- Israel

- /

- Diversified Financial

- /

- TASE:SHVA

Najran Cement Leads 3 Undiscovered Gems with Strong Fundamentals

Reviewed by Simply Wall St

Amidst a backdrop of regional tension and market volatility, Gulf markets have recently seen declines due to looming tariff threats and geopolitical unrest. In such an environment, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Najran Cement (SASE:3002)

Simply Wall St Value Rating: ★★★★★★

Overview: Najran Cement Company is involved in the manufacture and sale of cement products in Saudi Arabia, with a market capitalization of SAR1.42 billion.

Operations: Najran Cement generates revenue primarily from manufacturing cement, with sales amounting to SAR531.62 million. The company's financial performance is influenced by its gross profit margin, which reflects the efficiency of its production processes and cost management.

Najran Cement, a smaller player in the industry, showcases a solid financial footing with its net debt to equity ratio at 13.2%, considered satisfactory. The company has demonstrated strong earnings growth of 53.6% over the past year, outpacing the Basic Materials industry's 38.5%. Despite a slight dip in Q1 sales to SAR 135.24 million from SAR 138.13 million last year, annual sales rose to SAR 534.51 million from SAR 485.65 million previously, highlighting resilience and potential for future growth as earnings are forecasted to grow by over one-third annually at around 37%.

- Navigate through the intricacies of Najran Cement with our comprehensive health report here.

Gain insights into Najran Cement's historical performance by reviewing our past performance report.

Formula Systems (1985) (TASE:FORTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Formula Systems (1985) Ltd. operates through its subsidiaries to offer a range of software solutions, IT professional services, and computer infrastructure and integration solutions, with a market cap of ₪5.70 billion.

Operations: Formula Systems generates revenue primarily through its subsidiaries by offering software solutions and IT professional services. The company focuses on both proprietary and non-proprietary software, along with computer infrastructure and integration solutions.

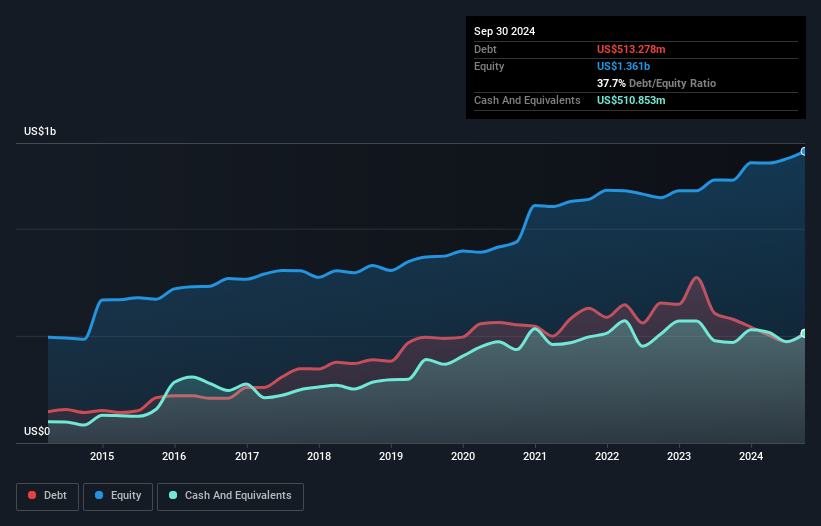

Formula Systems, a nimble player in the IT sector, has demonstrated robust growth with earnings climbing 26% over the past year. The company's price-to-earnings ratio stands at 19.6x, presenting a favorable comparison to the industry average of 20.5x. Impressively, Formula Systems has reduced its debt-to-equity ratio from 62.6% to 33.7% over five years, indicating prudent financial management. Recent earnings for Q1 reveal sales of $754 million and net income of $19 million, reflecting consistent performance improvement from last year’s figures of $698 million and $17 million respectively. Additionally, they declared a dividend payout totaling approximately $6.8 million this May.

- Click here to discover the nuances of Formula Systems (1985) with our detailed analytical health report.

Understand Formula Systems (1985)'s track record by examining our Past report.

Automatic Bank Services (TASE:SHVA)

Simply Wall St Value Rating: ★★★★★★

Overview: Automatic Bank Services Limited operates payment systems for international debit cards in Israel and has a market cap of ₪981.20 million.

Operations: The company's revenue from the clearing segment is ₪151.46 million.

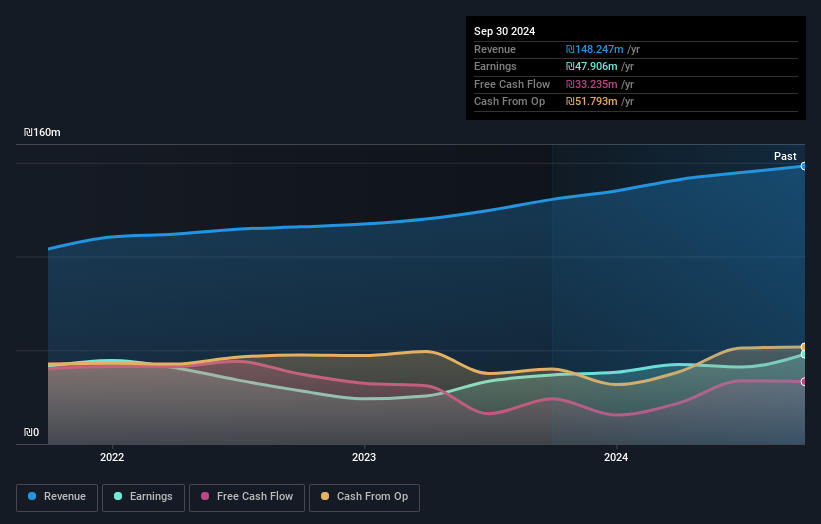

Automatic Bank Services, a niche player in the Middle East, has shown a robust performance with earnings surging by 33.2% over the past year. The company's revenue stands at ILS 151.46 million, up from ILS 134.92 million previously, while net income reached ILS 50.91 million compared to last year's ILS 38.22 million. With no debt on its books for five years and high-quality earnings reported, Automatic Bank Services seems well-positioned in its sector. Recently, it declared an annual dividend of ILS 0.75 per share, reflecting confidence in its financial health and future prospects.

- Take a closer look at Automatic Bank Services' potential here in our health report.

Learn about Automatic Bank Services' historical performance.

Key Takeaways

- Click through to start exploring the rest of the 225 Middle Eastern Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:SHVA

Automatic Bank Services

Operates payment systems for international debit cards in Israel.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives