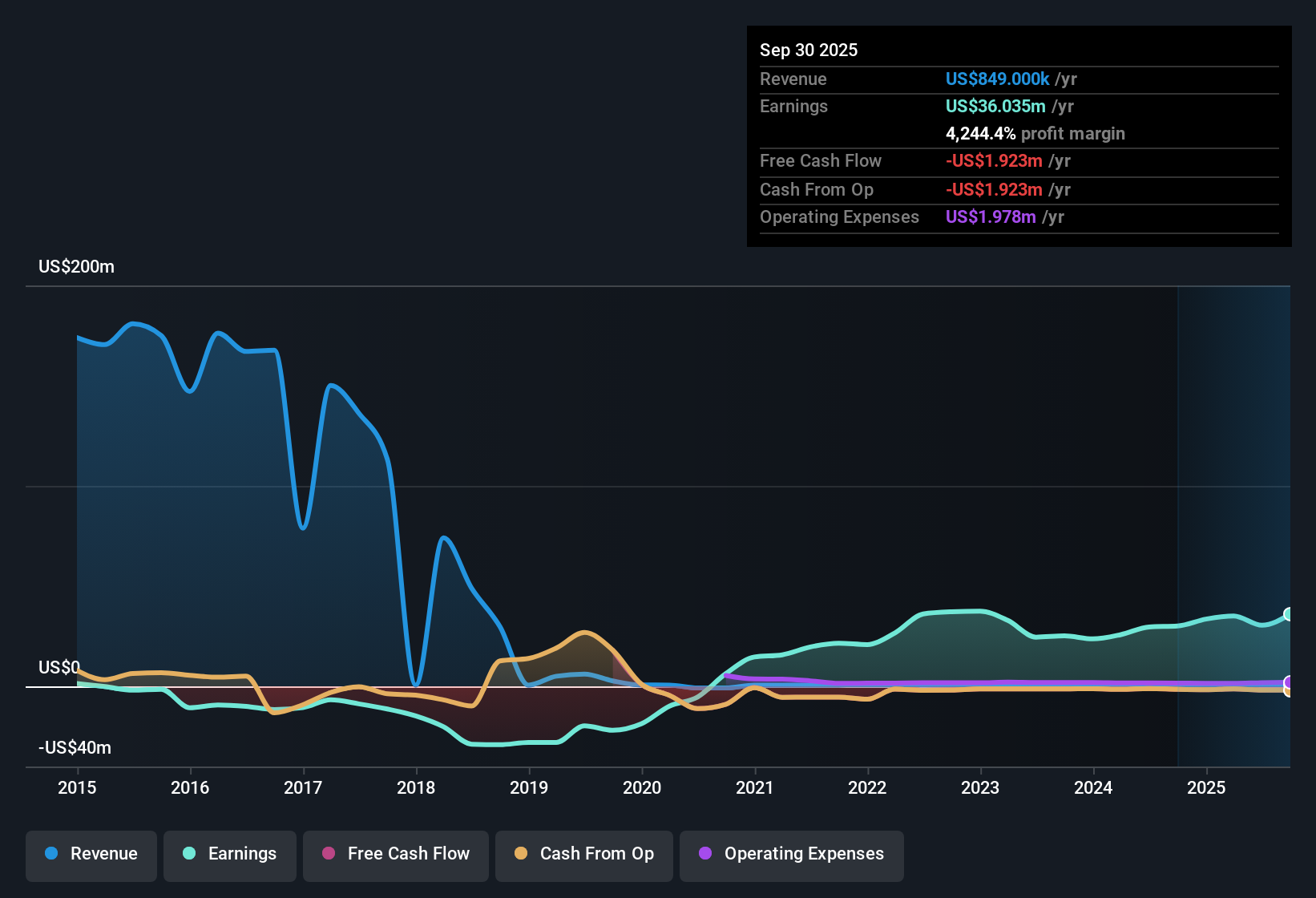

Priortech Ltd's (TLV:PRTC) stock was strong after they recently reported robust earnings. However, our analysis suggests that shareholders may be missing some factors that indicate the earnings result was not as good as it looked.

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Priortech's profit received a boost of US$2.1m in unusual items, over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. Priortech had a rather significant contribution from unusual items relative to its profit to September 2025. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Priortech.

Our Take On Priortech's Profit Performance

As we discussed above, we think the significant positive unusual item makes Priortech's earnings a poor guide to its underlying profitability. For this reason, we think that Priortech's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. The good news is that, its earnings per share increased by 22% in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of Priortech.

Today we've zoomed in on a single data point to better understand the nature of Priortech's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:PRTC

Priortech

Through its subsidiaries, develops, manufactures, and markets inspection and metrology system, and coreless organic substrate technology for semiconductor industry in Israel and internationally.

Solid track record with imperfect balance sheet.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

EchoStar's 43.91 fair value will redefine its market position

VTEX - A hidden Latin American growth opportunity?

Overweight on ANN

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026