- China

- /

- Electronic Equipment and Components

- /

- SHSE:603416

3 High Growth Tech Stocks To Watch In Global Markets

Reviewed by Simply Wall St

Global markets have recently experienced a positive shift, driven by the de-escalation of U.S.-China trade tensions and lower-than-expected inflation figures, which have bolstered investor sentiment and led to notable gains in major indices such as the Nasdaq Composite. In this environment, high growth tech stocks are particularly intriguing as they often thrive on innovation and adaptability, qualities that can be advantageous amid evolving economic conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.42% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Elicera Therapeutics | 75.80% | 107.14% | ★★★★★★ |

| Elliptic Laboratories | 23.60% | 57.11% | ★★★★★★ |

| CD Projekt | 33.48% | 37.39% | ★★★★★★ |

| Arabian Contracting Services | 20.34% | 32.01% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

We'll examine a selection from our screener results.

Hugel (KOSDAQ:A145020)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hugel, Inc. is a company that develops and manufactures biopharmaceuticals both in South Korea and internationally, with a market cap of ₩3.70 trillion.

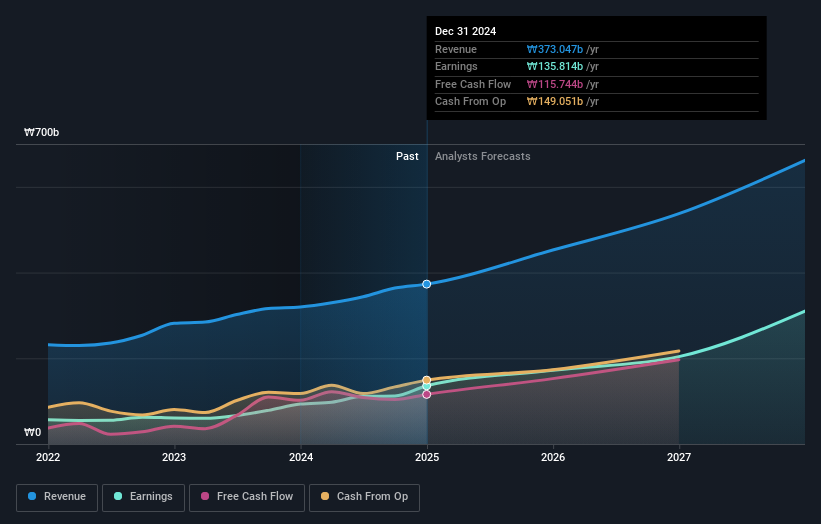

Operations: The company generates revenue primarily from its pharmaceuticals segment, with reported sales of ₩373.05 billion.

Hugel's recent strategic presentations at high-profile conferences, coupled with a robust first-quarter earnings report, underscore its dynamic presence in the biotech sector. Notably, the company's revenue is on an upward trajectory with a 17.8% annual growth rate, outpacing the Korean market average of 7.5%. This growth is complemented by an impressive 45.9% increase in earnings over the past year and projections for a 20.9% rise annually moving forward. Additionally, Hugel has demonstrated its commitment to shareholder value through a significant share repurchase program, buying back shares worth KRW 68.37 billion at year-end 2024. These financial maneuvers not only reflect Hugel’s solid market position but also hint at its potential for sustained growth and innovation in the evolving biotech landscape.

- Click here to discover the nuances of Hugel with our detailed analytical health report.

Understand Hugel's track record by examining our Past report.

WuXi Xinje ElectricLtd (SHSE:603416)

Simply Wall St Growth Rating: ★★★★☆☆

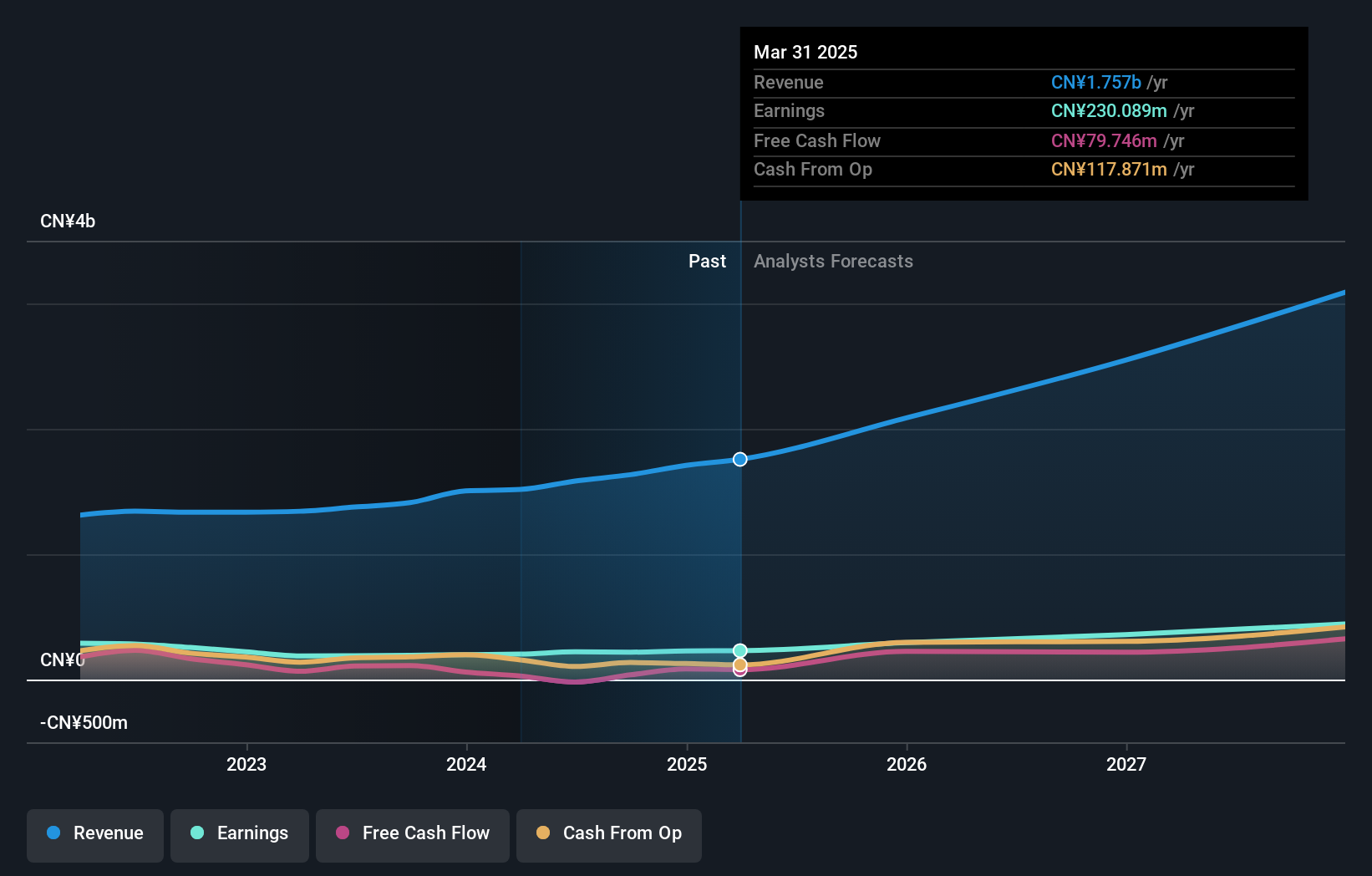

Overview: WuXi Xinje Electric Co., Ltd. is involved in the development, production, and sale of industrial automation products both in China and internationally, with a market capitalization of approximately CN¥9.75 billion.

Operations: WuXi Xinje Electric focuses on industrial automation products, generating revenue through both domestic and international markets. The company operates with a market capitalization of approximately CN¥9.75 billion.

WuXi Xinje ElectricLtd. demonstrates a robust trajectory in the tech sector, underscored by its latest financial outcomes with a notable increase in quarterly revenue to CNY 388.3 million from CNY 339.86 million year-over-year and a rise in net income to CNY 46.01 million from CNY 44.47 million. This performance is augmented by an aggressive R&D stance, as evidenced by substantial investment growth aimed at fostering innovation within the electronic industry where it has outpaced average earnings growth of its peers (13.6% vs 2.6%). Moreover, the company's strategic maneuvers include issuing over 16 million shares, securing gross proceeds of approximately CAD 386 million, which underscores its commitment to expanding its technological footprint and enhancing shareholder value amidst volatile market conditions.

- Unlock comprehensive insights into our analysis of WuXi Xinje ElectricLtd stock in this health report.

Explore historical data to track WuXi Xinje ElectricLtd's performance over time in our Past section.

Nayax (TASE:NYAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nayax Ltd. is a fintech company that provides comprehensive solutions for automated self-service retailers and merchants across various regions, with a market cap of ₪5.51 billion.

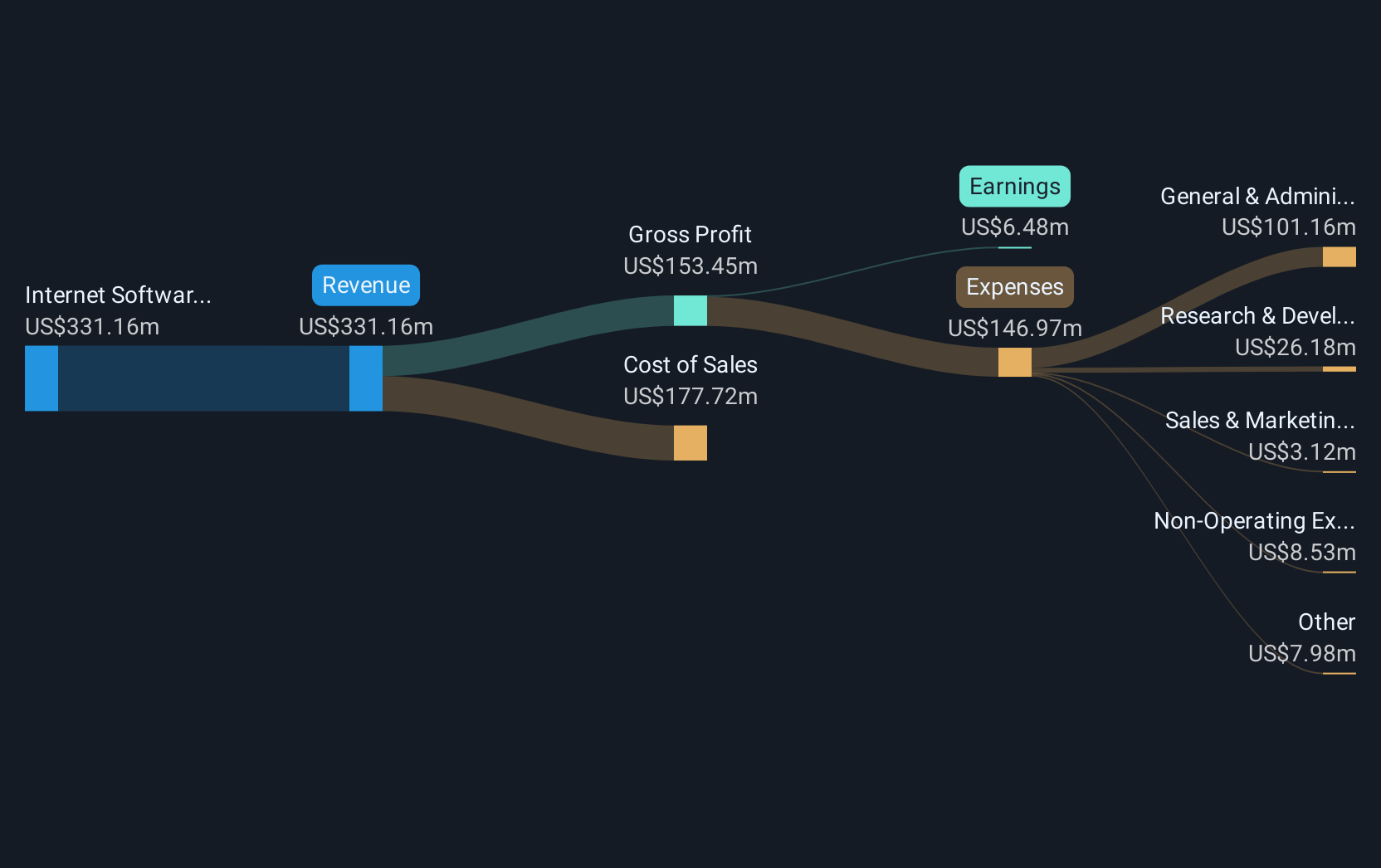

Operations: The company generates revenue primarily through its Internet Software and Services segment, which amounts to $314.01 million. This fintech firm's solutions cater to automated self-service retailers and merchants across multiple regions, including the United States, Europe, the UK, Australia, and Israel.

Nayax Ltd. is shaping the future of automated retail and fintech, evidenced by its robust revenue guidance for 2025, projecting growth between 30% to 35%. This outlook is bolstered by a strategic emphasis on R&D, crucial for maintaining its competitive edge in the dynamic tech landscape. Recent presentations at industry forums highlight Nayax's commitment to innovation, particularly in secure payment solutions and AI-driven vending technologies that enhance operational efficiency and consumer engagement. Moreover, the company's partnership with N-and Group integrates cutting-edge payment technology into smart screens, expanding its market reach across various sectors. With these initiatives, Nayax not only anticipates significant organic growth but also positions itself as a pivotal player in evolving retail environments.

- Click here and access our complete health analysis report to understand the dynamics of Nayax.

Assess Nayax's past performance with our detailed historical performance reports.

Key Takeaways

- Access the full spectrum of 751 Global High Growth Tech and AI Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WuXi Xinje ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603416

WuXi Xinje ElectricLtd

Engages in the development, production, and sale of industrial automation products in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives