- Germany

- /

- Medical Equipment

- /

- DB:PHH2

Exploring Undiscovered Gems In November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of policy shifts under the new Trump administration, investors are witnessing fluctuations across key indices such as the S&P 500 and Russell 2000, reflecting broader market sentiment. Amidst these changes, small-cap stocks often present unique opportunities for those looking to explore potential growth areas that may not yet be widely recognized. Identifying a good stock in this environment involves assessing how well a company can adapt to regulatory changes and economic conditions while maintaining strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Gallantt Ispat | 15.54% | 36.20% | 40.12% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Macpower CNC Machines | NA | 22.62% | 35.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Shree Pushkar Chemicals & Fertilisers | 21.25% | 18.34% | 4.43% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Paul Hartmann (DB:PHH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Paul Hartmann AG is a company that manufactures and sells medical and care products across Germany, the rest of Europe, the Middle East, Africa, Asia and Pacific region, and the Americas with a market cap of approximately €699.69 million.

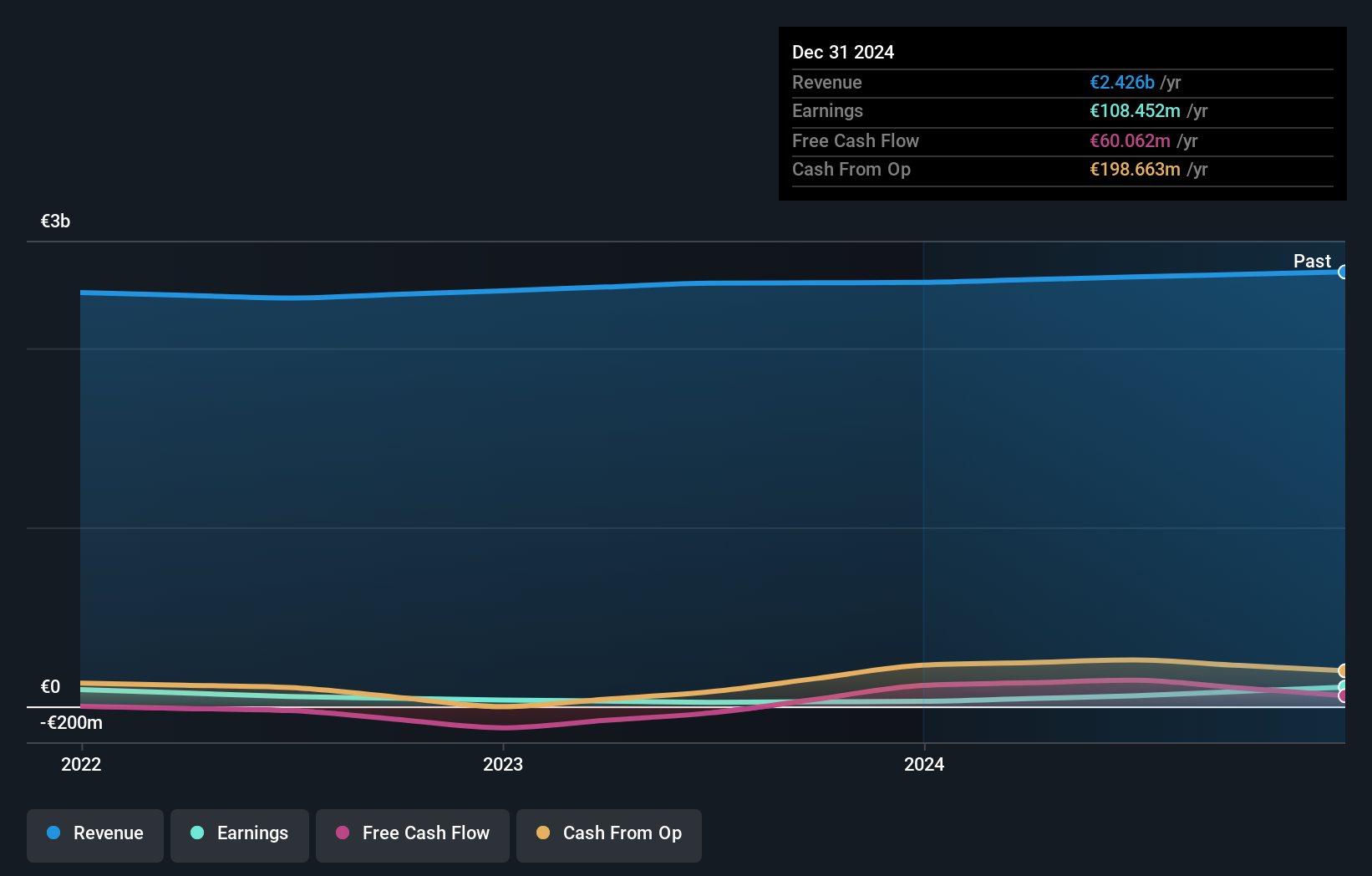

Operations: The company's primary revenue streams include Incontinence Management (€769.70 million), Wound Care (€597.39 million), Infection Management (€516.66 million), and Complementary divisions of the group (€499.70 million).

Hartmann, a nimble player in the medical equipment sector, has shown remarkable earnings growth of 156% over the past year, outpacing its industry peers. Despite this impressive performance, its earnings have seen a 17.7% reduction annually over the last five years. The company’s financial health appears robust with interest payments well-covered by EBIT at 6.2 times and a satisfactory net debt to equity ratio of 13%. Trading significantly below fair value estimates suggests potential upside for investors seeking undervalued opportunities in this space.

- Get an in-depth perspective on Paul Hartmann's performance by reading our health report here.

Understand Paul Hartmann's track record by examining our Past report.

Formula Systems (1985) (TASE:FORTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Formula Systems (1985) Ltd. operates through its subsidiaries to offer a range of software solutions, IT professional services, software product marketing and support, computer infrastructure and integration solutions, with a market cap of ₪4.73 billion.

Operations: Formula Systems (1985) Ltd. generates revenue primarily through its subsidiaries offering software solutions and IT professional services. The company's financial performance is reflected in its market capitalization of approximately ₪4.73 billion.

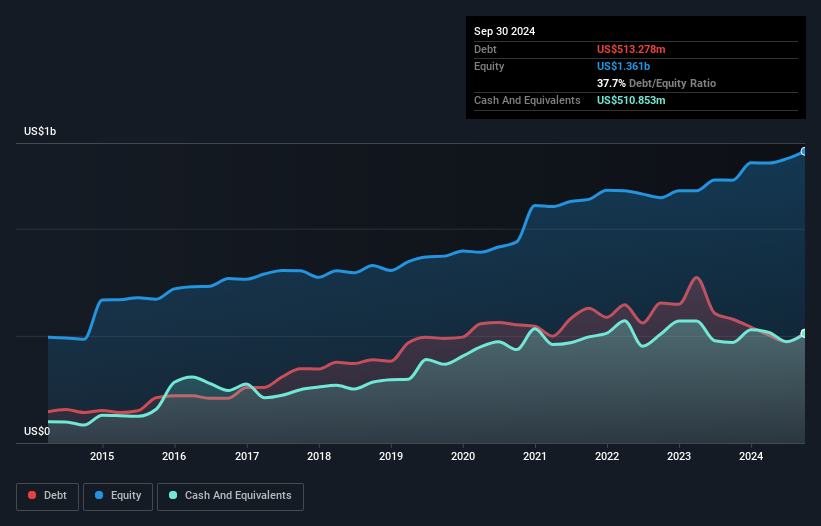

Formula Systems, a small player in the tech space, has shown consistent earnings growth of 13.9% annually over the past five years, although its recent 3.7% yearly growth lagged behind the IT industry's 8.7%. The company's debt situation has improved significantly with its debt-to-equity ratio dropping from 56.9% to 35.6%, and it boasts high-quality earnings backed by a strong interest coverage of 19.5 times EBIT—well above standard expectations. With a price-to-earnings ratio of 18.8x, Formula Systems seems attractively valued compared to the industry average of 20.3x, indicating potential for value-conscious investors seeking opportunities in smaller tech firms.

- Dive into the specifics of Formula Systems (1985) here with our thorough health report.

Learn about Formula Systems (1985)'s historical performance.

Torii Pharmaceutical (TSE:4551)

Simply Wall St Value Rating: ★★★★★★

Overview: Torii Pharmaceutical Co., Ltd. is a Japanese company that manufactures and markets pharmaceutical products, with a market cap of ¥133.49 billion.

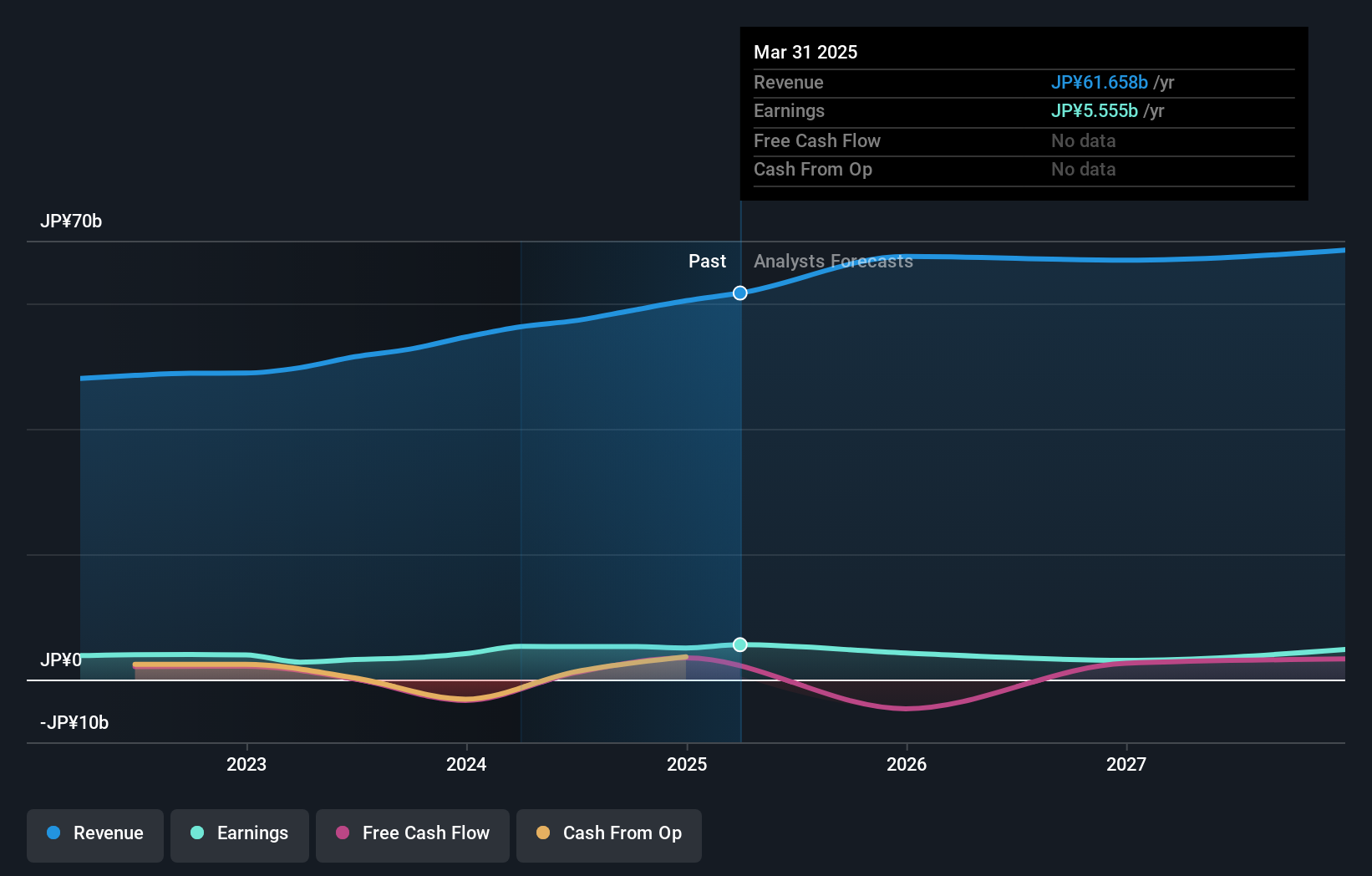

Operations: The company generates revenue through the manufacture and marketing of pharmaceutical products in Japan. With a market capitalization of ¥133.49 billion, it operates within the pharmaceutical sector focusing on domestic sales.

In the pharmaceutical realm, Torii Pharmaceutical stands out with its impressive earnings growth of 52.7% over the past year, surpassing the industry's 12.2%. This growth is backed by high-quality earnings and a solid financial footing, as evidenced by being debt-free for five years. The company also showcases positive free cash flow, with a recent figure at US$1.09 million in June 2024. However, future prospects appear challenging with forecasts indicating an average annual earnings decline of 1% over the next three years, suggesting potential headwinds despite current profitability and no concern over cash runway or interest coverage.

- Navigate through the intricacies of Torii Pharmaceutical with our comprehensive health report here.

Assess Torii Pharmaceutical's past performance with our detailed historical performance reports.

Key Takeaways

- Gain an insight into the universe of 4640 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:PHH2

Paul Hartmann

Manufactures and sells medical and care products in Germany, rest of Europe, the Middle East, Africa, Asia and Pacific region, and the Americas.

Excellent balance sheet established dividend payer.