Undiscovered Gems And 2 Other Small Caps With Promising Potential

Reviewed by Simply Wall St

In a week marked by volatility and competitive concerns in the technology sector, U.S. markets saw mixed results with small-cap indices like the S&P 600 experiencing fluctuations amid broader economic uncertainties. As global markets navigate these challenges, discerning investors often look beyond immediate headlines to identify promising opportunities within smaller companies that may offer unique growth potential. In this context, identifying stocks with strong fundamentals and innovative capabilities can be crucial for uncovering undiscovered gems in the small-cap space.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| All E Technologies | NA | 18.60% | 31.35% | ★★★★★★ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Scandi Standard (OM:SCST)

Simply Wall St Value Rating: ★★★★☆☆

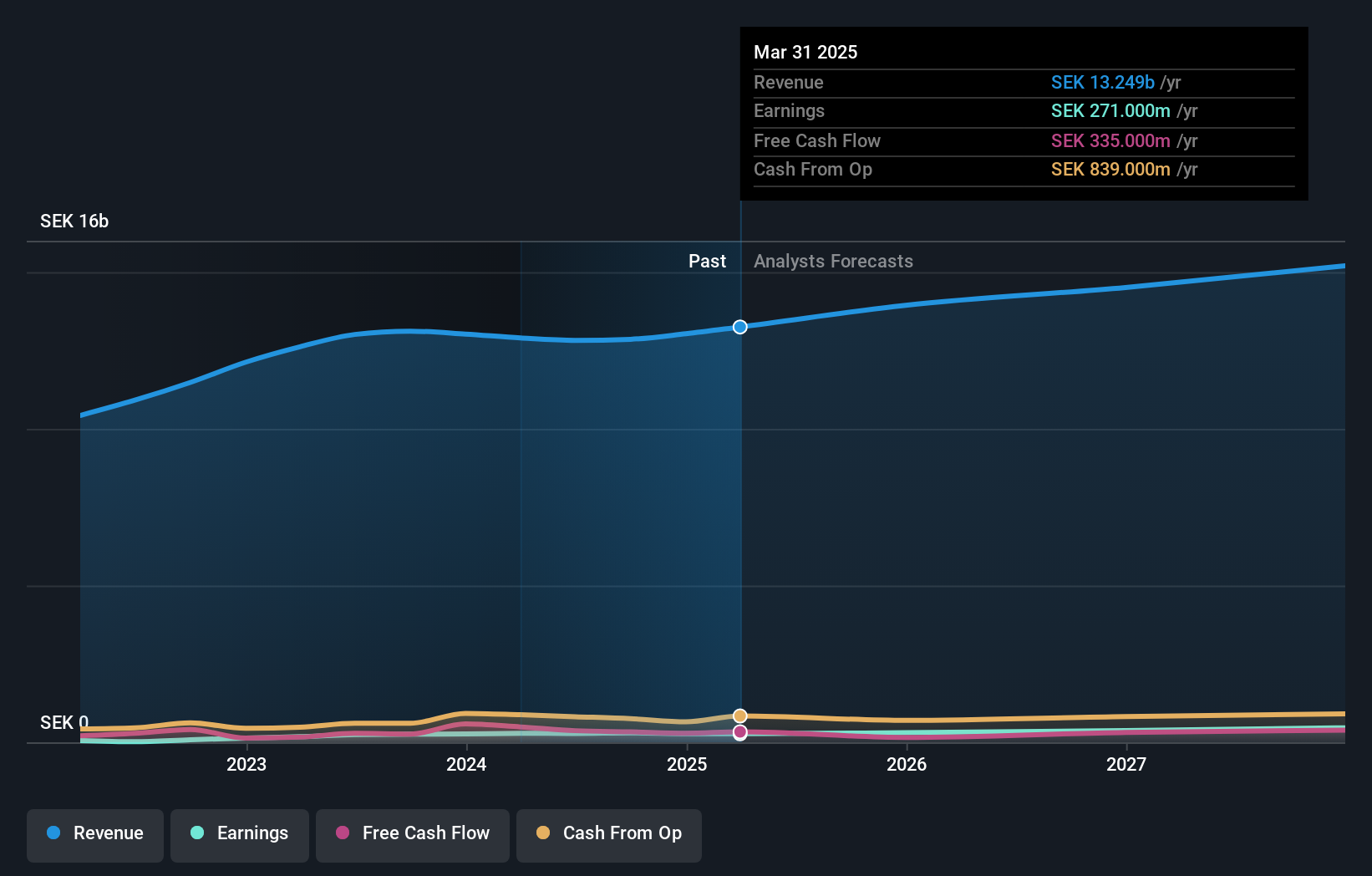

Overview: Scandi Standard AB (publ) is a company that produces and sells chilled, frozen, and ready-to-eat chicken products across various countries including Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, and internationally with a market cap of SEK5.49 billion.

Operations: Scandi Standard generates revenue primarily from its Ready-To-Cook segment, contributing SEK9.80 billion, followed by the Ready-To-Eat segment at SEK2.56 billion.

Scandi Standard showcases promising potential with earnings growth of 16% over the past year, outpacing the food industry's 15.8%. The company trades at a significant discount, approximately 51% below its estimated fair value. Despite a high net debt to equity ratio of 56%, Scandi's interest payments are well-covered by EBIT at 3.5 times coverage, indicating manageable financial obligations. Over five years, their debt to equity ratio has notably improved from nearly 120% to just above half that figure today. With high-quality earnings and positive free cash flow, Scandi seems positioned for robust future performance in its sector.

- Delve into the full analysis health report here for a deeper understanding of Scandi Standard.

Review our historical performance report to gain insights into Scandi Standard's's past performance.

IMAX China Holding (SEHK:1970)

Simply Wall St Value Rating: ★★★★★★

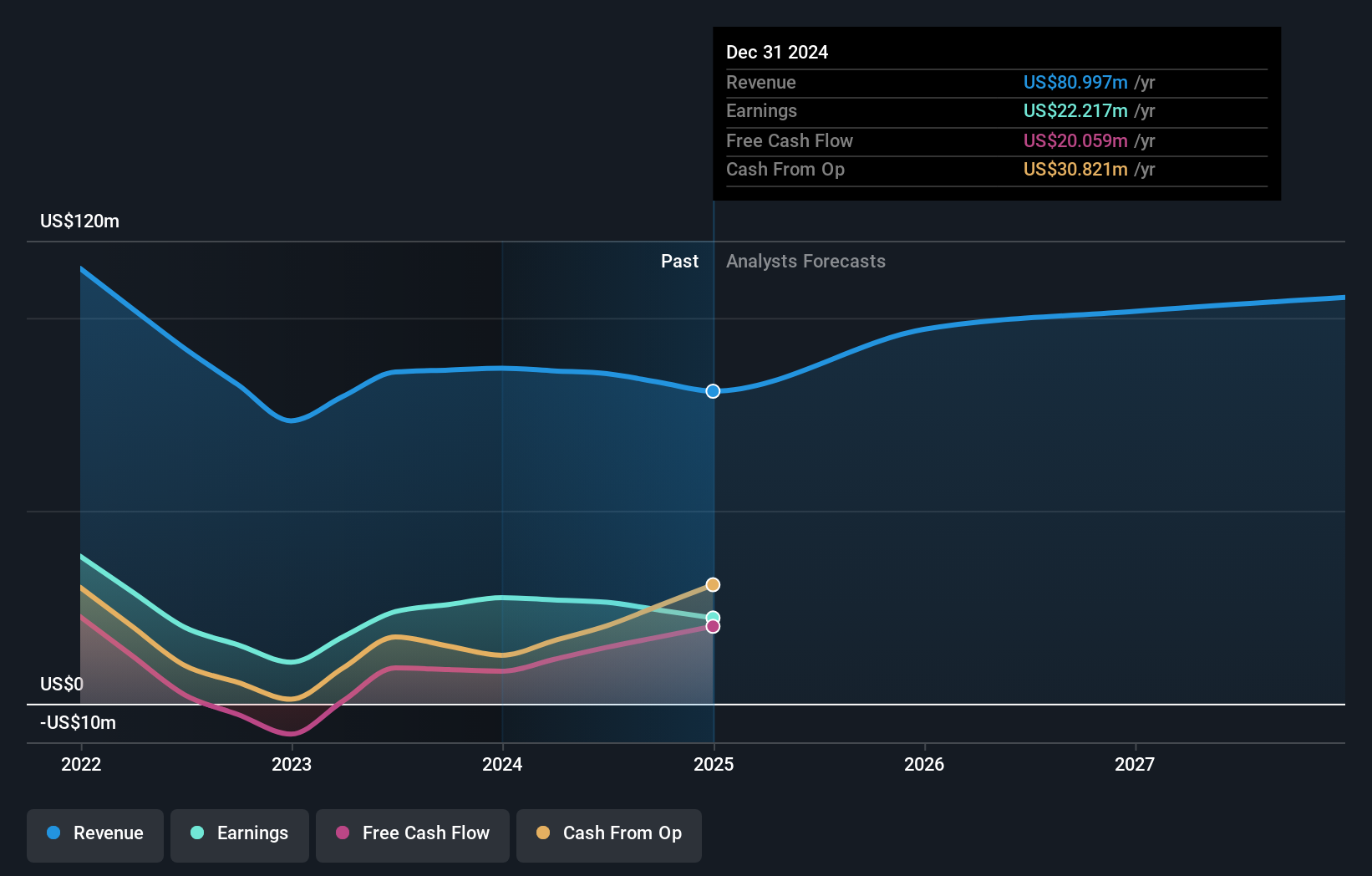

Overview: IMAX China Holding, Inc. is an investment holding company that offers digital and film-based motion picture technologies across the People's Republic of China, Hong Kong, Macau, and Taiwan with a market capitalization of HK$2.60 billion.

Operations: IMAX China generates revenue primarily from Technology Products and Services, contributing $64.08 million, and Content Solutions, which adds $20.69 million. The company's market capitalization stands at HK$2.60 billion.

IMAX China Holding, a nimble player in the entertainment sector, has shown promising financial health with earnings growth of 10% over the past year. The firm stands out by being debt-free for five years, which suggests prudent financial management and robust operational efficiency. Its revenue is projected to grow at an impressive rate of 11.71% annually, surpassing industry averages. Trading at a modest discount of 4.8% below its estimated fair value indicates potential upside for investors seeking undervalued opportunities in this space. Recent administrative changes reflect ongoing strategic adjustments within the company’s operations in Hong Kong.

- Unlock comprehensive insights into our analysis of IMAX China Holding stock in this health report.

Assess IMAX China Holding's past performance with our detailed historical performance reports.

Malam - Team (TASE:MLTM)

Simply Wall St Value Rating: ★★★★☆☆

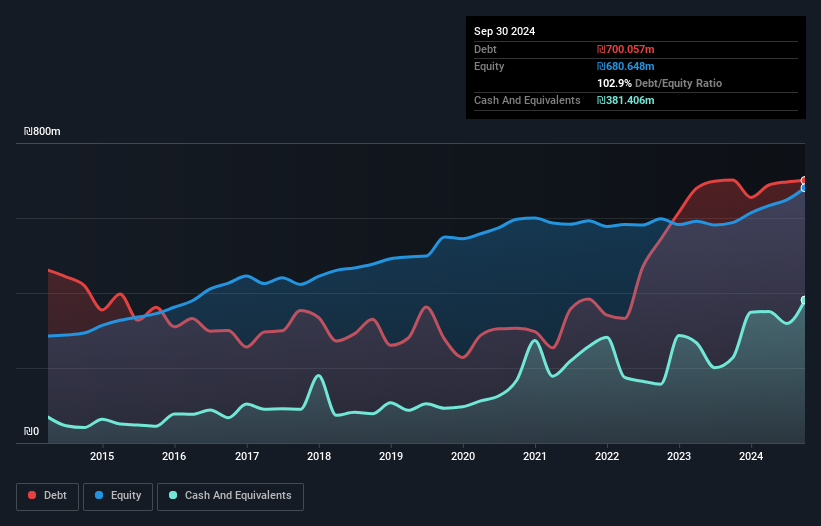

Overview: Malam - Team Ltd is an Israeli company that offers a range of information technology services, with a market capitalization of ₪1.96 billion.

Operations: Malam - Team's primary revenue streams include Hardware and Cloud Infrastructure, generating ₪1.99 billion, and Software, Projects, and Business Solutions, contributing ₪1.38 billion. The company also earns from Salary Service, Human Resources and Long-Term Savings with revenues of ₪312.24 million.

Malam - Team has been making waves with its impressive earnings growth of 84% over the past year, outpacing the IT industry's 17.9%. The company's debt to equity ratio has climbed from 50.5% to a hefty 102.9% in five years, pointing to a high level of debt, while its net debt to equity ratio stands at 46.8%. Despite this leverage, interest payments are well covered by EBIT at a multiple of 3.4x. Recent financials reveal strong performance with third-quarter sales hitting ILS 909 million and net income reaching ILS 31 million, showcasing robust profitability and potential for future value appreciation within the industry context.

- Take a closer look at Malam - Team's potential here in our health report.

Understand Malam - Team's track record by examining our Past report.

Turning Ideas Into Actions

- Reveal the 4664 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SCST

Scandi Standard

Produces and sells chilled, frozen, and ready-to-eat chicken products in Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, rest of Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion