Interested In Matrix IT's (TLV:MTRX) Upcoming ₪0.82 Dividend? You Have Four Days Left

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Matrix IT Ltd. (TLV:MTRX) is about to trade ex-dividend in the next four days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Therefore, if you purchase Matrix IT's shares on or after the 20th of March, you won't be eligible to receive the dividend, when it is paid on the 8th of April.

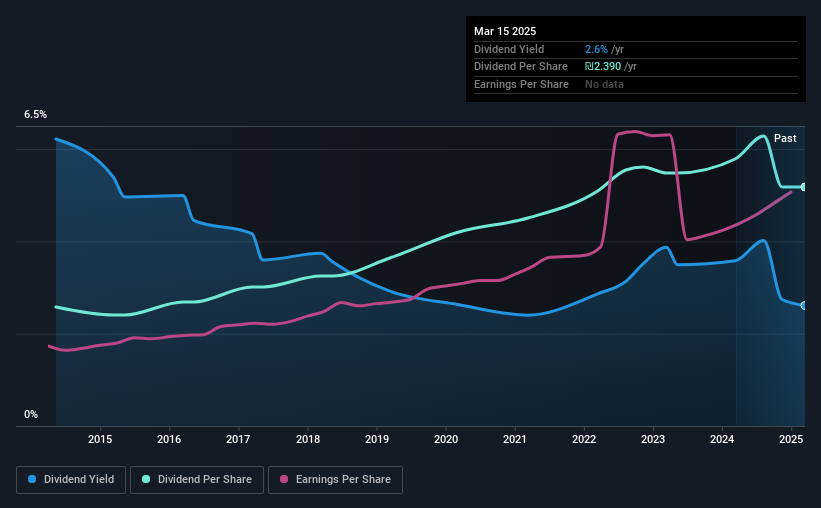

The company's next dividend payment will be ₪0.82 per share, and in the last 12 months, the company paid a total of ₪2.39 per share. Last year's total dividend payments show that Matrix IT has a trailing yield of 2.6% on the current share price of ₪91.53. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for Matrix IT

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Matrix IT paid out 124% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance. A useful secondary check can be to evaluate whether Matrix IT generated enough free cash flow to afford its dividend. Fortunately, it paid out only 32% of its free cash flow in the past year.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Matrix IT fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Click here to see how much of its profit Matrix IT paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Fortunately for readers, Matrix IT's earnings per share have been growing at 11% a year for the past five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past 10 years, Matrix IT has increased its dividend at approximately 7.2% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Is Matrix IT an attractive dividend stock, or better left on the shelf? Earnings per share have been rising nicely although, even though its cashflow payout ratio is low, we question why Matrix IT is paying out so much of its profit. While it does have some good things going for it, we're a bit ambivalent and it would take more to convince us of Matrix IT's dividend merits.

While it's tempting to invest in Matrix IT for the dividends alone, you should always be mindful of the risks involved. For example - Matrix IT has 1 warning sign we think you should be aware of.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:MTRX

Matrix IT

Provides information technology (IT) solutions and services in Israel, the United States, and Europe.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion