What trends should we look for it we want to identify stocks that can multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. However, after briefly looking over the numbers, we don't think E & M Computing (TLV:EMCO) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on E & M Computing is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.17 = ₪53m ÷ (₪776m - ₪455m) (Based on the trailing twelve months to September 2023).

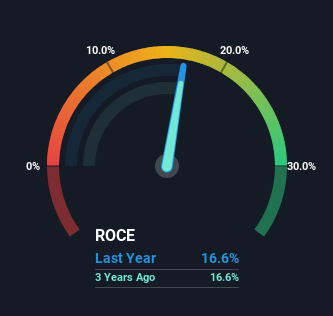

Thus, E & M Computing has an ROCE of 17%. By itself that's a normal return on capital and it's in line with the industry's average returns of 17%.

View our latest analysis for E & M Computing

Historical performance is a great place to start when researching a stock so above you can see the gauge for E & M Computing's ROCE against it's prior returns. If you'd like to look at how E & M Computing has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

So How Is E & M Computing's ROCE Trending?

Things have been pretty stable at E & M Computing, with its capital employed and returns on that capital staying somewhat the same for the last five years. This tells us the company isn't reinvesting in itself, so it's plausible that it's past the growth phase. So don't be surprised if E & M Computing doesn't end up being a multi-bagger in a few years time.

Another thing to note, E & M Computing has a high ratio of current liabilities to total assets of 59%. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

In Conclusion...

We can conclude that in regards to E & M Computing's returns on capital employed and the trends, there isn't much change to report on. And investors may be recognizing these trends since the stock has only returned a total of 23% to shareholders over the last five years. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

One more thing: We've identified 4 warning signs with E & M Computing (at least 2 which are a bit unpleasant) , and understanding them would certainly be useful.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if E & M Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:EMCO

E & M Computing

Provides technological solutions in Israel.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Why EnSilica is Worth Possibly 13x its Current Price

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Superintelligence Pivot: Meta’s $135 Billion Bet on the Energy-Compute Nexus

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.