- Israel

- /

- Electronic Equipment and Components

- /

- TASE:ORTC

We Wouldn't Be Too Quick To Buy O.R.T. Technologies Ltd (TLV:ORTC) Before It Goes Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that O.R.T. Technologies Ltd (TLV:ORTC) is about to go ex-dividend in just 3 days. Typically, the ex-dividend date is two business days before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Therefore, if you purchase O.R.T. Technologies' shares on or after the 21st of April, you won't be eligible to receive the dividend, when it is paid on the 29th of April.

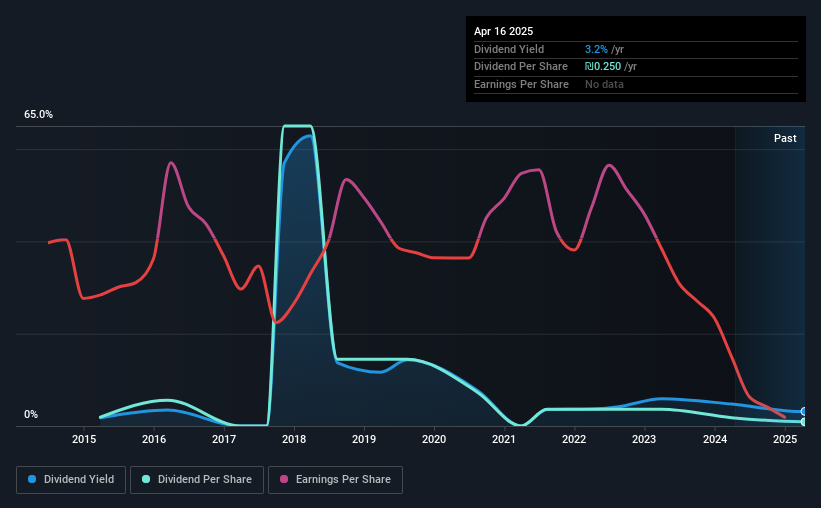

The company's next dividend payment will be ₪0.25 per share, and in the last 12 months, the company paid a total of ₪0.25 per share. Based on the last year's worth of payments, O.R.T. Technologies stock has a trailing yield of around 3.2% on the current share price of ₪7.903. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether O.R.T. Technologies has been able to grow its dividends, or if the dividend might be cut.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. O.R.T. Technologies reported a loss last year, so it's not great to see that it has continued paying a dividend. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If O.R.T. Technologies didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term.

See our latest analysis for O.R.T. Technologies

Click here to see how much of its profit O.R.T. Technologies paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. O.R.T. Technologies reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. O.R.T. Technologies has seen its dividend decline 7.2% per annum on average over the past 10 years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Get our latest analysis on O.R.T. Technologies's balance sheet health here.

To Sum It Up

Has O.R.T. Technologies got what it takes to maintain its dividend payments? It's hard to get used to O.R.T. Technologies paying a dividend despite reporting a loss over the past year. Worse, the dividend was not well covered by cash flow. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

With that in mind though, if the poor dividend characteristics of O.R.T. Technologies don't faze you, it's worth being mindful of the risks involved with this business. For example, we've found 4 warning signs for O.R.T. Technologies (3 shouldn't be ignored!) that deserve your attention before investing in the shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ORTC

O.R.T. Technologies

Engages in development, production, and marketing of smart ticketing and data collection systems for managing public transportation.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion