- Israel

- /

- Capital Markets

- /

- TASE:ATRY

Undiscovered Gems in the Middle East to Explore This May 2025

Reviewed by Simply Wall St

As most Gulf markets experience a downturn due to lackluster earnings and global economic uncertainties, investors are keeping a close eye on U.S.-China trade negotiations and Federal Reserve policy decisions. In this climate, identifying promising stocks requires focusing on companies with strong fundamentals and resilience in the face of external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Middle East Specialized Cables (SASE:2370)

Simply Wall St Value Rating: ★★★★★☆

Overview: Middle East Specialized Cables Company, with a market cap of SAR1.46 billion, operates in Saudi Arabia and the United Arab Emirates, focusing on the manufacturing and sale of fiber optic cables, steel insulated wires and cables, copper insulated wires and cables, and aluminum insulated wires and cables.

Operations: The company generates revenue primarily from its Wire & Cable Products segment, totaling SAR1.14 billion.

Middle East Specialized Cables (MESC) has been making waves with an impressive 86% earnings growth over the past year, outpacing the Electrical industry average of 11.3%. The company's net income surged to SAR 91 million from SAR 48.94 million last year, reflecting its strong operational performance. MESC's debt-to-equity ratio improved from 29.8% to 18.5% over five years, highlighting effective financial management. Despite a volatile share price recently, its price-to-earnings ratio of 16.1x remains attractive compared to the SA market's average of 22x, suggesting potential value for investors seeking opportunities in this dynamic sector.

- Take a closer look at Middle East Specialized Cables' potential here in our health report.

Gain insights into Middle East Specialized Cables' past trends and performance with our Past report.

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Value Rating: ★★★★★★

Overview: Atreyu Capital Markets Ltd operates in Israel through its subsidiaries, offering investment management services, with a market cap of ₪1.10 billion.

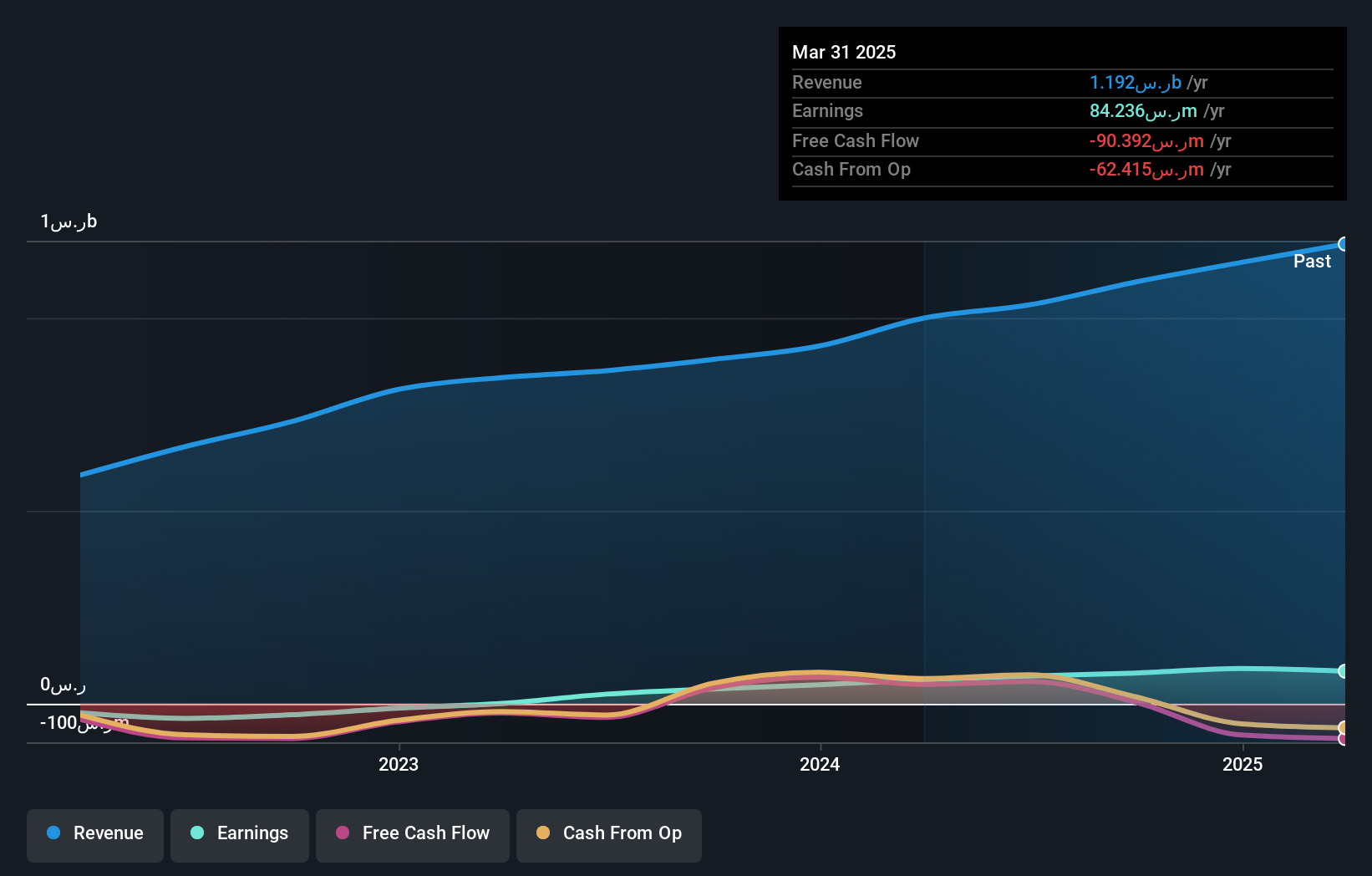

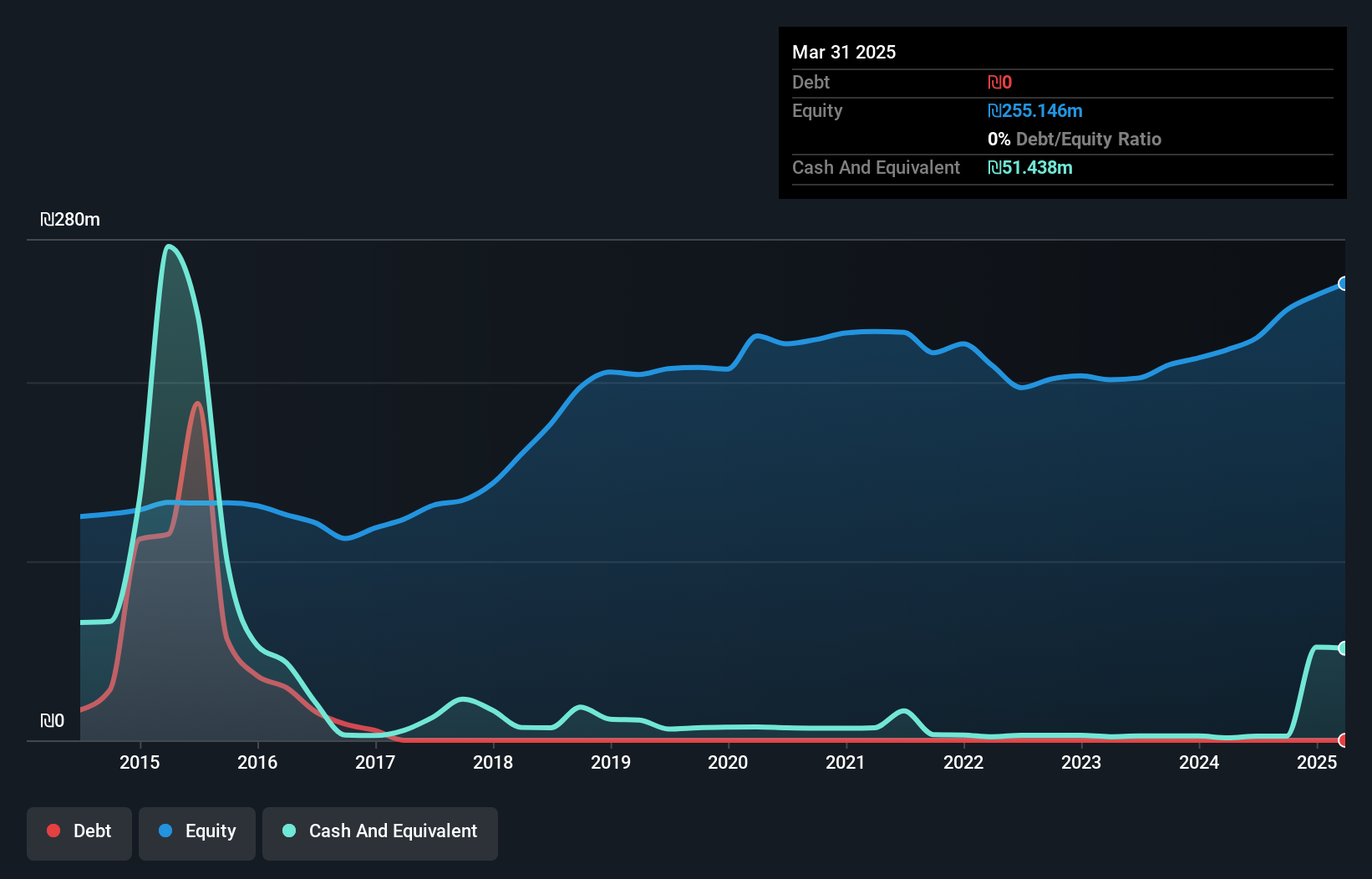

Operations: Atreyu Capital Markets generates revenue primarily from its investment management segment, amounting to ₪97.31 million.

Atreyu Capital Markets, a nimble player in the Middle East financial scene, is making waves with its robust performance. With earnings surging by 27.8% over the past year, it outpaces the industry average of 19%. The company reported a net income of ILS 93.26 million for 2024, up from ILS 73 million previously, showcasing high-quality earnings. Trading at a discount of approximately 7% to its estimated fair value adds to its appeal as an investment opportunity. Notably debt-free for five years and boasting positive free cash flow, Atreyu's financial health seems solid without interest payment concerns looming overhead.

- Click here to discover the nuances of Atreyu Capital Markets with our detailed analytical health report.

Understand Atreyu Capital Markets' track record by examining our Past report.

Malam - Team (TASE:MLTM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Malam - Team Ltd is an Israeli company offering a range of information technology services, with a market capitalization of ₪1.67 billion.

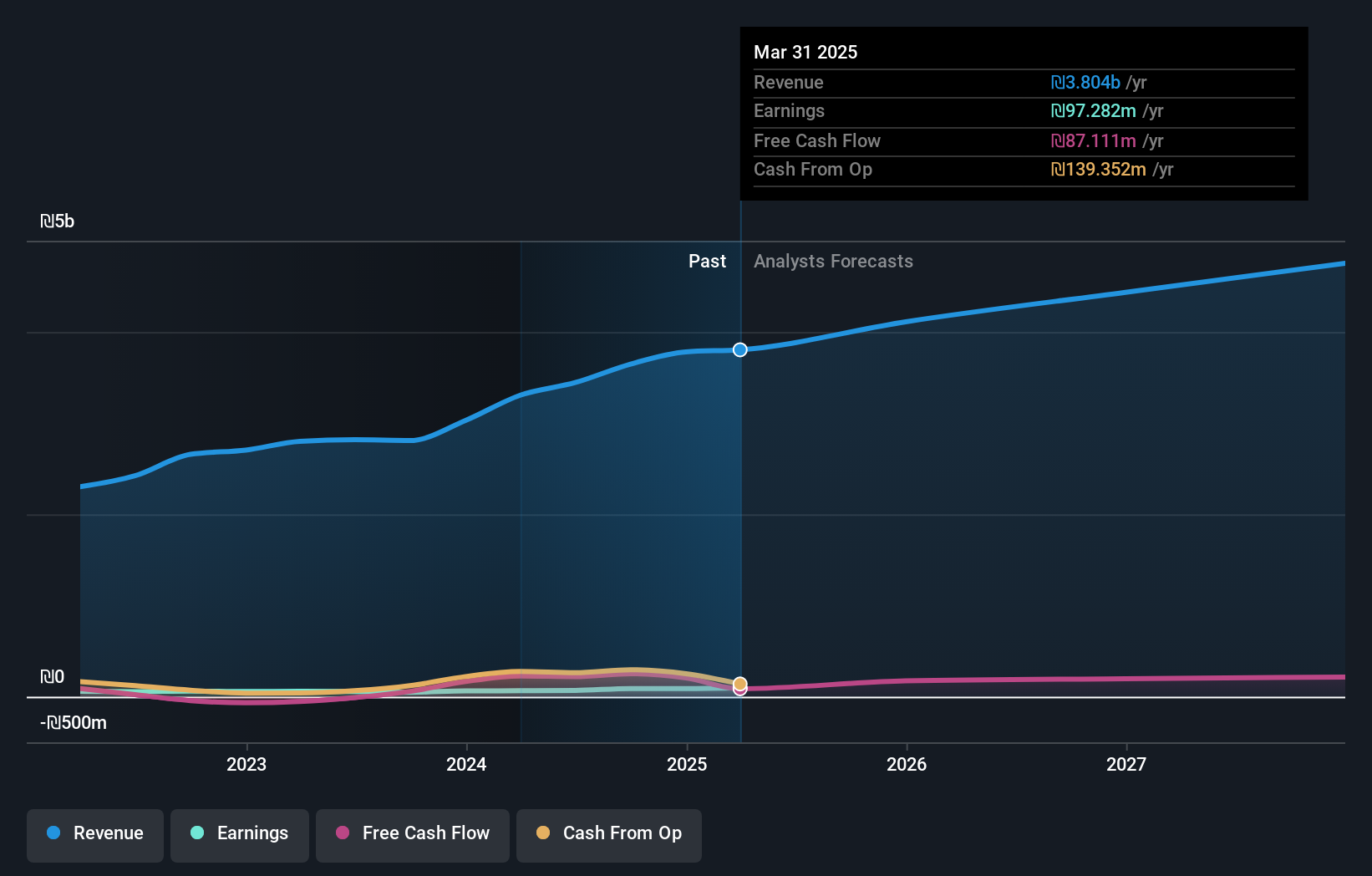

Operations: Malam - Team Ltd generates revenue primarily from Hardware and Cloud Infrastructure, contributing ₪2.09 billion, and Software, Projects, and Business Solutions at ₪1.41 billion. The Salary Service, Human Resources, and Long-Term Savings segment adds another ₪323.35 million to its revenue streams.

Malam - Team, a notable player in the Middle Eastern IT sector, demonstrated robust performance with sales reaching ILS 3.78 billion for 2024, up from ILS 3.03 billion the previous year. Net income also rose to ILS 88.54 million compared to ILS 63.88 million last year, reflecting strong earnings growth of 38.6%, outpacing the industry average of 24.5%. The company's interest payments are well covered by EBIT at a ratio of 3.6x, and its net debt to equity ratio stands at a satisfactory level of 27%. Despite past declines in earnings over five years by an average of 6.4% annually, Malam - Team's current trajectory suggests promising financial health and potential for continued growth in its niche market segment.

- Unlock comprehensive insights into our analysis of Malam - Team stock in this health report.

Review our historical performance report to gain insights into Malam - Team's's past performance.

Taking Advantage

- Investigate our full lineup of 243 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Atreyu Capital Markets, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ATRY

Atreyu Capital Markets

Through its subsidiaries, provides investment management services in Israel.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives